Xcel Energy 2003 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2003 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

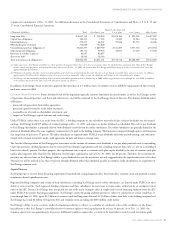

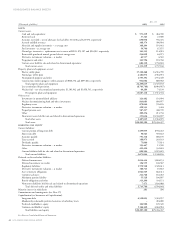

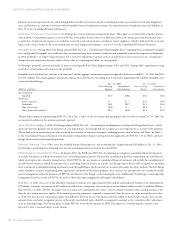

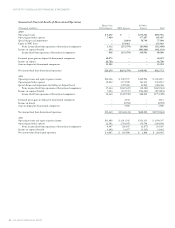

Dec. 31

(Thousands of dollars) 2003 2002

LONG-TERM DEBT

NSP-Minnesota Debt

First Mortgage Bonds, Series due:

Dec. 1, 2004–2006, 3.9%–4.1% $6,990 (a) $ 9,145 (a)

March 1, 2003, 5.875% –100,000

April 1, 2003, 6.375% –80,000

Dec. 1, 2005, 6.125% 70,000 70,000

Aug. 1, 2006, 2.875% 200,000 –

Aug. 1, 2010, 4.75% 175,000 –

Aug. 28, 2012, 8% 450,000 450,000

March 1, 2011, variable rate, 6.265% at Dec. 31, 2002 –13,700 (b)

March 1, 2019, 8.5% 27,900 (b) 27,900 (b)

Sept. 1, 2019, 8.5% 100,000 (b) 100,000 (b)

July 1, 2025, 7.125% 250,000 250,000

March 1, 2028, 6.5% 150,000 150,000

April 1, 2030, 8.5% 69,000 (b) 69,000 (b)

Dec. 1, 2004–2008, 4.35%–5% 11,990 (a) 14,090 (a)

Guaranty Agreements, Series due Feb. 1, 2003–May 1, 2003, 5.375%–7.4% –28,450 (b)

Senior Notes due Aug. 1, 2009, 6.875% 250,000 250,000

Retail Notes due July 1, 2042, 8% 185,000 185,000

Other 399 427

Unamortized discount – net (8,721) (8,931)

Total 1,937,558 1,788,781

Less redeemable bonds classified as current (see Note 6) –13,700

Less current maturities 4,502 212,762

Total NSP-Minnesota long-term debt $1,933,056 $1,562,319

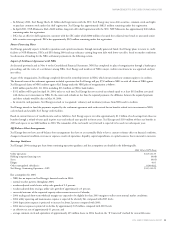

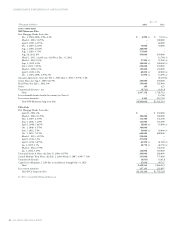

PSCo Debt

First Mortgage Bonds, Series due:

April 15, 2003, 6% $ – $ 250,000

March 1, 2004, 8.125% 100,000 100,000

Nov. 1, 2005, 6.375% 134,500 134,500

June 1, 2006, 7.125% 125,000 125,000

April 1, 2008, 5.625% 18,000 (b) 18,000 (b)

Oct. 1, 2008, 4.375% 300,000 –

June 1, 2012, 5.5% 50,000 (b) 50,000 (b)

Oct. 1, 2012, 7.875% 600,000 600,000

March 1, 2013, 4.875% 250,000 –

April 1, 2014, 5.5% 275,000 –

April 1, 2014, 5.875% 61,500 (b) 61,500 (b)

Jan. 1, 2019, 5.1% 48,750 (b) 48,750 (b)

March 1, 2022, 8.75% –146,340

Jan. 1, 2024, 7.25% 110,000 110,000

Unsecured Senior A Notes, due July 15, 2009, 6.875% 200,000 200,000

Secured Medium-Term Notes, due Feb. 2, 2004–March 5, 2007, 6.9%–7.11% 145,000 175,000

Unamortized discount (6,835) (4,612)

Capital lease obligations, 11.2% due in installments through May 31, 2025 47,650 49,747

Total 2,458,565 2,064,225

Less current maturities 147,131 282,097

Total PSCo long-term debt $2,311,434 $1,782,128

See Notes to Consolidated Financial Statements.

46 XCEL ENERGY 2003 ANNUAL REPORT

CONSOLIDATED STATEMENTS OF CAPITALIZATION