Xcel Energy 2003 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2003 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

XCEL ENERGY 2003 ANNUAL REPORT 53

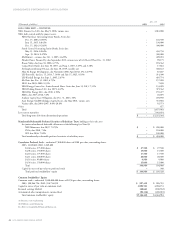

Reclassifications Certain items in the statements of operations and balance sheets have been reclassified from prior period presentation to conform to

the 2003 presentation. These reclassifications had no effect on net income or earnings per share. The reclassifications were primarily related to organizational

changes, such as the divestiture of NRG, and the reclassification of asset retirement obligations from Accumulated Depreciation to a liability account.

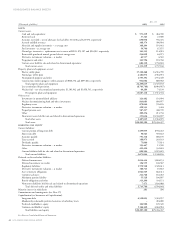

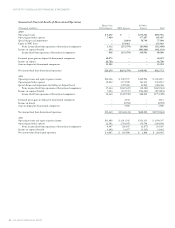

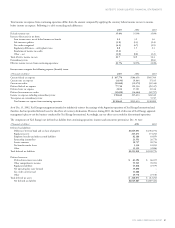

2. SPECIAL CHARGES

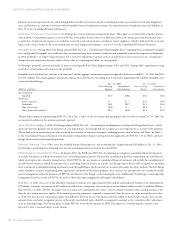

Special charges included in Operating Expenses for the years ended Dec. 31, 2003, 2002 and 2001, include the following:

(Millions of dollars) 2003 2002 2001

Regulated utility special charges:

Regulatory recovery adjustment (SPS) (see Note 14) $ – $ 5 $ –

Restaffing (utility and service companies) –939

Post-employment benefits (PSCo) ––23

Total regulated utility special charges –14 62

Other nonregulated special charges:

Holding company NRG restructuring charges 12 5–

TRANSLink Transmission Co. 7––

Total nonregulated special charges 19 5–

Total special charges $19 $19 $62

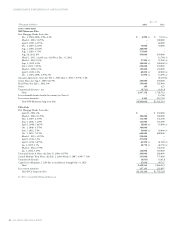

2003 TRANSLink Transmission Co., LLC In 2003, Xcel Energy recorded a $7 million pretax charge in connection with the suspension of the activities

related to the formation of TRANSLink Transmission Co., LLC (TRANSLink). The charge was recorded as a reserve against loans made by Xcel

Energy Transco Inc., a subsidiary of Xcel Energy, to TRANSLink Development Company, LLC, an interim start-up company. TRANSLink was a

for-profit independent transmission-only company proposed to be formed by Xcel Energy and several other utilities to integrate the operations of

their electric transmission systems into a single system. The formation activity was suspended due to continued market and regulatory uncertainty.

2003 and 2002 Holding Company NRG Restructuring Charges In 2003 and 2002, the Xcel Energy holding company incurred approximately

$12 million and $5 million, respectively, for charges related to NRG’s financial restructuring. Costs in 2003 included approximately $32 million of

financial advisor fees, legal costs and consulting costs related to the NRG bankruptcy transaction. These charges were partially offset by a $20 million

pension curtailment gain related to the termination of NRG employees from Xcel Energy’s pension plan, as discussed in Note 12 to the Consolidated

Financial Statements.

2002 Regulatory Recovery Adjustment – SPS In late 2001, SPS filed an application requesting recovery of costs incurred to comply with transition

to retail-competition legislation in Texas and New Mexico. During 2002, SPS entered into a settlement agreement with intervenors regarding the recovery

of industry restructuring costs in Texas, which was approved by the state regulatory commission in May 2002. Based on the settlement agreement, SPS

wrote off pretax restructuring costs of approximately $5 million.

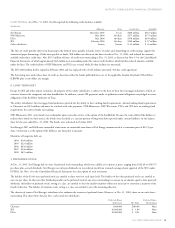

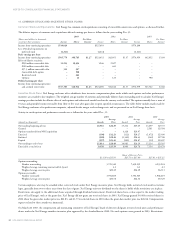

2002 and 2001 – Utility Restaffing During 2001, Xcel Energy expensed pretax special charges of $39 million for expected staff consolidation

costs for an estimated 500 employees in several utility-operating and corporate-support areas of Xcel Energy. In 2002, the identification of affected

employees was completed and additional pretax special charges of $9 million were expensed for the final costs of staff consolidations. Approximately

$6 million of these restaffing costs were allocated to Xcel Energy’s utility subsidiaries. All 564 of accrued staff terminations have occurred. See the

summary of costs below.

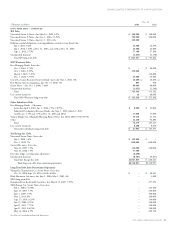

2001 – Post-employment Benefits PSCo adopted accrual accounting for post-employment benefits under SFAS No. 112 – “Employers Accounting

for Postemployment Benefits” in 1994. The costs of these benefits had been recorded on a pay-as-you-go basis and, accordingly, PSCo recorded a regulatory

asset in anticipation of obtaining future rate recovery of these transition costs. PSCo recovered its FERC jurisdictional portion of these costs. PSCo

requested approval to recover its Colorado retail natural gas jurisdictional portion in a 1996 retail-rate case, and its retail electric jurisdictional portion

in the electric-earnings test filing for 1997. In the 1996 rate case, the CPUC allowed recovery of post-employment benefit costs on an accrual basis,

but denied PSCo’s request to amortize the transition costs’ regulatory asset. Following various appeals, which proved unsuccessful, PSCo wrote off

$23 million pretax of regulatory assets related to deferred post-employment benefit costs as of June 30, 2001.