Volvo 1997 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 1997 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

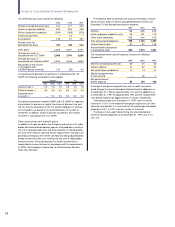

Interest-rate risks

Interest-rate risk relates to the risk that change in interest-rate levels

affect the Group’s earnings. By matching fixed-interest periods of

financial assets and liabilities, Volvo reduces the effects of interest-

rate changes. Interest-rate swaps are used to shorten the interest-

rate periods of the Group’s long-term loans. Exchange-rate swaps

make it possible to borrow in foreign currencies in different markets

without incurring currency risk.

Interest futures contracts and futures contracts are commonly

used by Volvo to offset fluctuations in variable interest rates on short-

term loans. Volvo has liquid contracts, such as standardized futures

contracts in Eurodollar with maturity terms of up to three years. Most

of these contracts are hedging transactions for short-term borrowing.

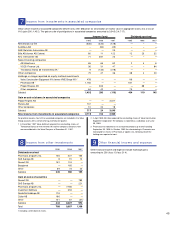

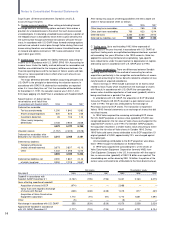

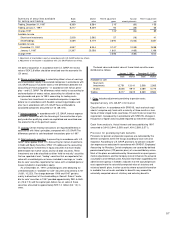

1995 1996 1997

Total outstanding interest related Notional Carrying Estimated Notional Carrying Estimated Notional Carrying Estimated

contracts, December 31 amount amount fair value amount amount fair value amount amount fair value

Interest-rate swaps

– receivable position 84,354 11 2,905 10,349 — 335 20,322 9 875

– payable position 69,746 (167) (963) 15,416 (34) (462) 28,142 (25) (1,760)

Forwards and futures

– receivable position 83,621 — 52 153,553 — 303 165,186 — 435

– payable position 169,882 — (378) 170,670 — (550) 190,866 (17) (465)

Options – purchased

– receivable position — — — 426 — 2 145 — 1

– payable position — — — — — — — — —

Options – written

– receivable position — — — — — — — — —

– payable position 400 (1) (1) — — — — — —

Interest-rate caps and floors purchased

– receivable position — — — 301 1 1 376 — 1

– payable position — — — 8 (8) (8) 159 — —

Interest-rate caps and floors written

– receivable position — — — 300 — — — — —

– payable position — — — 88 (44) (44) 88 (44) (44)

Total (157) 1,615 (85) (423) (77) (957)

Credit risks in financial instruments

Counterparty risks

The derivative instruments used by Volvo to reduce its foreign-

exchange and interest-rate risk in turn give rise to a counterparty risk,

the risk that a counterparty will not fulfill its part of a forward or

options contract, and that a potential gain will not be realized. Risks

are limited through careful credit checking and the establishment of

maximum levels of exposure. Where appropriate, the Volvo Group

arranges master netting agreements with the counterparty to reduce

exposure. The credit exposure in interest-rate and foreign exchange

contracts is represented by the positive fair value – the potential gain

on these contracts – as of the reporting date. The risk exposure is

calculated daily. The credit risk in futures contracts is limited through

daily or monthly cash settlements of the net change in value of open

contracts. Since contracts off the balance sheet involve substantial

credit risks, agreements on future contracts are made only with those

banks for which limits are assigned based on careful credit checking.

The estimated exposure in currency interest-rate swaps, forward

exchange contracts and futures and options purchased amounted to

2,291, 2,441 and 380 as of December 31, 1997.

Volvo does not have any significant exposure to an individual

customer or counterparty.

An increase of credit risk – on or off the balance sheet – occurs in

financial instruments when counterparties have similar economic

characteristics that could cause their ability to meet contractual

obligations to be impaired by unfavorable developments in the busi-

ness community.

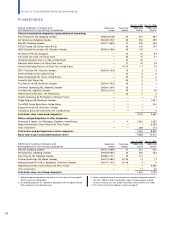

Credit risk in financial investments

The liquidity in the Group is invested mainly in local cash pools or

directly with Volvo Group Finance. This concentrates the credit risk to

the Group’s in-house bank. Volvo Group Finance invests the liquid

funds in the money and capital markets.

All investments must meet criteria for low credit risk and high

liquidity.

Calculation of fair value of financial instruments

Volvo has used various methods and assumptions, which were based

on evaluations of market conditions and risks existing at the time, to

estimate the fair value of the Group’s financial instruments as of

December 1995, 1996 and 1997, respectively. In the case of certain

instruments, including cash and cash equivalents, non-trade accounts

payable and accruals and short-term debt, it was assumed that the

carrying amount approximated fair value for the majority of these

marketable instruments, due to their short maturities.

Quoted market prices or dealer quotes for the same or similar

instruments were used for the majority of marketable securities, long-

term investments, long-term debt, forward exchange contracts and

options contracts. Other techniques – such as estimating the dis-

counted value of future cash flows, replacement cost and termination

cost – have been used to determine fair value for the remaining

financial instruments. These values represent approximate valuations

and may not be realized.

Unrealized exchange losses are charged to income for hedging

transactions related to booked items, while unrealized gains are not.

Unrealized gains are taken into account when calculating market

value.

Notes to Consolidated Financial Statements