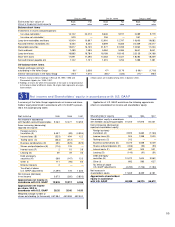

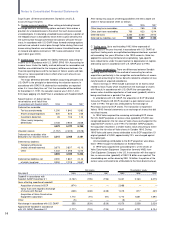

Volvo 1997 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 1997 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

Pharm acia & Upjohn, Inc./ Pharm acia AB

Following the conversion of debentures in 1995, Volvo’s holding

amounted to 27.3% of the share capital and 27.8% of the voting

rights. In October 1995 the Pharmacia shares were exchanged for

shares in the newly formed Pharmacia & Upjohn, Inc. As of December

31, 1995, Volvo held 13.8% of the share capital and voting rights.

In July 1996 Volvo sold 50,006,534 Pharmacia & Upjohn shares.

The capital gain amounted to 7,766 and Volvo’s holding thereafter

amounted to 3.9% of the share capital and voting rights in the com-

pany.

Investm ent AB Bure

In 1996 Volvo sold its entire holding, 17.7%, yielding a gain of 394.

Spira AB

The entire holding, 9.5%, was sold in 1996, with a resulting capital

gain of 10.

Pleiad Real Estate AB

At year-end 1994, Volvo held 25% of the share capital and 40% of

the voting rights in Pleiad Real Estate AB. During 1995 Volvo repur-

chased the properties owned by Pleiad that are used in Volvo’s op-

erations in Göteborg.

Partena AB

The holding, 44%, was divested in 1995, resulting in a gain of 707.

AutoNova AB

During 1995 Volvo Car Corporation and TWR Group Ltd., Great

Britain, formed a jointly owned company, AutoNova AB, to manu-

facture so-called niche cars. Volvo Car Corporation owns 49% of the

shares in AutoNova. Operations are located in Volvo Cars’ plant in

Uddevalla.

NordicTel Holdings AB

The entire holding, 8%, was sold in 1995, yielding a gain of 176.

Cultor Ab

Volvo’s holding in Cultor Ab(10.4% of the share capital and 1.5% of

the voting rights) was divested in 1995, resulting in a gain of 166.

UST Inc. (form erly US Tobacco Inc.)

In 1995 the shares (0.8%) in UST Inc. was divested. The capital gain

amounted to 75.

Protorp Förvaltnings AB (form erly Protorp Intressenter AB)

In 1994 and 1996 the holding in Protorp was written down by 488

and 2, respectively, due to dividends paid. In addition, a write-down of

247 was effected in 1996 in connection with repayment of share

capital. Volvo’s holding in Protorp Förvaltnings AB amounts to 43.0%

of the share capital and 33.3% of the voting rights. The holding is

recorded at cost.

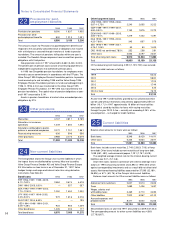

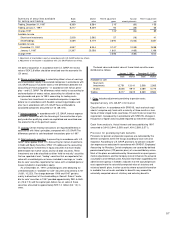

Changes in the Volvo Group’s holdings of shares and

participations: 1996 1997

Balance sheet, December 31, preceding year 18,087 12,412

Acquisitions and divestments, net (6,006) (8,212)

New issue of shares 3 128

Share of income of associated companies 636 222

Write-downs (248) (11)

Translation differences (27) 32

Other (33) 12

Balance sheet, December 31, current year 12,412 4,583

■■

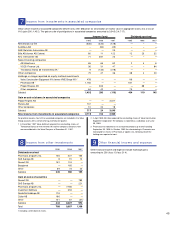

14 Long-term sales-financing receivables

1995 1996 1997

Installment credits 642 2,084 7,572

Financial leasing 2,759 3,571 5,606

Other receivables 760 176 789

Total 4,161 5,831 13,967

The increase in 1997 is due to that the sales-financing companies

in North America and Great Britain, in which Volvo was previously

a part-owner, are now under own management as wholly owned

subsidiaries.

■■

15 Other long-term receivables

1995 1996 1997

Loans 2,766 3,157 2,269

Other receivables 3,977 4,268 3,708

Total 6,743 7,425 5,977

Other long-term receivables include noninterest-bearing debenture

loans to associated companies at nominal value of 2,732 (2,759;

2,905).

■■

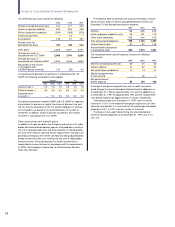

16 Inventories

1995 1996 1997

Finished products 14,159 14,477 17,785

Production materials, etc. 9,770 8,671 10,208

Total 23,929 23,148 27,993

■■

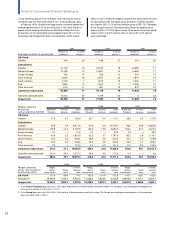

17 Short-term sales-financing receivables

1995 1996 1997

Installment credits 1,387 1,805 4,173

Financial leasing 2,208 2,946 3,794

Dealer financing 2,169 4,178 8,775

Other receivables 411 792 1,595

Total 6,175 9,721 18,337

The increase in 1997 is due to that the sales-financing companies

in North America and Great Britain, in which Volvo was previously

a part-owner, are now under own management as wholly owned

subsidiaries.

■■

18 Other receivables

1995 1996 1997

Accounts receivable 13,696 12,933 13,704

Prepaid expenses and

accrued income 4,293 3,219 2,867

Other receivables 4,742 6,106 7,686

Total, after deduction of

reserves of 710 for doubtful

receivables (1,037; 1,034) 22,731 22,258 24,257

A small portion of the receivables extends over a period of more than

one year but may be used as security for bank loans, as required.

Notes to Consolidated Financial Statements