Xcel Energy 2003 Annual Report Download

Download and view the complete annual report

Please find the complete 2003 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16XCELENERGY2003ANNUALREPORT

XCELENERGY2003ANNUALREPORT17

Table of contents

-

Page 1

XCEL฀ENERGY฀2003฀ANNUAL฀REPORT฀฀฀฀฀17 -

Page 2

..., Inc. (broadband telecommunications services), Planergy International, Inc. (energy management solutions) and Eloigne Co. (investments in rental housing projects that qualify for low-income housing tax credits). During 2003, the board of directors of Xcel Energy approved management's plan to exit... -

Page 3

...subsidiaries and the holding company, where corporate financing activity occurs. Discontinued operations consist of the following: - the regulated natural gas businesses Viking and BMG, which were sold in 2003; - NRG, which emerged from bankruptcy in late 2003, at which time Xcel Energy divested its... -

Page 4

... cost recovery mechanism in Colorado changed in 2003. For 2002 and 2001, electric utility margins in Colorado reflect the impact of sharing energy costs and savings between customers and shareholders relative to a target cost per delivered kilowatt-hour under the retail incentive cost adjustment... -

Page 5

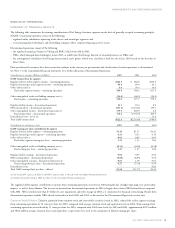

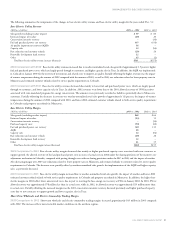

...) 2003 vs. 2002 2002 vs. 2001 Sales growth (excluding weather impact) Estimated impact of weather Conservation incentive recovery Fuel and purchased power cost recovery Air quality improvement recovery (AQIR) Capacity sales Rate reductions and customer refunds Renewable development fund recovery... -

Page 6

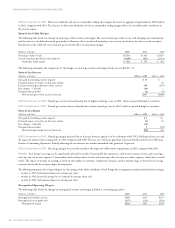

... changing sales requirements and the unit cost of wholesale natural gas purchases. However, due to purchased natural gas cost recovery mechanisms for sales to retail customers, fluctuations in the wholesale cost of natural gas have little effect on natural gas margin. (Millions of dollars) 2003 2002... -

Page 7

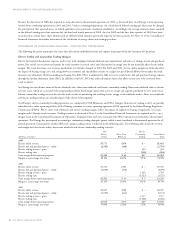

... electric utility plant at PSCo as a part of the general Colorado rate case, which will reduce annual depreciation expense by $20 million and reduced 2003 depreciation expense by approximately $10 million. Special Charges Special charges reported in 2003 relate to the TRANSLink project and NRG... -

Page 8

... liquidity. These events ultimately led to the restructuring of NRG in late 2002 and its bankruptcy filing in May 2003. See Note 4 to the Consolidated Financial Statements. Certain costs related to NRG's restructuring were incurred at the holding company level 24 XCEL ENERGY 2003 ANNUAL REPORT -

Page 9

... million pension curtailment gain related to the termination of NRG employees from Xcel Energy's pension plan. In 2003, Xcel Energy also recorded a $7 million charge in connection with the suspension of the formation of the independent transmission company TRANSLink Transmission Co., LLC (TRANSLink... -

Page 10

... costs and resulted in numerous asset impairments as the strategic and economic value of assets under development and in operation changed. NRG's asset impairments and related charges in 2003 include approximately $40 million in first-quarter charges related to NRG's NEO landfill gas projects... -

Page 11

...cents per share, in the third quarter of 2002. Tax Benefits Related to Investment in NRG With NRG's emergence from bankruptcy in December 2003, Xcel Energy has divested its ownership interest in NRG and plans to take a loss deduction in 2003. These benefits, since related to Xcel Energy's investment... -

Page 12

.... Xcel Energy bases its discount rate assumption on benchmark interest rates quoted by an established credit rating agency, Moody's Investors Service (Moody's), and has consistently benchmarked the interest rate used to derive the discount rate to the movements in the long-term corporate bond... -

Page 13

... gas and, in Minnesota and Colorado, conservation and energy-management program costs. In Minnesota and Colorado, changes in purchased electric capacity costs are not recovered through these rate-adjustment mechanisms. For Wisconsin electric operations, where automatic cost-of-energy adjustment... -

Page 14

... refund obligations under the electric QSP plan was recorded in 2003 relating to the electric service unavailability and customer complaint measures. No refund under the gas QSP is anticipated. In 2003, PSCo filed an application to put into effect a purchased-capacity cost-adjustment mechanism... -

