Volvo 1997 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 1997 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26

Financial review by business area

In the medium-heavy segment (7,5 to 15,9 tons total weight), Volvo is retain-

ing its strategy of having a product program under the Volvo name, with key

components produced by Volvo, while cooperation with Mitsubishi in this seg-

ment will lead to a common model platform in the future.

Much higher volum e of sales and deliveries in North America

Volvo’s total deliveries of trucks in Europe in 1997 amounted to 34,460

(34,970) units, a decrease of 1%. Deliveries in Western Europe declined by 4%,

while shipments to Eastern Europe rose 29%. During the year the European

market was characterized by severe competition.

Deliveries in North America rose 24%, to 20,900 (16,850) units, due in parti-

cular to favorable market acceptance of the new Volvo VN and 770 models.

Deliveries in South America were up 40%, to 6,970 units, in a sharply increased

total market that leveled off in the fourth quarter.

Volvo’s deliveries in Asia and other markets declined by a total of 3%, to

6,650 trucks.

Lower m argins on European operations

affected operating income

Trucks’ operating income amounted to SEK 1,812 M (878). The trend of results

in North America during the year was positive, with a gradually declining loss

that was converted to a profit in the fourth quarter. The profitability of the

European business was acceptable but earnings were affected by intense com-

petition and depressed margins. The results of the South American operations

were positive. Trucks’ operating margin was 3.6% (2.0) and its return on

operating capital was 18% (10).

High utilization of production capacity

Trucks produced 69,720 (62,750) medium-heavy and heavy trucks in 1997.

Utilization of capacity in the assembly plants and in production of components

during the year was high in Europe as well as in North and South America.

Growth of the North Am erican operations

Trucks’ operations in North America in 1997 were characterized by stable growth

and good market acceptance of the Volvo VN models. Comprehensive measures

were taken to improve profitability. Notable measures included a change in

management structure and the concentration of all production in the assembly

plant in New River Valley. O ther programs were focused on the dealer network

and on strengthening sales-financing companies and customer relations.

Volvo enters the Prem ium Sleeper segm ent

In 1997, as a further development of the Volvo VN, the Group introduced the

Volvo 770 for the North American market. The 770 model has a more spacious

cab that is fully equipped with a microwave oven and refrigerator/freezer, among

other amenities, to create the best possible environment for the operator.

With the introduction of the Volvo 770, Volvo is taking a major step into the

“Premium Sleeper” segment in North America. Premium Sleepers are the largest

trucks that are specially designed for so-called owner-operators. The segment has

been one of the fastest-growing in North America in recent years.

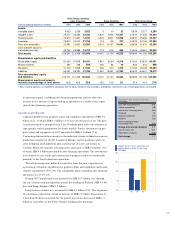

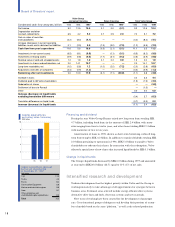

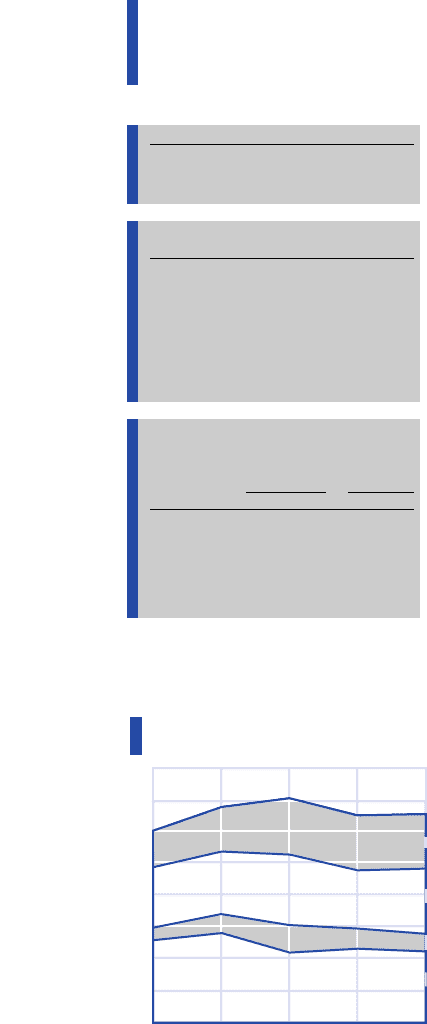

Market trends, trucks ≥16 tons

Registrations of new trucks, thousands of units

97

959493

100

200

300

400

500

800

700

600

Japan

655

174

190

57

234

96

655

171

205

53

226

Western Europa

North America

Other Countries

655

174

190

57

234

655

171

205

53

226

Total

The total market for Class

8 trucks in North Am erica

continued to grow,

amounting to approxim a-

tely 205,000 vehicles, whi-

le the total market in

Western Europe declined

slightly, to 171,000 units.

Dem and rose in South

Am erica, and also in Eas-

tern Europe. The financial

turbulence and currency

problems that characteri-

zed Southeast Asia resul-

ted in lower sales of

trucks in this region.

Num ber of trucks invoiced

Number 1995 1996 1997

Western Europe 32,330 32,310 31,030

Eastern Europe 1,830 2,660 3,430

North America 27,090 16,850 20,900

South America 7,800 4,980 6,970

Asia 5,270 4,850 4,710

Other countries 2,170 2,030 1,940

Total 76,490 63,680 68,980

SEK million 1995 1996 1997

Net sales 51,027 44,275 50,840

Operating income 5,073 878 1,812

Operating margin, % 9.9 2.0 3.6

Trucks’ largest m arkets

(truck s ≥16 tons)

Volvo trucks Market share,

registered %

1996 1997 1996 1997

USA 15,460 17,290 9.1 9.7

Brazil 3,570 4,510 24.3 23.3

Great Britain 5,780 4,420 19.2 16.7

France 4,770 4,130 13.7 13.5

Germany 3,270 3,090 8.5 7.5

A complete 11-year summary is shown on pages 76–87.