Volvo 1997 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 1997 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

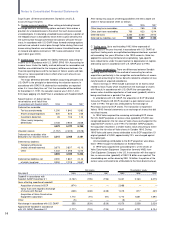

the date of acquisition. In accordance with U.S. GAAP, the excess

value of SEK 2.8 billion should be amortized over the economic life

(20 years).

E. Shares and participations. In calculating Volvo’s share of earnings

and shareholders’ equity in associated companies in accordance with

U.S. GAAP, account has been taken of the differences between the

accounting of these companies – in accordance with Volvo’s princi-

ples – and U.S. GAAP. The differences relate mainly to accounting for

and amortization of excess values, accounting for utilized tax-loss

carryforwards and, prior to 1993, accounting for tooling costs.

Income from investments in associated companies is reported

before tax in accordance with Swedish accounting principles, and

after tax in accordance with U.S. GAAP. Taxes attributable to

associated companies amounted to 103 (68; 672).

F. Interest expense. In accordance with U.S. GAAP, interest expense

incurred in connection with the financing of the construction of pro-

perty and other qualifying assets are capitalized and amortized over

the economic life of the pertinent assets.

G. Leasing. Certain leasing transactions are reported differently in

accordance with Volvo’s principles, compared with U.S. GAAP. The

differences pertain to sale-leaseback transactions prior to 1997.

H. Debt and equity securities. In accounting in accordance with U.S.

GAAP, Volvo applies SFAS 115: Accounting for Certain Investments

in Debt and Equity Securities. SFAS 115 addresses the accounting

and reporting for investments in equity securities that have readily

determinable fair market values, and for all debt securities. These

investments are to be classified as either “held-to-maturity” securities

that are reported at cost, “trading” securities that are reported at fair

value with unrealized gains or losses included in earnings, or “availa-

ble-for-sale” securities, reported at fair value, with unrealized gains or

losses included in shareholders’ equity.

As of December 31, 1997, unrealized gains after deducting for

unrealized losses in “available-for-sale” securities amounted to 3,747

(1,661; 10,233). The change between 1996 and 1997 pertains

mainly to divestment of the shareholding in Renault. Sale of “availa-

ble-for-sale” securities in 1997 provided approximately SEK 6.4 billi-

on (13.6: 1.9) and the capital gain, before tax, on sales of these

securities amounted to approximately SEK 1.0 billion (8.3: 1.2) in

1997.

The book value and market value of these listed securities were

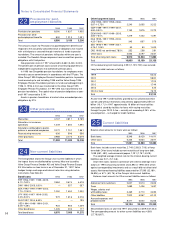

distributed as follows.

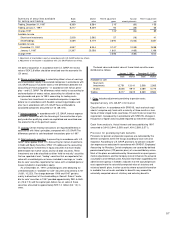

January 1, 1997 December 31, 1997

Book Market Book Market

Available for sale

Short-term

investments 12,751 13,141 2,508 2,565

Shares 8,646 9,917 2,089 5,779

Trading 8,217 8,309 8,369 8,584

I. Other. Includes adjustments pertaining to pension costs.

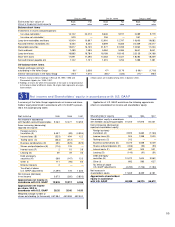

Supplem entary U.S. GAAP inform ation

Classification. In accordance with SFAS 95, “cash and cash equi-

valents” comprise only funds with a maturity of three months or less.

Some of Volvo’s liquid funds (see Notes 19 and 20) do not meet this

requirement. Consequently, in accordance with SFAS 95, changes in

this portion of liquid funds should be reported as investment activities.

Cash flow analysis. Actual interest and taxes paid during 1997

amounted to 3,943 (3,944; 3,509) and 1,454 (2,569; 3,571).

Provision for postemploym ent benefits

Provisions for pension and pension expenses are calculated by the

different companies within the Group according to local rules and

regulation. According to U.S. GAAP, provisions for pension and pen-

sion expenses are calculated in accordance with SFAS87: Employees’

Accounting for Pensions. Certain employees are covered by defined

pension benefit plans (ITP pension plans) of a noncontributory nature.

Most of the plans are administered by Governmental or quasi-govern-

mental organizations, and the Company cannot influence the actuarial

assumptions and methods used. Actuarial information supplied by the

administrative agency in Sweden, indicates that the accrued pension

costs approximate the actuarially computed value of statutory and

voluntary benefit plans. In other countries where actuarial information

is available, the net assets available for benefits may exceed the

actuarially computed value of statutory and voluntary benefits.

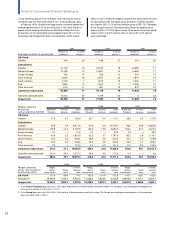

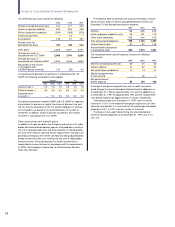

Sum m ary of securities available Book Market FAS15 adjustment Tax and FAS 15 adjustment

for selling and trading value value gross minority interests net

Trading, December 31, 1997 8,369 8,584 215 1(60) 155

Trading, January 1, 1997 8,217 8,309 92 (26) 66

Change 1997 123 2(34) 89

Available for sale

Short-term investments 2,508 2,565 57 (16) 41

Shareholdings 2,089 5,779 3,690 (1,033) 2,657

Available for sale

December 31, 1997 4,597 8,344 3,747 1(1,049) 2,698

January 1, 1997 21,397 23,058 1,661 (465) 1,196

Change 1997 2,086 (584) 1,502

1 Adjustment of shareholders’ equity in accordance with U.S. GAAP before tax effects.

2 Adjustment of net income in accordance with U.S. GAAP before tax effects.