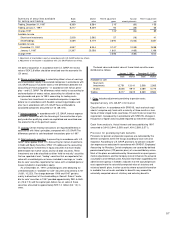

Volvo 1997 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 1997 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

■■

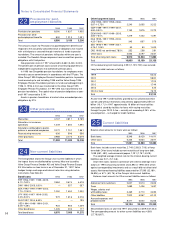

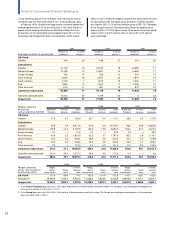

22 Provisions for post-

em ployment benefits

1995 1996 1997

Provisions for pensions 6,090 1,937 1,905

Provisions for other

postemployment benefits 800 1,213 1,391

Total 6,890 3,150 3,296

The amounts shown for Provisions for postemployment benefits cor-

respond to the actuarially calculated value of obligations not insured

with a third party or secured through transfers of funds to pension

foundations. The amount of pensions falling due within one year is

included. The Swedish Group companies have insured their pension

obligations with third parties.

Group pension costs in 1997 amounted to 3,660 (3,446; 3,030).

The greater part of pension costs consist of continuing payments to

independent organizations that administer pension plans.

In 1996 two Groupwide pension foundations for employees were

formed to secure commitments in accordance with the ITP plan. The

Volvo Group 1995 Employee Pension Foundation pertains to pension

funds earned up to and including 1995 and the Volvo Group 1996

Employee Pension Foundation pertains to funds earned beginning in

1996. In 1996, 4,244 was transferred to the Volvo Group 1995

Employee Pension Foundation. In 1997 396 was transferred to the

pension foundations. The capital value of pension obligations at year-

end 1997 amounted to 5,141.

Assets in pension foundations at market value, exceeded pension

obligations by 315.

■■

23 Other provisions

1995 1996 1997

Warranties 4,137 4,811 5,769

Allocations in insurance

operations 1,449 1,650 1,890

Allocations attributable to partici-

pations in associated companies 2,072 1,701 1,851

Restructuring measures 606 596 556

Other provisions 2,988 3,175 5,679

Total 11,252 11,933 15,745

■■

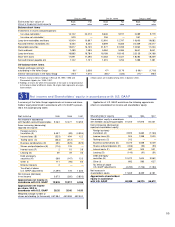

24 Non-current liabilities

The listing below shows the Group’s non-current liabilities in which

the largest loans are distributed by currency. Most are issued by

Volvo Group Finance Sweden AB and Volvo Group Finance Europe

BV. Information on loan terms is as of December 31, 1997. Volvo

hedges foreign-exchange and interest-rate risks using derivative

instruments. See Note 30.

Bond loans 1995 1996 1997

FRF 1994-1997/ 1999–2009,

6.12–7.62% 2,584 3,674 4,618

DKK 1996/ 2005, 6.00% — 357 357

SEK 1992–1997/ 1999–2002,

7.70–12.50% 1,050 1,450 1,300

JPY 1995–1997/ 1999–2005,

0.29–5.00% 972 1,316 3,216

NLG 1997/ 2004, 6.60% — — 195

USD 1994–1996/ 1999–2001,

6.06–7.38% 934 955 1,409

Other bond loans 1,435 203 177

Total bond loans 6,975 7,955 11,272

Other long-term loans 1995 1996 1997

USD 1995–1997/ 1999–2006,

5.87–10.75% 2,240 2,655 3,222

GBP 1989–1997/ 1999–2007,

5.80–9.30% 1,153 1,875 2,273

DEM 1993–1997/ 1999–2005,

3.84–7.50% 1,319 1,442 1,491

NLG 1995–1997/ 1999–2003,

4.20–7.68% 343 857 575

SEK 1995–1997/ 1999–2007,

4.75–11.05% 50 50 1,400

CAD 1995/ not confirmed, 7.85% 252 258 281

Other loans 4,553 3,097 2,621

Total other long-term loans 9,910 10,234 11,863

Total 16,885 18,189 23,135

Of the above long-term borrowing, 2,992 (1,109; 780) was secured.

Long-term debt matures as follows:

1999 6,223

2000 5,660

2001 1,703

2002 1,749

2003 425

2004 or later 7,375

Total 23,135

At year-end 1997 credit facilities granted but not utilized and which

can be used without restrictions amounted to approximately SEK 22

billion (16; 17). In 1997 approximately 16 billion of these facilities

consisted of stand-by facilities for loans with varying maturities

through the year 2003. A fee – normally not exceeding 0.25% of the

unused portion – is charged for credit facilities.

■■

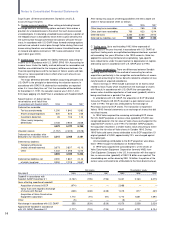

25 Current liabilities

Balance sheet amounts for loans were as follows:

1995 1996 1997

Bank loans 6,346 8,429 14,411

Other loans 5,345 5,834 3,871

Total 11,691 14,263 18,282

Bank loans include current maturities, 2,748 (2,082;1,706), of long-

term debt. Other loans include current maturities of long-term debt,

1,498 (651; 482), and commercial papers, 1,291 (1,757; 4,518).

The weighted average interest rate for the interest-bearing current

liabilities was 5.0% (5.1; 6.6).

Short-term loans raised in connection with interest arbitrage trans-

actions in 1995 amounting to 5,642 and 2,893 in 1996 were offset

against corresponding investments and as a result did not affect total

assets. Noninterest-bearing liabilities accounted for 37,595 (32,189;

36,826), or 67% (69; 76) of the Group’s total current liabilities.

Balance sheet amounts for Other current liabilities were as follows:

1995 1996 1997

Advances from customers 2,627 2,514 2,603

Taxes 1,689 1,436 1,637

Wages, salaries and

withholding taxes 3,469 3,710 3,690

Other liabilities 7,922 5,967 6,102

Accrued expenses and

prepaid income 8,417 6,602 8,306

Total 24,124 20,229 22,338

Secured bank loans at year-end 1997 amounted to 2,369 (641;443)

The corresponding amount for other current liabilities was 4,563

(2,778;3,657).

50

Notes to Consolidated Financial Statements