Volvo 1997 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 1997 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

7

The business environment

The year 1997 was characterized by economic growth in North America and

Europe, where the Gross National Product rose 3.6% and 2.4%, respectively.

Growth in the Southeast Asian countries was slowed significantly during the

second half of the year due to the finance and currency crisis in many countries.

The crisis was characterized by declining currencies and share prices in ASEAN

countries and Korea. The trend in the region continued to be turbulent during

the early part of 1998.

The average exchange rate for the U.S. dollar relative to the Swedish krona

strengthened by nearly 15% during the year, while the ECU was largely

unchanged relative to the krona. Large parts of the world economy experienced

historically low inflation with a consequent weak growth in interest rates.

Total market

The trend of the economy in OECD countries favored investments in passenger

cars, trucks and construction equipment and kept demand for these products at

the same relatively high level of the preceding year. The world market for buses

continued to be weak. Vehicle sales in Asia (with the exception of Japan) fell

sharply during the fourth quarter of 1997 and decreased by 7% for the full year.

It is difficult to determine in a short- and medium-term perspective what effects

the finance and currency crisis will have on economic growth in Southeast Asia

and the trend of the market reflects growing uncertainty. Industry analysts foresee

a decline of 30% during 1998, which would reduce the region’s share of world car

sales from 11% in 1996 to around 8% in 1998.

Trend of trading policy

The World Trade Organization (WTO) is highly important for the continuing

development of global rules for trading and investing that will also permit open,

equitable and nondiscriminatory trading between countries and regions, in the

automotive industry as well as other fields. It is urgent that negotiations pertaining

to membership for China, Russia and other applicant nations be concluded so

that the WTO can become a truly global organization. The enlargement of the

European Union (EU) and its efforts to create increasingly open trade relations

with other countries and regions are also important for the development of more

favorable operating conditions.

Com petitive situation

The excess capacity and severe competition that exists within the passenger car

industry is characteristic of Volvo’s business environment. It is a trend that is

being accentuated by the continuing establishment of new entries in the field.

The market for heavy trucks is under strong price pressure combined with the

introduction of a number of new product concepts, including financing and leas-

ing. Intensive efforts are being made throughout the transport vehicle industry to

distribute increasing investments and other costs over larger volumes of business.

This applies primarily in the bus and construction equipment segments as well as

for vehicle components where many small manufacturers are being incorporated

in large groups that are broadening their product programs and becoming more

global. The establishment of new operations and various forms of cooperation in

growth markets are other ways of broadening the volume base.

Brunswick

Cummins

Caterpillar

Volvo

Yanmar

Caterpillar

Komatsu

Hitachi

Volvo

JI Case

Evo Bus

(Setra Mercedes)

Volvo

Hino

Scania

MAN

Mercedes

Paccar

Volvo

Renault

Scania

Marine

and in-

dustrial

engines

Cars

Trucks

Buses

Con-

struction

Equip-

ment

BMW

Mercedes Benz

Audi

Volvo

Lexus

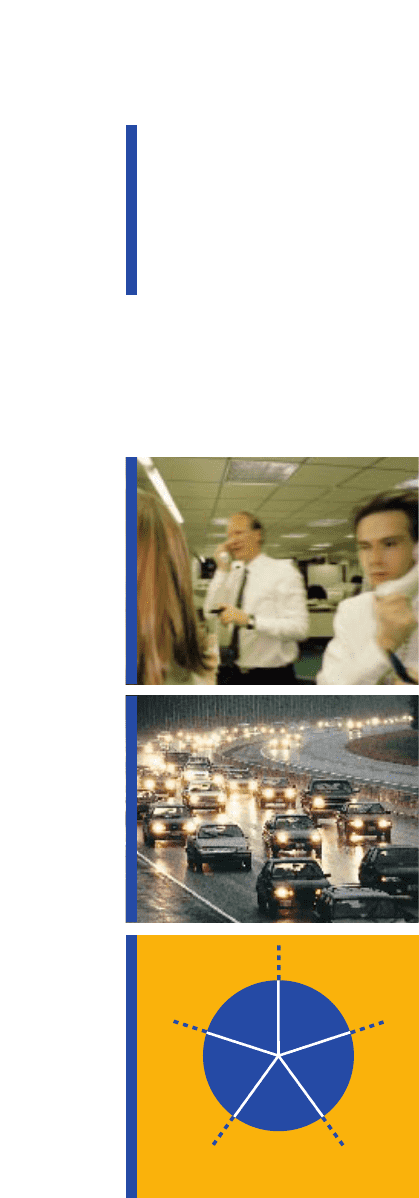

Volvo is a relatively sm all

player in the transport

equipm ent industry. But,

relative to the principal

com petitors in the various

business areas, Volvo

holds a strong interna-

tional position in each

area.

Board of Directors’

Report