Xcel Energy 2003 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2003 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

86 XCEL ENERGY 2003 ANNUAL REPORT

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

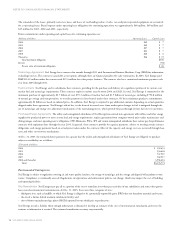

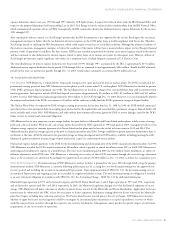

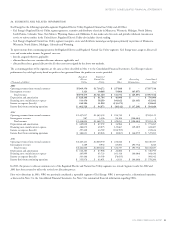

21. SUMMARIZED QUARTERLY FINANCIAL DATA (UNAUDITED)

Summarized quarterly unaudited financial data is as follows:

Quarter ended

March 31, 2003 June 30, 2003 Sept. 30, 2003 Dec. 31, 2003

(Thousands of dollars, except per share amounts) (a) (a) (a) (a)

Revenue $2,086,107 $1,721,754 $2,019,853 $2,109,802

Operating income (loss) 304,022 162,624 358,658 259,943

Income (loss) from continuing operations 126,778 54,982 180,039 148,221

Discontinued operations – income (loss) 13,234 (337,544) 107,456 329,226

Net income (loss) 140,012 (282,562) 287,495 477,447

Earnings (loss) available for common shareholders 138,952 (283,622) 286,435 476,386

Earnings (loss) per share from continuing operations – basic $ 0.32 $ 0.14 $ 0.45 $ 0.37

Earnings (loss) per share from continuing operations – diluted $0.31 $ 0.14 $ 0.43 $ 0.36

Earnings (loss) per share from discontinued operations – basic $0.03 $ (0.85) $ 0.27 $ 0.83

Earnings (loss) per share from discontinued operations – diluted $0.03 $ (0.85) $ 0.26 $ 0.78

Earnings (loss) per share total – basic $0.35 $ (0.71) $ 0.72 $ 1.20

Earnings (loss) per share total – diluted $0.34 $ (0.71) $ 0.69 $ 1.14

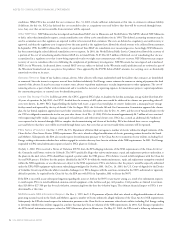

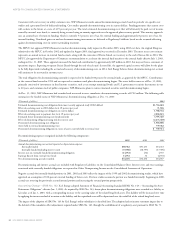

Quarter ended

March 31, 2002 June 30, 2002 Sept. 30, 2002 Dec. 31, 2002

(Thousands of dollars, except per share amounts) (b) (b) (b) (b)

Revenue $1,834,811 $1,598,832 $1,726,436 $1,875,049

Operating income (loss) 253,498 262,513 373,188 251,838

Income (loss) from continuing operations 121,578 117,242 178,002 110,871

Discontinued operations – income (loss) (18,074) (29,940) (2,382,042) (315,628)

Net income (loss) 103,504 87,302 (2,204,040) (204,757)

Earnings (loss) available for common shareholders 102,444 86,242 (2,205,100) (205,818)

Earnings (loss) per share from continuing operations – basic $ 0.34 $ 0.31 $ 0.44 $ 0.27

Earnings (loss) per share from continuing operations – diluted $ 0.34 $ 0.31 $ 0.44 $ 0.27

Earnings (loss) per share from discontinued operations – basic $ (0.05) $ (0.08) $ (5.99) $ (0.79)

Earnings (loss) per share from discontinued operations – diluted $ (0.05) $ (0.08) $ (5.99) $ (0.77)

Earnings (loss) per share total – basic $ 0.29 $ 0.23 $ (5.55) $ (0.52)

Earnings (loss) per share total – diluted $ 0.29 $ 0.23 $ (5.55) $ (0.50)

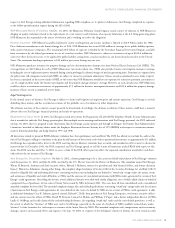

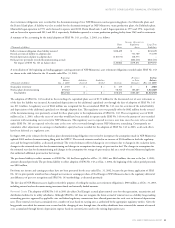

(a) 2003 results include special charges in certain quarters, as discussed in Note 2 to the Consolidated Financial Statements, and unusual items as follows:

–Results from continuing operations were decreased for NRG-related restructuring costs incurred by the holding company in the amount of $1.4 million in the first quarter,

$7.3 million in the second quarter, and $3.0 million in the third quarter.

–Fourth-quarter results from continuing operations were increased by $22 million, or 3 cents per share, for adjustments made to depreciation accruals for the year, due to a

regulatory decision approving the extension of NSP-Minnesota’s Prairie Island nuclear plant to operate over the license term.

–Fourth-quarter results from continuing operations were increased by $30 million, or 7 cents per share, for adjustments made to income tax accruals to reflect the successful

resolution of various outstanding tax issues.

–Fourth-quarter results from continuing operations were decreased by $7 million pretax, or 1 cent per share, for charges recorded related to the TRANSLink project due to

regulatory and operating uncertainties.

–Fourth-quarter results from discontinued operations were increased by $111 million, or 26 cents per share, for reversal of equity in prior NRG losses due to the divestiture of

NRG in December 2003, and increased by $288 million, or 68 cents per share, due to revisions to the estimated tax benefits related to Xcel Energy’s investment in NRG. See

Note 3 to the Consolidated Financial Statements for further discussion of these items.

–Fourth-quarter results from discontinued operations were decreased by $59 million, or 14 cents per share, due to the estimated impairment expected to result from the disposal

of Xcel Energy International’s Argentina assets, as discussed in Note 3 to the Consolidated Financial Statements, and by $16 million, or 4 cents per share, due to the accrual

of e prime’s cost to settle an investigation by the Commodity Futures Trading Commission.

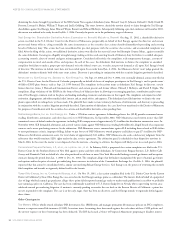

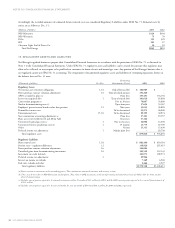

(b) 2002 results include special charges in certain quarters, as discussed in Note 2 to the Consolidated Financial Statements, and unusual items as follows:

–First-quarter results from continuing operations were decreased by $9 million, or 1 cent per share, for a special charge related to utility/service company employee restaffing

costs, and by $5 million, or 1 cent per share, for regulatory recovery adjustments at SPS included in special charges.

–Results from continuing operations were decreased in the amount of $1.2 million in the third quarter and $3.6 million in the fourth quarter for NRG-related restructuring

costs incurred by the holding company.

–Fourth-quarter results from discontinued operations were decreased by $95 million, or 23 cents per share, for NRG charges related to asset impairments and financial

restructuring costs, and increased by $30 million, or 7 cents per share, due to revisions to the estimated tax benefits related to Xcel Energy’s investment in NRG.