Page 15

.... Xcel Energy no longer considers NRG's financial restructuring a critical accounting policy due to the divestiture resulting from NRG's emergence from bankruptcy. Accounting Policy Judgments/Uncertainties Affecting Application See Additional Discussion At Regulatory Mechanisms and Cost Recovery... -

Page 16

... will be affected by events beyond the control of Xcel Energy, or otherwise change over time. This may require adjustments to recorded results to better reflect the events and updated information that becomes available. The accompanying financial statements reflect management's best estimates and... -

Page 17

... sharing mechanisms. Xcel Energy manages commodity price risk by entering into purchase and sales commitments for electric power and natural gas, long-term contracts for coal supplies and fuel oil, and derivative instruments. Xcel Energy's risk management policy allows the company to manage... -

Page 18

... in calculating VaR. The VaR model employs a 95-percent confidence interval level based on historical price movement, lognormal price distribution assumption, delta half-gamma approach for non-linear instruments and various holding periods varying from two to five days. 34 XCEL ENERGY 2003 ANNUAL... -

Page 19

..., the calculated VaRs were: (Millions of dollars) Year ended Dec. 31, 2002 Average During 2002 High Low Electric commodity trading (a) Natural gas commodity trading (c) Natural gas retail marketing (c) NRG power marketing (b) (a) Comprises transactions for both NSP-Minnesota and PSCo. (b) NRG VaR... -

Page 20

... activities related to continuing operations decreased during 2003 compared with 2002 due to refinancing activities in 2003 to better align Xcel Energy's capital structure and manage the cost of capital given the improving credit quality of Xcel Energy and its subsidiaries. During 2003, Xcel Energy... -

Page 21

... coverage ratios. The Articles of Incorporation of Xcel Energy place restrictions on the amount of common stock dividends it can pay when preferred stock is outstanding. Under the provisions, dividend payments may be restricted if Xcel Energy's capitalization ratio (on a holding company basis... -

Page 22

...'s Ratings Services (Standard & Poor's) and Moody's Investors Services, Inc. (Moody's). Short-Term Funding Sources Historically, Xcel Energy has used a number of sources to fulfill short-term funding needs, including operating cash flow, notes payable, commercial paper and bank lines of credit. The... -

Page 23

... through internally generated funds. Xcel Energy plans to renew its credit facilities at NSP-Minnesota, PSCo and SPS during 2004 and may refinance existing long-term debt with lower-rate debt, based on market conditions. See discussion of funding for the NRG settlement payments in the following... -

Page 24

... Implementation Group Issue No. C20 "Scope Exceptions: Interpretation of the Meaning of Not Clearly and Closely Related in Paragraph 10(b) Regarding Contracts with a Price Adjustment Feature." DELOITTE & TOUCHE LLP Minneapolis, Minnesota February 27, 2004 40 XCEL ENERGY 2003 ANNUAL REPORT -

Page 25

... of Financial Accounting Standards No. 144, "Accounting for the Impairment or Disposal of Long-Lived Assets," on January 1, 2002. PRICEWATERHOUSECOOPERS LLP Minneapolis, Minnesota March 28, 2003, except as to Notes 29 and 30, which are as of December 3, 2003. XCEL ENERGY 2003 ANNUAL REPORT 41 -

Page 26

...) from discontinued operations - net of tax (see Note 3) Income (loss) before extraordinary items Extraordinary items - net of tax of $5,747 Net income (loss) Dividend requirements on preferred stock Earnings (loss) available to common shareholders WEIGHTED AVERAGE COMMON SHARES OUTSTANDING 429,571... -

Page 27

... disclosure of cash flow information: Cash paid for interest (net of amounts capitalized) Cash paid for income taxes (net of refunds received) See Notes to Consolidated Financial Statements. $ 402,506 $ (6,379) $ $ 640,628 24,935 $ 708,560 $ 327,018 XCEL ENERGY 2003 ANNUAL REPORT 43 -

Page 28

... and other Current assets held for sale and related to discontinued operations Total current assets Property, plant and equipment, at cost: Electric utility plant Natural gas utility plant Nonregulated property and other Construction work in progress: utility amounts of $908,256 and $855,842... -

Page 29

...Dividends declared: Cumulative preferred stock Common stock Issuances of common stock - net proceeds Acquisition of NRG minority common shares Repayment of ESOP loan Balance at Dec. 31, 2002 Net income Currency translation adjustments Minimum pension liability After-tax net unrealized losses related... -

