Xcel Energy 2003 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2003 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70 XCEL ENERGY 2003 ANNUAL REPORT

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

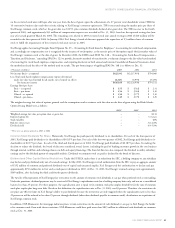

In June 2001, the governor of Texas signed legislation postponing the retail competition and restructuring for SPS until at least 2007. This legislation

amended the 1999 legislation, Senate Bill No. 7 (SB-7), which provided for retail electric competition beginning in Texas in January 2002. Under the

amended legislation, prior PUCT orders issued in connection with the restructuring of SPS are considered null and void. In addition, under the new

legislation, SPS is entitled to recover all reasonable and necessary expenditures made or incurred before Sept. 1, 2001, to comply with SB-7.

As a result of these legislative developments, SPS reapplied the provisions of SFAS No. 71 for its generation business during the second quarter of 2001.

More than 95 percent of SPS’ retail electric revenues are from operations in Texas and New Mexico. Because of the delays to electric restructuring

in Texas and New Mexico, SPS’ previous plans to implement restructuring, including the divestiture of generation assets, have been abandoned.

Accordingly, SPS will continue to be subject to rate regulation under traditional cost-of-service regulation, consistent with its past accounting and

ratemaking practices for the foreseeable future (at least until 2007).

During the fourth quarter of 2001, SPS completed a $500 million, medium-term debt financing. The proceeds were used to reduce short-term borrowings

that had resulted from the 2000 defeasance of first mortgage bonds. In its regulatory filings and communications, SPS proposed to amortize its defeasance

costs over the five-year life of the refinancing, consistent with historical ratemaking, and has requested incremental rate recovery of $25 million of other

restructuring costs in Texas and New Mexico. These nonfinancing restructuring costs have been deferred and are being amortized consistent with rate

recovery. Based on these 2001 events, management’s expectation of rate recovery of prudently incurred costs and the corresponding reduced uncertainty

surrounding the financial impacts of the delay in restructuring, SPS restored certain regulatory assets totaling $17.6 million as of Dec. 31, 2001, and

reported related after-tax extraordinary income of $11.8 million, or 3 cents per share. Regulatory assets previously written off in 2000 were restored only

for items currently being recovered in rates and items where future rate recovery is considered probable.

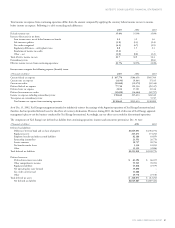

15. FINANCIAL INSTRUMENTS

Fair Values

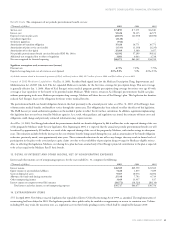

The estimated Dec. 31 fair values of Xcel Energy’s recorded financial instruments, separately identifying amounts that are within continuing operations

and amounts included related to discontinued operations, are as follows:

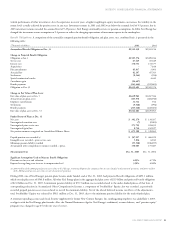

2003 2002

Carrying Carrying

(Thousands of dollars) Amount Fair Value Amount Fair Value

Continuing Operations

Mandatorily redeemable preferred securities of subsidiary trust $–$–$ 494,000 $ 463,348

Long-term investments $828,802 $ 827,375 $ 649,160 $ 647,395

Notes receivable, including current portion $12,643 $ 12,643 $ 5,352 $ 5,352

Long-term debt, including current portion $6,678,808 $7,363,457 $5,877,220 $6,123,173

Discontinued Operations

Long-term investments $–$–$4,048 $ 4,048

Notes receivable, including current portion $ 826 $ 826 $ 990,815 $ 990,815

Long-term debt, including current portion $–$–$8,875,018 $6,048,886

The carrying amount of cash, cash equivalents and short-term investments approximates fair value because of the short maturity of those instruments.

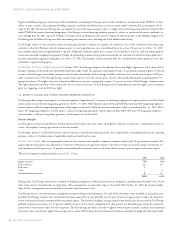

The fair values of Xcel Energy’s long-term investments, mainly debt securities in an external nuclear decommissioning fund, are estimated based on

quoted market prices for those or similar investments. The fair value of notes receivable is based on expected future cash flows discounted at market

interest rates. The balance in notes receivable is primarily a $10 million unsecured note from NRG to Xcel Energy that was part of the NRG bankruptcy

settlement for intercompany claims Xcel Energy had against NRG. The term of the note is 30 months and the interest rate is 3 percent. The fair values of

Xcel Energy’s long-term debt and mandatorily redeemable preferred securities are estimated based on the quoted market prices for the same or similar

issues, or the current rates for debt of the same remaining maturities and credit quality.

The fair value estimates presented are based on information available to management as of Dec. 31, 2003 and 2002. These fair value estimates have

not been comprehensively revalued for purposes of these Consolidated Financial Statements since that date, and current estimates of fair values may

differ significantly.

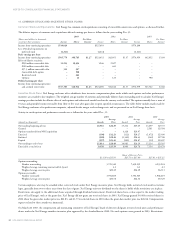

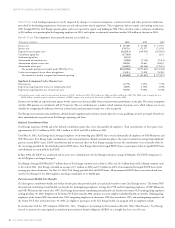

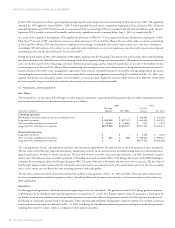

Guarantees

Xcel Energy provides guarantees and bond indemnities supporting certain of its subsidiaries. The guarantees issued by Xcel Energy guarantee payment

or performance by its subsidiaries under specified agreements or transactions. As a result, Xcel Energy’s exposure under the guarantees is based upon the

net liability of the relevant subsidiary under the specified agreements or transactions. Most of the guarantees issued by Xcel Energy limit the exposure of

Xcel Energy to a maximum amount stated in the guarantee. Unless otherwise indicated below, the guarantees require no liability to be recorded, contain no

recourse provisions and require no collateral. On Dec. 31, 2003, Xcel Energy had the following amount of guarantees and exposure under these guarantees,

including those related to e prime, which is a component of discontinued operations: