Volvo 1997 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 1997 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

15

The operating margin for the Group developed favorably during the year and

amounted to 4.6% for the full year and 5% for the fourth quarter isolated.

Incom e from investm ents in associated com panies

Income from investments in associated companies amounted to SEK 2,929 M

(314). The gain on the sale of the shareholding in Pripps Ringnes AB was SEK

3,027 M. Volvo’s share of the loss in NedCar was SEK 128 M. Income from

investments in associated companies active in sales financing was charged with

credit losses in the Brazilian operations and the total loss amounted to SEK 146 M.

Incom e from other investm ents

Income from other shares and participations, SEK 1,168 M (9,007) included a

gain of SEK 783 M on the sale of Renault shares and SEK 221 M from the sale

of SAS Sverige shares. The dividend from Pharmacia & Upjohn amounted to

SEK 165 M. Income in 1996 includes gain on the sale of shares in Pharmacia &

Upjohn of SEK 7,766 M.

Net interest income

Net interest income, SEK 738 M (1,546) was lower than in 1996. The lower

return was attributable to declining interest rates and the fact that liquid funds

were to a large extent invested in interest-bearing papers with short maturities.

Tax expense

Tax expenses pertained mainly to current taxes in foreign subsidiaries.

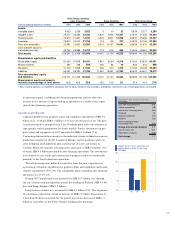

Consolidated income statements 1995 1996 1997

Net sales 171,511 156,060 183,625

Cost of sales (128,529) (121,249) (138,990)

Gross income 42,982 34,811 44,635

Research and development expenses (7,343) (8,271) (8,659)

Selling expenses (17,418) (14,895) (17,160)

Administrative expenses (7,399) (6,685) (7,018)

Other operating income 4,168 5,086 3,187

Other operating expenses (5,966) (6,336) (6,567)

Operating income before

nonrecurring items 9,024 3,710 8,418

Nonrecurring items 1,215 — —

Operating income 10,239 3,710 8,418

Income from investments

in associated companies 2,119 314 2,929

Income from other investments 788 9,007 1,168

Interest income and similar credits 3,996 4,817 3,486

Interest expenses and similar charges (3,757) (3,271) (2,748)

Other financial income and expenses (337) (374) (77)

Income after financial items 13,048 14,203 13,176

Taxes (3, 741) (1,825) (2,705)

Minority interests (45) 99 (112)

Net income 9,262 12,477 10,359

Income in SEK per share 20.20 26.90 22.90

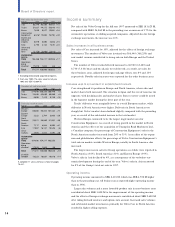

Operating incom e (loss) before non-

recurring items, by business area

SEKM 1995 1996 1997

Cars 1,089 1,498 4,510

Trucks 5,073 878 1,812

Buses 405 331 550

Construction

Equipment 717 11,162 1,444

Marine and

industrial engines 212 (27) 181

Aero 103 153 472

Other and

eliminations (106) (376) (577)

Automotive

operations 7,493 3,619 8,392

Operations being

divested 1,531 91 26

Total 9,024 3,710 8,418

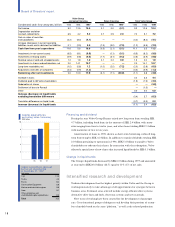

Factors that affected

operating incom e

SEK billion 1997

Operating income from

automotive operations 1996 3.6

Increased volume

and profit margins 2.1

Change in product mix,

Volvo 400 to S40 and V40 0.9

Higher research and

development expenses (0.3)

Higher selling expenses (1.6)

Acquired companies 0.3

Effect of changes in

foreign exchange rates 2.6

Other 0.8

Operating income, automotive

operations 8.4

1 From July 1995. Operating income for full year

1995 was SEK 1,679 M.

Condensed incom e statements,

sales financing

SEKM 1995 1996 1997

Net sales 4,295 5,101 5,956

Operating Income 82 146 202

Income from

investments in

associated companies 98 6 (146)

Financial income

and expenses 8 (16) 1

Income after

financial items 188 136 57