Page 30

...2003-May 1, 2003, 5.375%-7.4% Senior Notes due Aug. 1, 2009, 6.875% Retail Notes due July 1, 2042, 8% Other Unamortized discount - net Total Less redeemable bonds classified as current (see Note 6) Less current maturities Total NSP-Minnesota...,225 282,097 $1,782,128 46 XCEL ENERGY 2003 ANNUAL REPORT -

Page 31

...2006, 5.125% Unsecured Senior C Notes, due Oct. 1, 2033, 6% Pollution control obligations, securing pollution control revenue bonds due: July 1, 2011, 5.2% July 1, 2016, 1.25% at Dec. 31, 2003, and 1.6% at Dec. 31, 2002 Sept. 1, 2016, 5.75% Unamortized discount Total SPS long-term debt NSP-Wisconsin... -

Page 32

... Center, Inc. Senior Secured Notes, Series due June 15, 2013, 7.31% NRG Peaking Finance LLC, due 2019, 6.67% NRG Pike Energy LLC, due 2010, 4.92% PERC, due 2017-2018, 5.2% Audrain Capital Lease Obligation, due Dec. 31, 2023, 10% Saale Energie GmbH Schkopau Capital Lease, due May 2021, various rates... -

Page 33

... agencies, for any difference between the total amount collected under the clauses and the recoverable costs incurred. In addition, Xcel Energy presents its revenue net of any excise or other fiduciary-type taxes or fees. A summary of significant rate-adjustment mechanisms follows: - PSCo's electric... -

Page 34

... TO CONSOLIDATED FINANCIAL STATEMENTS - In Colorado, PSCo operates under an electric performance-based regulatory plan, which provides for an annual earnings test. NSP-Minnesota and PSCo operate under various service standards, which could require customer refunds if certain criteria are not met... -

Page 35

... paid by Xcel Energy in connection with combined state filings. In accordance with PUHCA requirements, the holding company also allocates its own net income tax benefits to its direct subsidiaries based on the positive tax liability of each company. Xcel Energy defers income taxes for all temporary... -

Page 36

...if an event occurs or a circumstance changes between annual tests that may reduce the fair value of a reporting unit below its carrying value. Xcel Energy's goodwill consisted primarily of project-related goodwill at Utility Engineering for 2003 and 2002. During 2003, impairment testing resulted in... -

Page 37

... in 2003 included approximately $32 million of financial advisor fees, legal costs and consulting costs related to the NRG bankruptcy transaction. These charges were partially offset by a $20 million pension curtailment gain related to the termination of NRG employees from Xcel Energy's pension plan... -

Page 38

..., LLC; and BMG. After-tax disposal gains of $23.3 million, or 6 cents per share, were recorded for the natural gas utility segment, primarily related to the sale of Viking. NRG Segment Change in Accounting for NRG in 2003 Prior to NRG's bankruptcy filing in May 2003, Xcel Energy accounted for NRG as... -

Page 39

... assumptions for long-term power pool prices, escalated future project operating costs and expected plant operation given assumed market conditions at that time. NRG continued to incur asset impairments and related charges in 2003. Prior to its bankruptcy filing in May 2003, NRG recorded more than... -

Page 40

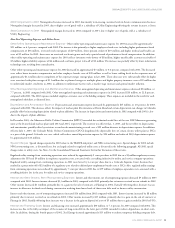

...Gas Utility Segment NRG Segment All Other Segment Total 2003 Operating revenue Operating and other expenses Special charges and impairments Equity in NRG losses Pretax income (loss) from operations of discontinued components Income tax expense (benefit... $ 203,945 56 XCEL ENERGY 2003 ANNUAL REPORT -

Page 41

...for sale and related to discontinued operations as of Dec. 31 are as follows: (Thousands of dollars) 2003 2002 Cash Trade receivables - net Derivative instruments valuation - at market Deferred income tax benefits Other current assets Current assets held for sale Property, plant and equipment - net... -

Page 42

... grade rating, Xcel Energy announced a financial improvement plan for NRG, which included an initial step of acquiring 100 percent of NRG through a tender offer and merger involving a tax-free exchange of 0.50 shares of Xcel Energy common stock for each outstanding share of NRG common stock. The... -

Page 43

...655 million 7. PREFERRED STOCK At Dec. 31, 2003, Xcel Energy had six series of preferred stock outstanding, which were callable at its option at prices ranging from $102.00 to $103.75 per share plus accrued dividends. Xcel Energy can only pay dividends on its preferred stock from retained earnings... -

