Xcel Energy 2003 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2003 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.80 XCEL ENERGY 2003 ANNUAL REPORT

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

dismissing the claims brought by purchasers of the NRG Senior Notes against defendants James Howard, Gary R. Johnson, Richard C. Kelly, David H.

Peterson, Leonard A. Bluhm, William T. Pieper and Luella Goldberg. The court, however, denied the motion related to claims brought by Xcel Energy

shareholders against Xcel Energy, James Howard, Wayne Brunetti and Edward McIntyre. Subsequently, following a pre-trial conference in December 2003,

this matter was ordered to be ready for trial by Feb. 1, 2006. Presently the parties are in the preliminary stages of discovery.

Xcel Energy Inc. Shareholder Derivative Action; Essmacher vs. Brunetti; McLain vs. Brunetti On Aug. 15, 2002, a shareholder derivative

action was filed in the U.S. District Court for the District of Minnesota, purportedly on behalf of Xcel Energy, against the directors and certain

present and former officers, citing essentially the same circumstances as the securities class actions described immediately preceding and asserting

breach of fiduciary duty. This action has been consolidated for pre-trial purposes with the securities class actions, and an amended complaint was

filed. After the filing of this action, two additional derivative actions were filed in the state trial court for Hennepin County, Minn., against essentially

the same defendants, focusing on allegedly wrongful energy trading activities and asserting breach of fiduciary duty for failure to establish adequate

accounting controls, abuse of control and gross mismanagement. Considered collectively, the complaints seek compensatory damages, a return of

compensation received, and awards of fees and expenses. In each of the cases, the defendants filed motions to dismiss the complaint or amended

complaint for failure to make a proper pre-suit demand, or in the federal court case, to make any pre-suit demand at all, upon Xcel Energy’s board

of directors. The motions in federal court have not been ruled upon. In an order dated Jan. 6, 2004, the Minnesota district court judge granted the

defendants’ motion to dismiss both of the state court actions. Discovery is proceeding in conjunction with the securities litigation previously described.

Newcome vs. Xcel Energy Inc.; Barclay vs. Xcel Energy Inc. On Sept. 23, 2002 and Oct. 9, 2002, two essentially identical actions were filed in

the U.S. District Court for the District of Colorado, purportedly on behalf of classes of employee participants in Xcel Energy’s, and its predecessors’,

401(k) or ESOP plans from as early as Sept. 23, 1999 forward. The complaints in the actions name as defendants Xcel Energy, its directors, certain

former directors, James J. Howard and Giannantonio Ferrari, and certain present and former officers, Edward J. McIntyre and David E. Ripka. The

complaints allege violations of the ERISA in the form of breach of fiduciary duty in allowing or encouraging purchase, contribution and/or reten-

tion of Xcel Energy’s common stock in the plans and making misleading statements and omissions in that regard. The complaints seek injunctive relief,

restitution, disgorgement and other remedial relief, interest and an award of fees and expenses. The defendants have filed motions to dismiss the com-

plaints upon which no rulings have yet been made. The plaintiffs have made certain voluntary disclosure of information, and discovery is proceeding

in conjunction with the securities litigation previously described. Upon motion of defendants, the cases have been transferred to the District of Minnesota

for purposes of coordination with the securities class actions and shareholders derivative action pending there.

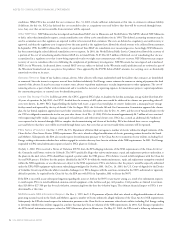

SchlumbergerSema, Inc. vs. Xcel Energy Inc. Under a 1996 data services agreement, SchlumbergerSema, Inc. (SLB) provides automated meter

reading, distribution automation, and other data services to NSP-Minnesota. In September 2002, NSP-Minnesota issued written notice that SLB

committed events of default under the agreement, including SLB's nonpayment of approximately $7.4 million for distribution automation assets. In

November 2002, SLB demanded arbitration and asserted various claims against NSP-Minnesota totaling $24 million for alleged breach of an expansion

contract and a meter purchasing contract. In the arbitration, NSP-Minnesota asserts counterclaims against SLB including those related to SLB’s failure

to meet performance criteria, improper billing, failure to pay for use of NSP-Minnesota owned property and failure to pay $7.4 million for NSP-

Minnesota distribution automation assets, for total claims of approximately $41 million. NSP-Minnesota also seeks a declaratory judgment from the

arbitrators that would terminate SLB's rights under the data services agreement. The arbitration panel is scheduled to hear dispositive motions in

March 2004. In the event the matter is not disposed of on the motions, a hearing to arbitrate the dispute will likely occur in second quarter 2004.

Cornerstone Propane Partners, L.P., et al., vs. e prime, inc., et al. In February 2004, a purported class action complaint was filed in the U.S.

District Court for the Southern District of New York against e prime and three other defendants, by Cornerstone Propane Partners, L.P., Robert Calle

Gracey and Dominick Viola on behalf of a class who purchased or sold one or more New York Mercantile Exchange natural gas futures and/or options

contracts during the period from Jan. 1, 2000 to Dec. 31, 2002. The complaint alleges that defendants manipulated the price of natural gas futures

and options and/or the price of natural gas underlying those contracts in violation of the Commodities Exchange Act. On Feb. 2, 2004, the plaintiff

requested that this action be consolidated with a similar suit involving Reliant Energy Services. Xcel Energy is in the process of reviewing this recently

filed complaint and intends to vigorously defend itself in the lawsuit.

Texas-Ohio Energy, Inc. vs. Centerpoint Energy, et al. On Nov. 19, 2003, a class action complaint filed in the U.S. District Court for the Eastern

District of California by Texas-Ohio Energy, Inc. was served on the Xcel Energy naming e prime as a defendant. The lawsuit, filed on behalf of a purported

class of large wholesale natural gas purchasers, alleges that e prime falsely reported natural gas trades to market trade publications in an effort to artificially

raise natural gas prices in California. The case has been conditionally transferred to U.S. District Judge Pro in Nevada who is supervising western areas

wholesale natural gas marketing litigation. A motion is currently pending to transfer the case back to the Eastern District of California. e prime has

not yet responded to the complaint. The case is in the early stages, there has been no discovery, and Xcel Energy intends to vigorously defend against

these claims.

Other Contingencies

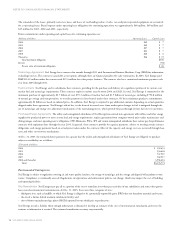

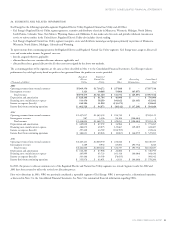

Tax Matters PSCo’s wholly owned subsidiary PSR Investments, Inc. (PSRI) owns and manages permanent life insurance policies on PSCo employees,

known as corporate-owned life insurance (COLI). At various times, borrowings have been made against the cash values of these COLI policies and

the interest expense on these borrowings has been deducted. The IRS had issued a Notice of Proposed Adjustment proposing to disallow interest