Xcel Energy 2003 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2003 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

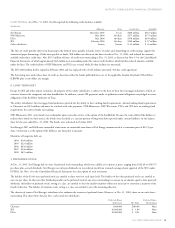

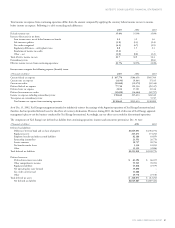

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

XCEL ENERGY 2003 ANNUAL REPORT 65

volatile performance of other investments. As is the experience in recent years, a higher weighting in equity investments can increase the volatility in the

return levels actually achieved by pension assets in any year. Investment returns in 2001 and 2002 were below the assumed level of 9.5 percent, but in

2003 investment returns exceeded the assumed level of 9.25 percent. Xcel Energy continually reviews its pension assumptions. In 2004, Xcel Energy has

changed the investment-return assumption to 9.0 percent to reflect the changing expectations of investment experts in the marketplace.

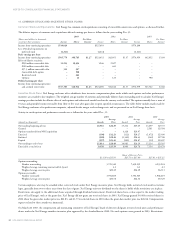

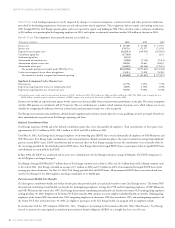

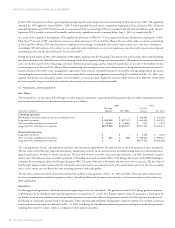

Benefit Obligations A comparison of the actuarially computed pension-benefit obligation and plan assets, on a combined basis, is presented in the

following table:

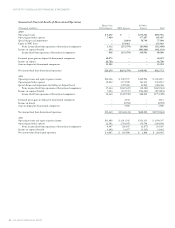

(Thousands of dollars) 2003 2002

Accumulated Benefit Obligation at Dec. 31 $2,512,138 $2,381,214

Change in Projected Benefit Obligation

Obligation at Jan. 1 $2,505,576 $2,409,186

Service cost 67,449 65,649

Interest cost 170,731 172,377

Acquisitions –7,848

Plan amendments 85,937 3,903

Actuarial loss 82,197 65,763

Settlements (9,546) (994)

Special termination benefits –4,445

Curtailment gain (26,407) –

Benefit payments (243,446) (222,601)

Obligation at Dec. 31 $2,632,491 $2,505,576

Change in Fair Value of Plan Assets

Fair value of plan assets at Jan. 1 $2,639,963 $3,267,586

Actual return on plan assets 605,978 (404,940)

Employer contributions 31,712 912

Settlements (9,546) (994)

Benefit payments (243,446) (222,601)

Fair value of plan assets at Dec. 31 $3,024,661 $2,639,963

Funded Status of Plans at Dec. 31

Net asset $ 392,170 $ 134,387

Unrecognized transition asset (7) (2,003)

Unrecognized prior service cost 273,725 224,651

Unrecognized (gain) loss 9,710 182,927

Net pension amounts recognized on Consolidated Balance Sheets $ 675,598 $ 539,962

Prepaid pension asset recorded(a) $ 567,227 $ 466,229

Intangible asset recorded – prior service costs 5,816 6,943

Minimum pension liability recorded (55,528) (106,897)

Accumulated other comprehensive income recorded – pretax 158,083 173,687

Measurement Date Dec. 31, 2003 Dec. 31, 2002

Significant Assumptions Used to Measure Benefit Obligations

Discount rate for year-end valuation 6.25% 6.75%

Expected average long-term increase in compensation level 3.50% 4.00%

(a) $19.9 million of the 2003 prepaid pension asset relates to Xcel Energy’s remaining obligation for companies that are now classified as discontinued operations, and $17.5 million

of the 2002 prepaid pension asset relates to such discontinued operations.

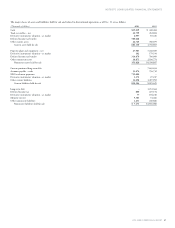

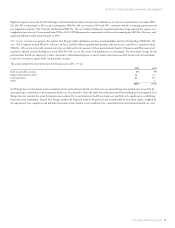

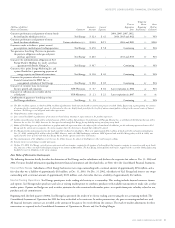

During 2002, one of Xcel Energy’s pension plans became under funded, and at Dec. 31, 2003, had projected benefit obligations of $653.1 million,

which exceeds plan assets of $563.8 million. All other Xcel Energy plans in the aggregate had plan assets of $2.5 billion and projected benefit obligations

of $2.0 billion on Dec. 31, 2003. A minimum pension liability of $55.5 million was recorded related to the under-funded plan as of that date. A

corresponding reduction in Accumulated Other Comprehensive Income, a component of Stockholders’ Equity, also was recorded, as previously

recorded prepaid pension assets were reduced to record the minimum liability. Net of the related deferred income tax effects of the adjustments,

total Stockholders’ Equity was reduced by $98.1 million at Dec. 31, 2003, due to the minimum pension liability for the under-funded plan.

A retirement spending account and Social Security supplement for former New Century Energies, Inc. nonbargaining employees was added July 1, 2003,

to align it with the Xcel Energy plan formula. Also, the Normal Retirement Age for Xcel Energy’s traditional, account balance, and “pension equity”

programs was changed to age 65 with one year of service.