Page 44

... to NRG's emergence from bankruptcy in December 2003 and Xcel Energy's corresponding divestiture of its ownership interest in NRG. Accordingly, Xcel Energy's tax benefits related to its investment in NRG are reported in discontinued operations. Xcel Energy's federal net operating loss and tax credit... -

Page 45

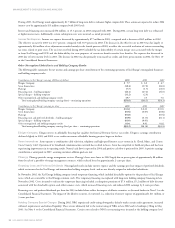

...: 2003 2002 2001 Federal statutory rate Increases (decreases) in tax from: State income taxes, net of federal income tax benefit Life insurance policies Tax credits recognized Regulatory differences - utility plant items Resolution of income tax audits Other - net Total effective income tax rate... -

Page 46

...compensation and nominating committee of Xcel Energy's board of directors did grant restricted stock units and performance shares under the Xcel Energy omnibus incentive plan approved by the shareholders in 2000. No stock options were granted in 2003. Restrictions 62 XCEL ENERGY 2003 ANNUAL REPORT -

Page 47

... a 27 percent total shareholder return (TSR) for 10 consecutive business days and other criteria relating to Xcel Energy's common equity ratio. TSR is measured using the market price per share of Xcel Energy common stock, which at the grant date was $12.93, plus common dividends declared after grant... -

Page 48

... employee's average pay and Social Security benefits. Xcel Energy's policy is to fully fund into an external trust the actuarially determined pension costs recognized for ratemaking and financial reporting purposes, subject to the limitations of applicable employee-benefit and tax laws. Pension Plan... -

Page 49

... Energies, Inc. nonbargaining employees was added July 1, 2003, to align it with the Xcel Energy plan formula. Also, the Normal Retirement Age for Xcel Energy's traditional, account balance, and "pension equity" programs was changed to age 65 with one year of service. XCEL ENERGY 2003 ANNUAL REPORT... -

Page 50

... Energy had a leveraged employee stock ownership plan (ESOP) that covered substantially all employees of NSP-Minnesota and NSP-Wisconsin. Xcel Energy made contributions to this noncontributory, defined contribution plan to the extent it realized tax savings from dividends paid on certain ESOP shares... -

Page 51

... to the payment of these postretirement benefits. Minnesota and Wisconsin retail regulators required external funding of accrued SFAS No. 106 costs to the extent such funding was tax advantaged. The investment strategy for the postretirement health care fund assets is fairly conservative, with... -

Page 52

... components of the net periodic cost $ 95.8 $(79.4) $ 7.3 $ (6.0) The employer subsidy for retiree medical coverage was eliminated for former New Century Energies, Inc. nonbargaining employees who retire after July 1, 2003. Xcel Energy's subsidiary Viking Gas Transmission Co. was sold on Jan... -

Page 53

... retirees remain in Xcel Energy's postretirement health care plan without participating in the new Medicare prescription drug coverage, Medicare will share the cost of Xcel Energy's plan. This legislation has therefore reduced Xcel Energy's share of the obligation for future retiree medical benefits... -

Page 54

...of Xcel Energy's long-term investments, mainly debt securities in an external nuclear decommissioning fund, are estimated based on quoted market prices for those or similar investments. The fair value of notes receivable is based on expected future cash flows discounted at market interest rates. The... -

Page 55

... on Dec. 31, 2003, including $4.2 million related to NRG. However, under the NRG bankruptcy settlement, NRG deposited cash with Xcel Energy that, on Feb. 6, 2004, was replaced with a letter of credit such that Xcel Energy has no further exposure under these indemnities. (g) Non-timely payment of the... -

Page 56

... exposed to market price risk for the purchase and sale of electric energy and natural gas. In such jurisdictions, Xcel Energy recovers purchased power expenses and natural gas costs based on fixed price limits or under established sharing mechanisms. Commodity price risk is managed by entering into... -

Page 57

..., 2003, Xcel Energy had various commodity-related contracts deemed as cash flow hedges extending through 2009. Amounts deferred are recorded in earnings as the hedged purchase or sales transaction is settled. This could include the physical purchase or sale of electric energy, the use of natural gas... -

Page 58

...in electric or gas rates the costs of certain financial instruments purchased to reduce commodity cost volatility. Fair Value Hedges Xcel Energy and its subsidiaries enter into interest rate swap instruments that effectively hedge the fair value of fixed rate debt. In June 2003, Xcel Energy entered... -

