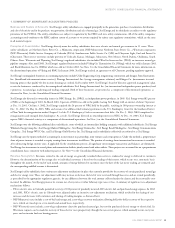

Xcel Energy 2003 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2003 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

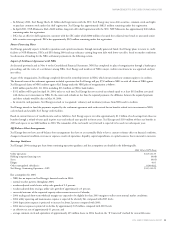

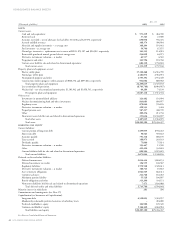

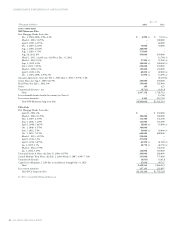

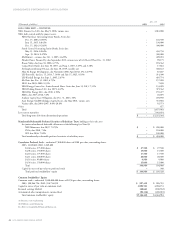

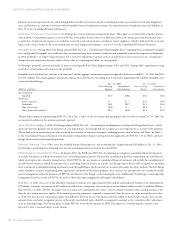

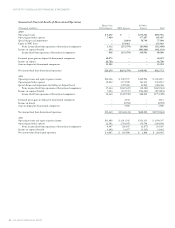

Dec. 31

(Thousands of dollars) 2003 2002

LONG-TERM DEBT – CONTINUED

NRG Finance Co. LLC, due May 9, 2006, various rates – 1,081,000

NRG debt secured solely by project assets:

NRG Northeast Generating Senior Bonds, Series due:

Dec. 15, 2004, 8.065% – 126,500

June 15, 2015, 8.842% – 130,000

Dec. 15, 2024, 9.292% – 300,000

South Central Generating Senior Bonds, Series due:

May 15, 2016, 8.962% – 450,750

Sept. 15, 2024, 9.479% – 300,000

MidAtlantic – various, due Oct. 1, 2005, 4.625% – 409,201

Flinders Power Finance Pty, due September 2012, various rates of 6.14%–6.49% at Dec. 31, 2002 – 99,175

Brazos Valley, due June 30, 2008, 6.75% – 194,362

Camas Power Boiler, due June 30, 2007, and Aug. 1, 2007, 3.65% and 3.38% – 17,861

Sterling Luxembourg #3 Loan, due June 30, 2019, variable rate – 360,122

Hsin Yu Energy Development, due November 2006–April 2012, 4%–6.475% – 85,607

LSP Batesville, due Jan. 15, 2014, 7.164% and July 15, 2025, 8.16% – 314,300

LSP Kendall Energy, due Sept. 1, 2005, 2.65% – 495,754

McClain, due Dec. 31, 2005, 6.75% – 157,288

NEO, due 2005–2008, 9.35% – 7,658

NRG Energy Center, Inc. Senior Secured Notes, Series due June 15, 2013, 7.31% – 133,099

NRG Peaking Finance LLC, due 2019, 6.67% – 319,362

NRG Pike Energy LLC, due 2010, 4.92% – 155,477

PERC, due 2017–2018, 5.2% – 28,695

Audrain Capital Lease Obligation, due Dec. 31, 2023, 10% – 239,930

Saale Energie GmbH Schkopau Capital Lease, due May 2021, various rates – 333,926

Various debt, due 2003–2007, 0.0%–20.8% – 92,573

Other – 677

Total – 8,875,018

Less current maturities – 7,643,654

Total long-term debt from discontinued operations $– $1,231,364

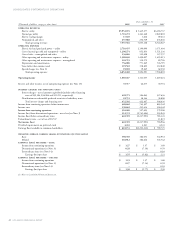

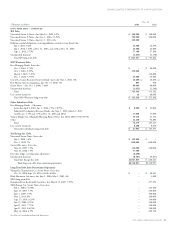

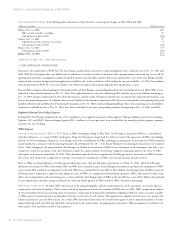

Mandatorily Redeemable Preferred Securities of Subsidiary Trusts holding as their sole asset

the junior subordinated deferrable debentures of the following (see Note 8):

NSP-Minnesota, due 2037, 7.875% $–$200,000

PSCo, due 2038, 7.6% –194,000

SPS, due 2036, 7.85% –100,000

Total mandatorily redeemable preferred securities of subsidiary trusts $–$494,000

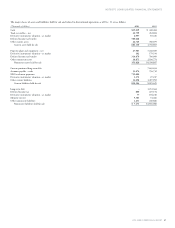

Cumulative Preferred Stock –authorized 7,000,000 shares of $100 par value; outstanding shares:

2003: 1,049,800; 2002: 1,049,800

$3.60 series, 275,000 shares $27,500 $ 27,500

$4.08 series, 150,000 shares 15,000 15,000

$4.10 series, 175,000 shares 17,500 17,500

$4.11 series, 200,000 shares 20,000 20,000

$4.16 series, 99,800 shares 9,980 9,980

$4.56 series, 150,000 shares 15,000 15,000

Total 104,980 104,980

Capital in excess of par value on preferred stock –340

Total preferred stockholders’ equity $104,980 $ 105,320

Common Stockholders’ Equity

Common stock – authorized 1,000,000,000 shares of $2.50 par value; outstanding shares:

2003: 398,964,724; 2002: 398,714,039 $ 997,412 $ 996,785

Capital in excess of par value on common stock 3,890,501 4,038,151

Retained earnings (deficit) 368,663 (100,942)

Accumulated other comprehensive income (loss) (90,136) (269,010)

Total common stockholders’ equity $5,166,440 $4,664,984

(a) Resource recovery financing

(b) Pollution control financing

See Notes to Consolidated Financial Statements.

48 XCEL ENERGY 2003 ANNUAL REPORT

CONSOLIDATED STATEMENTS OF CAPITALIZATION