Xcel Energy 2003 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2003 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MANAGEMENT’S DISCUSSION AND ANALYSIS

XCEL ENERGY 2003 ANNUAL REPORT 27

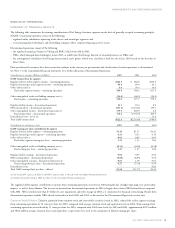

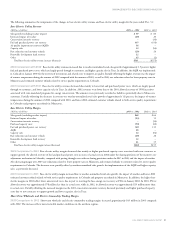

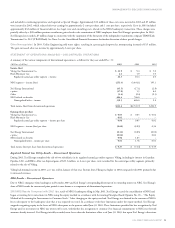

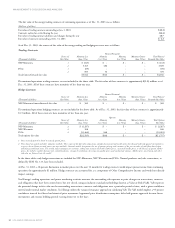

2003 Nonregulated Results Compared with 2002 Results of discontinued nonregulated operations, other than NRG, include an after-tax loss of

$59 million, or 14 cents per share, expected on the disposal of Xcel Energy International’s assets, based on the estimated fair value of such assets. Xcel

Energy’s remaining investment in Xcel Energy International at Dec. 31, 2003, was approximately $39 million. These losses from discontinued nonregulated

operations also include a charge of $16 million for costs of settling a Commodity Futures Trading Commission trading investigation of e prime.

2002 Nonregulated Results Compared with 2001 Nonregulated and holding company earnings for 2002 were reduced by impairment losses

recorded by Xcel Energy International for Argentina assets and disposal losses for Yorkshire Power. In 2002, Xcel Energy International decided it would

no longer fund one of its power projects in Argentina. This decision resulted in the shutdown of the Argentina plant facility, pending financing of

a necessary maintenance outage. Updated cash flow projections for the plant were insufficient to provide recovery of Xcel Energy International’s

investment. The write-down for this Argentina facility was approximately $13 million, or 3 cents per share.

In August 2002, Xcel Energy announced it had sold Xcel Energy International’s 5.25-percent interest in Yorkshire Power Group Limited for $33 million

to CE Electric UK. Xcel Energy International and American Electric Power Co. each held a 50-percent interest in Yorkshire, a UK retail electricity and

natural gas supplier and electricity distributor, before selling 94.75 percent of Yorkshire to Innogy Holdings plc in April 2001. The sale of the 5.25-percent

interest resulted in an after-tax loss of $8.3 million, or 2 cents per share, in the third quarter of 2002.

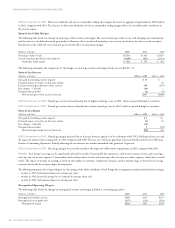

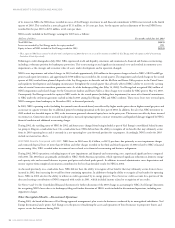

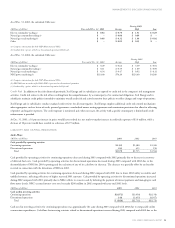

Tax Benefits Related to Investment in NRG With NRG’s emergence from bankruptcy in December 2003, Xcel Energy has divested its ownership

interest in NRG and plans to take a loss deduction in 2003. These benefits, since related to Xcel Energy’s investment in discontinued NRG operations,

are also reported as discontinued operations. During 2002, Xcel Energy recognized an initial estimate of the expected tax benefits of $706 million. This

benefit was based on the estimated tax basis of Xcel Energy’s cash and stock investments already made in NRG, and their deductibility for federal income

tax purposes.

Based on the results of a 2003 study, Xcel Energy recorded $105 million of additional tax benefits in the third quarter of 2003, reflecting an updated

estimate of the tax basis of Xcel Energy’s investments in NRG and state tax deductibility. Upon NRG’s emergence from bankruptcy, an additional

$288 million of tax benefit was recorded in the fourth quarter of 2003 to reflect the deductibility of expected settlement payments of $752 million,

uncollectible receivables from NRG, other state tax benefits and further adjustments to the estimated tax basis in NRG. Another $11 million of state

tax benefits were accrued earlier in 2003 based on projected impacts.

Based on current forecasts of taxable income and tax liabilities, Xcel Energy expects to realize approximately $1.1 billion of cash savings from these tax

benefits through a refund of taxes paid in prior years and reduced taxes payable in future years. Xcel Energy used $130 million of these tax benefits

in 2003 and expects to use $480 million in 2004. The remainder of the tax benefit carry forward is expected to be used over subsequent years.

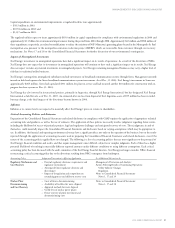

EXTRAORDINARY ITEM – ELECTRIC UTILITY RESTRUCTURING

In 2001, SPS recorded extraordinary income of $18 million before tax, or 3 cents per share, related to the regulated utility business to reflect the

impacts of industry restructuring developments for SPS. This represented a reversal of a portion of an extraordinary loss recorded in 2000 related

to industry restructuring. For more information on this 2001 extraordinary item, see Note 14 to the Consolidated Financial Statements.

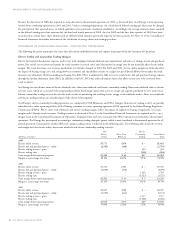

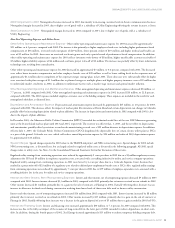

FACTORS AFFECTING RESULTS OF CONTINUING OPERATIONS

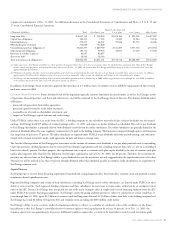

Xcel Energy’s utility revenues depend on customer usage, which varies with weather conditions, general business conditions and the cost of energy services.

Various regulatory agencies approve the prices for electric and natural gas service within their respective jurisdictions and affect our ability to recover our

costs from customers. In addition, Xcel Energy’s nonregulated businesses have had an adverse impact on Xcel Energy’s earnings in 2003 and 2002. The

historical and future trends of Xcel Energy’s operating results have been, and are expected to be, affected by a number of factors, including the following:

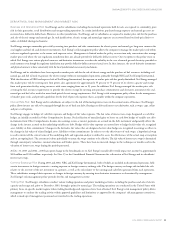

General Economic Conditions

Economic conditions may have a material impact on Xcel Energy’s operating results. The United States economy is showing recent signs of recovery as

measured by growth in the gross domestic product. However, certain operating costs, such as insurance and security, have increased due to economic

uncertainty, terrorist activity and war or the threat of war. Management cannot predict the impact of a future economic slowdown, fluctuating energy

prices, war or the threat of war. However, Xcel Energy could experience a material adverse impact to its results of operations, future growth or ability

to raise capital from a stalled economic recovery.

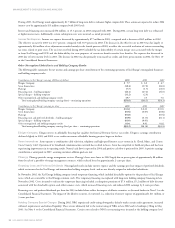

Sales Growth

In addition to the impact of weather, customer sales levels in Xcel Energy’s regulated utility businesses can vary with economic conditions, customer

usage patterns and other factors. Weather-normalized sales growth for retail electric utility customers was estimated to be 1.5 percent in 2003

compared with 2002, and 1.8 percent in 2002 compared with 2001. Weather-normalized sales growth for firm gas utility customers was estimated

to be approximately 1.6 percent in 2003 compared with 2002, and relatively flat in 2002 compared with 2001. Projections indicate that weather-

normalized sales growth in 2004 compared with 2003 will be approximately 2.2 percent for retail electric utility customers and 2.4 percent for

firm gas utility customers.