Page 59

... the Renewable Development Fund. All of the cost increases to NSP-Minnesota from these required payments and funding commitments are expected to be recoverable in Minnesota retail customer rates, mainly through existing cost recovery mechanisms. Funding commitments to the Renewable Development Fund... -

Page 60

..., Xcel Energy is required to pay additional amounts depending on actual quantities shipped under these agreements. Xcel Energy's risk of loss, in the form of increased costs, from market price changes in fuel is mitigated through the use of natural gas and energy cost-adjustment mechanisms of... -

Page 61

... and collected from customers in rates for future nuclear fuel disposal costs or decommissioning costs related to NSP-Minnesota's nuclear generating plants. See Note 18 to the Consolidated Financial Statements for further discussion of nuclear obligations. Ashland MGP Site NSP-Wisconsin was named as... -

Page 62

... utilities engaged in activities that may have been in violation of the NSR requirements. In 2001, Xcel Energy responded to the EPA's initial information requests related to NSP-Minnesota plants in Minnesota. On May 22, 2002, the EPA issued a follow-up information 78 XCEL ENERGY 2003 ANNUAL REPORT -

Page 63

... results of operations. Department of Labor Audit In 2001, Xcel Energy received notice from the Department of Labor (DOL) Employee Benefit Security Administration that it intended to audit the Xcel Energy pension plan. After multiple on-site meetings and interviews with Xcel Energy personnel, the... -

Page 64

... return of compensation received, and awards of fees and expenses. In each of the cases, the defendants filed motions to dismiss the complaint or amended complaint for failure to make a proper pre-suit demand, or in the federal court case, to make any pre-suit demand at all, upon Xcel Energy's board... -

Page 65

... incremental plant maintenance or capital expenditures, recovery of which would be expected from customers through the respective rate-recovery mechanisms. Management cannot predict the specific impact of such future requirements, if any, on its results of operations. XCEL ENERGY 2003 ANNUAL REPORT... -

Page 66

... securities, such as tax-exempt municipal bonds and U.S. government securities that mature in one to 20 years, and common stock of public companies. NSP-Minnesota plans to reinvest matured securities until decommissioning begins. At Dec. 31, 2003, NSP-Minnesota had recorded and recovered in rates... -

Page 67

... asset retirement obligations is $900 million as of Dec. 31, 2003, including external nuclear decommissioning investment funds and internally funded amounts. Removal Costs The adoption of SFAS No. 143 in 2003 also affects Xcel Energy's accrued plant removal costs for other generation, transmission... -

Page 68

...debt Conservation programs (a) Nuclear decommissioning costs (b) Employees' postretirement benefits other than pension Renewable resource costs Environmental costs State commission accounting adjustments (a) Plant asset recovery (Pawnee II and Metro Ash) Unrecovered natural gas costs (c) Unrecovered... -

Page 69

... the following reportable segments: Regulated Electric Utility, Regulated Natural Gas Utility and All Other. - Xcel Energy's Regulated Electric Utility segment generates, transmits and distributes electricity in Minnesota, Wisconsin, Michigan, North Dakota, South Dakota, Colorado, Texas, New Mexico... -

Page 70

... by $95 million, or 23 cents per share, for NRG charges related to asset impairments and financial restructuring costs, and increased by $30 million, or 7 cents per share, due to revisions to the estimated tax benefits related to Xcel Energy's investment in NRG. 86 XCEL ENERGY 2003 ANNUAL REPORT -

Page 71

... SERVICES Internet address: www.xcelenergy.com or contact Dianne Perry, Manager, Shareholder Services, at 612-215-4534 or e-mail [email protected]. FISCAL AGENTS XCEL ENERGY INC. Transfer Agent, Registrar, Dividend Distribution, Common and Preferred Stocks The Bank of New York... -

Page 72

...-Herring Ranch Company Albert F. Moreno 1, 4 Senior Vice President and General Counsel Levi Strauss & Co. W. Thomas Stephens 2, 3 Retired President and CEO MacMillan Bloedel, Ltd. Board Committees: 1. Audit 2. Governance, Compensation and Nominating 3. Finance 4. Operations and Nuclear * Wayne... -

Page 73

-

Page 74

U.S.฀Bancorp฀Center 800฀Nicollet฀Mall Minneapolis,฀MN฀55402 Xcel฀Energy฀investors฀hotline:฀1-877-914-9235 www.xcelenergy.com ©฀2004฀Xcel฀Energy฀Inc. Xcel฀Energy฀is฀a฀trademark฀of฀Xcel฀Energy฀Inc. Printed฀on฀recycled฀paper,฀using฀soy-based฀...