Xcel Energy 2003 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2003 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.74 XCEL ENERGY 2003 ANNUAL REPORT

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

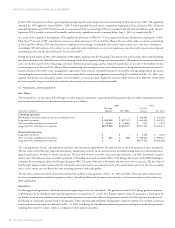

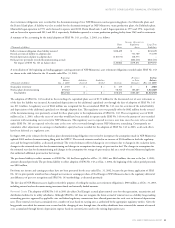

Xcel Energy recorded gains of $0 and $0.4 million related to ineffectiveness on commodity cash flow hedges during the years ended Dec. 31, 2003

and 2002, respectively.

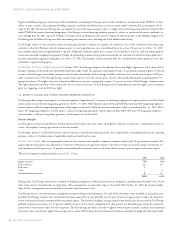

Xcel Energy and its subsidiaries enter into interest rate swap instruments that effectively fix the interest payments on certain floating-rate debt obligations.

These derivative instruments are designated as cash flow hedges for accounting purposes, and the change in the fair value of these instruments is

recorded as a component of Other Comprehensive Income. Xcel Energy expects to reclassify into earnings during the next 12 months net losses

from Other Comprehensive Income of approximately $1.6 million.

Xcel Energy and its subsidiaries also enter into interest rate lock agreements that effectively fix the yield or price on a specified treasury security for a

specific period. These derivative instruments are designated as cash flow hedges for accounting purposes, and the change in the fair value of these instruments

is recorded as a component of Other Comprehensive Income. Xcel Energy expects to reclassify into earnings during the next 12 months net gains from Other

Comprehensive Income of approximately $1.4 million.

Hedge effectiveness is recorded based on the nature of the item being hedged. Hedging transactions for the sales of electric energy are recorded as a

component of revenue; hedging transactions for fuel used in energy generation are recorded as a component of fuel costs; hedging transactions for gas

purchased for resale are recorded as a component of gas costs; and hedging transactions for interest rate swaps and interest rate lock agreements are

recorded as a component of interest expense. Certain Xcel Energy utility subsidiaries are allowed to recover in electric or gas rates the costs of certain

financial instruments purchased to reduce commodity cost volatility.

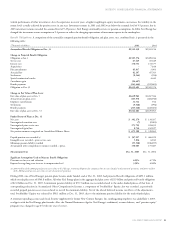

Fair Value Hedges Xcel Energy and its subsidiaries enter into interest rate swap instruments that effectively hedge the fair value of fixed rate debt. In

June 2003, Xcel Energy entered into two five-year swaps, with a $97.5 million notional value each, against Xcel Energy’s $195 million 3.40-percent

senior notes due 2008. Xcel Energy entered into the swaps to obtain greater access to the lower borrowing costs normally available on floating-rate debt.

These swap agreements involve the exchange of amounts based on a variable rate of six-month London Interbank Offered Rate (LIBOR) plus an adder

rate over the life of the agreement. The difference to be paid or received as interest rates change is accrued and recognized as an adjustment of interest

expense related to the debt. The fair market value of Xcel Energy’s interest rate swaps at Dec. 31, 2003, was $(6.3) million.

Hedges of Foreign Currency Exposure of a Net Investment in Foreign Operations Due to the discontinuance of NRG and Xcel Energy

International’s operations in 2003, as discussed in Notes 3 and 4 to the Consolidated Financial Statements, Xcel Energy no longer has foreign

currency exposure.

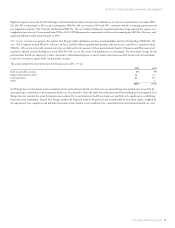

During 2002, to preserve the U.S. dollar value of projected foreign currency cash flows, Xcel Energy, through NRG, hedged those cash flows if appropriate

foreign hedging instruments were available. Xcel Energy recorded unrealized losses of $0.8 million associated with changes in the fair value of non-hedge,

foreign currency derivative instruments for the year ended Dec. 31, 2002. In addition, Xcel Energy recorded losses of $2.3 million related to the

discontinuance of hedge accounting for the year ended Dec. 31, 2002.

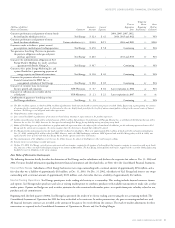

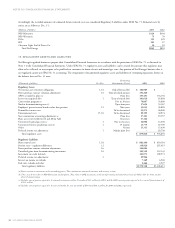

Derivatives Not Qualifying for Hedge Accounting Xcel Energy and its subsidiaries have trading operations that enter into derivative instruments.

These derivative instruments are accounted for on a mark-to-market basis in the Consolidated Statements of Operations. The results of these transactions

are recorded within Operating Revenues on the Consolidated Statements of Operations.

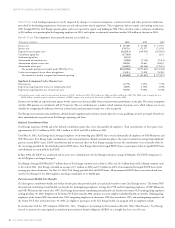

Normal Purchases or Normal Sales Contracts Xcel Energy’s utility subsidiaries enter into contracts for the purchase and sale of various commodities for

use in their business operations. SFAS No. 133 requires a company to evaluate these contracts to determine whether the contracts are derivatives. Certain

contracts that literally meet the definition of a derivative may be exempted from SFAS No. 133, as amended, as normal purchases or normal sales. Normal

purchases and normal sales are contracts that provide for the purchase or sale of something other than a financial instrument or derivative instrument that will

be delivered in quantities expected to be used or sold over a reasonable period in the normal course of business. In addition, normal purchase and normal sales

contracts must have a price based on an underlying that is clearly and closely related to the asset being sold or purchased. An underlying is a specified interest

rate, security price, commodity price, foreign exchange rate, index of prices or rates, or other variable, including the occurrence or nonoccurrence

of a specified event such as a scheduled payment under a contract. Contracts that meet the requirements of normal are documented and exempted from the

accounting and reporting requirements of SFAS No. 133. In June 2003, the Derivatives Implementation Group of FASB issued Implementation Issue No. C20

(C20) to clarify the circumstances when an underlying is not clearly and closely related to the asset being sold or purchased. Xcel Energy’s implementation

of C20 in 2003 had no impact on earnings. However, certain contracts did require a one-time fair value adjustment as of Oct. 1, 2003. The result of this

adjustment was the creation of a derivative liability with an offsetting regulatory asset to reflect expected recovery of the amounts from customers. The

derivative asset and related regulatory liability will be amortized over the respective lives of the contracts. See Note 19 to the Consolidated Financial Statements.

Xcel Energy evaluates all of its contracts within the regulated and nonregulated operations when such contracts are entered to determine if they are

derivatives and, if so, if they qualify and meet the normal designation requirements under SFAS No. 133. None of the contracts entered into within the

trading operations qualify for a normal designation.

Normal purchases and normal sales contracts are accounted for as executory contracts as required under other generally accepted accounting principles.