Xcel Energy 2003 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2003 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54 XCEL ENERGY 2003 ANNUAL REPORT

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

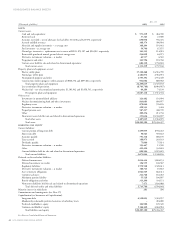

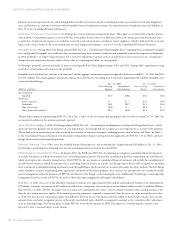

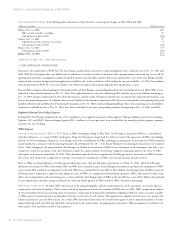

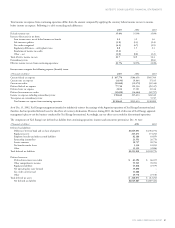

Accrued Special Charges The following table summarizes activity related to accrued special charges in 2003, 2002 and 2001:

(Millions of dollars) Utility Severance *

Balance, Dec. 31, 2000 $48

2001 accruals recorded – restaffing 39

Cash payments made in 2001 (50)

Balance, Dec. 31, 2001 37

Adjustments/revisions to prior year accruals 9

Cash payments made in 2002 (33)

Balance, Dec. 31, 2002 13

Cash payments made in 2003 (10)

Balance, Dec. 31, 2003 $3

* Reported on the balance sheet in Other Current Liabilities.

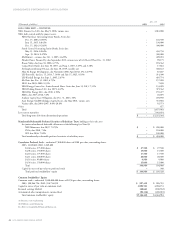

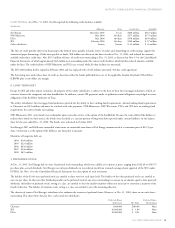

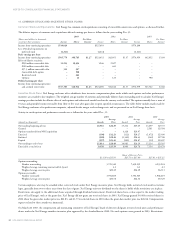

3. DISCONTINUED OPERATIONS

Pursuant to the requirements of SFAS No. 144, Xcel Energy classified and accounted for certain nonregulated assets as held for sale at Dec. 31, 2003 and

2002. SFAS No. 144 requires that assets held for sale are valued on an asset-by-asset basis at the lower of the carrying amount or fair value less costs to sell. In

applying those provisions, management considered cash flow analyses, bids and offers related to those assets and businesses. As a result, Xcel Energy recorded

estimated after-tax losses on disposal of nonregulated assets held for sale, as discussed below, of $59 million for the year ended Dec. 31, 2003. In accordance

with the provisions of SFAS No. 144, assets held for sale will not be depreciated commencing with their classification as such.

Due to NRG’s emergence from bankruptcy in December 2003 and Xcel Energy’s corresponding divestiture of its ownership interest in NRG, NRG is now

reflected as a discontinued operation at Dec. 31, 2003. Two regulated businesses also were sold during 2003 and have no assets or liabilities remaining at

Dec. 31, 2003. Results of operations for these divested businesses, and the results of businesses held for sale, are reported for all periods presented on a net

basis as discontinued operations. In addition, the assets and liabilities of the businesses divested in 2003 have been reclassified to corresponding Assets and

Liabilities Held for Sale and Related to Discontinued Operations at Dec. 31, 2002, in the accompanying Balance Sheet. The remaining assets and liabilities

of businesses still held for sale at Dec. 31, 2003, have been reclassified to the same corresponding amounts for reporting at Dec. 31, 2003 and 2002.

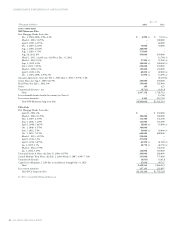

Regulated Natural Gas Utility Segment

During 2003, Xcel Energy completed the sale of two subsidiaries in its regulated natural gas utility segment: Viking, including its interest in Guardian

Pipeline, LLC; and BMG. After-tax disposal gains of $23.3 million, or 6 cents per share, were recorded for the natural gas utility segment, primarily

related to the sale of Viking.

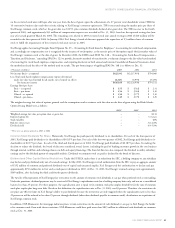

NRG Segment

Change in Accounting for NRG in 2003 Prior to NRG’s bankruptcy filing in May 2003, Xcel Energy accounted for NRG as a consolidated

subsidiary. However, as a result of NRG’s bankruptcy filing, Xcel Energy no longer had the ability to control the operations of NRG. Accordingly,

effective as of the bankruptcy filing date, Xcel Energy ceased the consolidation of NRG and began accounting for its investment in NRG using the

equity method in accordance with Accounting Principles Board Opinion No. 18 – “The Equity Method of Accounting for Investments in Common

Stock.” After changing to the equity method, Xcel Energy was limited in the amount of NRG’s losses subsequent to the bankruptcy date that it was

required to record. In accordance with these limitations under the equity method, Xcel Energy stopped recognizing equity in the losses of NRG

subsequent to the quarter ended June 30, 2003. These limitations provide for loss recognition by Xcel Energy until its investment in NRG is written

off to zero, with further loss recognition to continue if its financial commitments to NRG exist beyond amounts already invested.

Prior to NRG entering bankruptcy, Xcel Energy recorded more losses than the limitations provide for as of June 30, 2003. Upon Xcel Energy’s

divestiture of its interest in NRG in December 2003, the NRG losses recorded in excess of Xcel Energy’s investment in and financial commitment to NRG

were reversed. This resulted in an adjustment of the total NRG losses recorded for the year 2003 to $251 million. Xcel Energy’s share of NRG’s results for

all 2003 periods is reported in a single line item, Equity in Losses of NRG, as a component of discontinued operations. NRG’s 2003 results do reflect some

effects of asset impairments and restructuring costs, as discussed below. Xcel Energy’s share of NRG results for 2002 was a loss of $3.4 billion, due primarily

to asset impairments and other charges recorded in the third and fourth quarters of 2002 related to NRG’s financial restructuring.

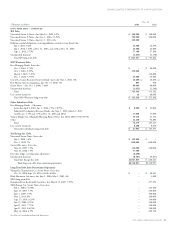

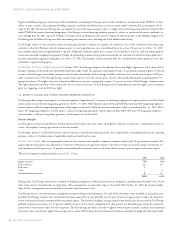

NRG Asset Impairments In 2002, NRG experienced credit-rating downgrades, defaults under numerous credit agreements, increased collateral

requirements and reduced liquidity. These events resulted in impairment reviews of a number of NRG assets in 2002. NRG completed an analysis

of the recoverability of the asset-carrying values of its projects each period, factoring in the probability weighting of different courses of action available

to NRG, given its financial position and liquidity constraints at the time of each analysis. This approach was applied consistently to asset groups with

similar uncertainties and cash flow streams. As a result, NRG determined that many of its construction projects and its operational projects became

impaired during 2002 and 2003 and should be written down to fair market value. In applying those provisions, NRG management considered cash

flow analyses, bids and offers related to those projects.