Volvo 1997 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 1997 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

Notes to Consolidated Financial Statements

■■

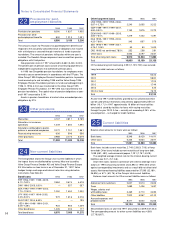

10 Ta x e s

Income after financial items was distributed as follows:

1995 1996 1997

Sweden 4,449 10,476 8,828

Outside Sweden 7,197 3,437 4,464

Share of income of

associated companies 1,402 290 (116)

Total 13,048 14,203 13,176

Tax expense was distributed as follows:

1995 1996 1997

Current taxes:

Sweden (18) (615) (133)

Outside Sweden (2,400) (1,532) (2,145)

Subtotal (2,418) (2,147) (2,278)

Deferred taxes:

Sweden (176) 574 (366)

Outside Sweden (475) (184) 42

Subtotal (651) 390 (324)

Associated companies (672) (68) (103)

Total taxes (3,741) (1,825) (2,705)

Tax expense pertains mainly to current taxes in foreign subsidiaries.

The sale of the shareholding in Renault resulted in a tax-deductible

loss that reduced Group tax expense by slightly more than 500.

Provision has been made for estimated tax charges that may arise

as a result of tax audits in the Volvo Group. Deductions claimed for

which no provision has been deemed necessary are equal an ex-

pense of approximately 699 (528; 940). This amount is included

among contingent liabilities.

Deferred taxes pertain mainly to an estimated tax on the change

in untaxed reserves, taking into account tax-loss carryforwards and

temporary differences.

At December 31, 1997, the Group had tax-loss carryforwards

amounting to approximately 4,900. Of this amount, approximately

2,400 has been recognized in calculating deferred tax liabilities.

Tax-loss carryforwards amounting to approximately 2,500 can thus

be utilized to reduce tax expense in future years and are attributable

to companies outside Sweden. Of this amount, 900 expires within

five years. Tax-loss carryforwards in Sweden are not restricted time-

wise.

The Swedish corporate income tax rate is 28%. The table below

shows the principal reason for the difference between this rate and

the Group’s tax rate, based on income after financial items

1995, % 1996, % 1997, %

Swedish corporate income tax rate 28 28 28

Difference in tax rate

in various countries 4 1 2

Capital gains (losses) (8) (22) (13)

Utilization of tax-loss carryforwards (7) (4) (2)

Losses for which no benefit

has been recognized 1 8 2

Non deductable expenses 3 3 2

Amortization of goodwill 5 0 0

Other, net 1 (1) 1

Tax rate for the Group, excluding

equity method 27 13 20

Equity method 2 0 1

Tax rate for the Group 29 13 21

■■

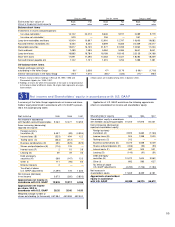

11 Minority interests

Minority interests in income (loss) and in equity consist mainly of

Henlys Group’s participation in Prévost Car Inc. (49%), Hitachi

Construction Machinery Company’s participation in Euclid-Hitachi

Heavy Equipment Inc. (40%), GPA Group’s minority interests in The

AGES Group, ALP (40%) and up to and including June 1997,

General Motors’ holding in Volvo Trucks North America Corporation

(13%).

■■

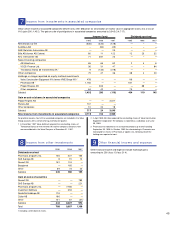

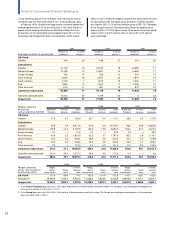

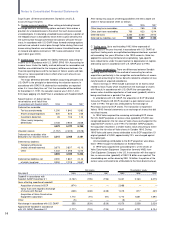

12 Intangible and tangible assets

Value in Value in Subsidiaries Value in

balance balance acquired balance

sheet sheet Invest- Sales/ and Translation Reclassi- sheet

Acquisition cost 1995 1996 ments scrapping divested differences fications 1997

Goodwill 6,251 2,974 — — 1,083 36 — 4,093

Patents 161 102 13 (2) 3 (5) — 111

Aircraft engine costs 1,108 1,115 88 — 42 16 — 1,261

Total intangible assets 7,520 4,191 101 (2) 1,128 47 — 5,465

Buildings 14,065 13,166 1,173 (84) 29 175 516 14,975

Land and land improvements 2,391 2,116 117 (40) 3 54 49 2,299

Machinery and equipment 137,713 38,782 6,453 (2,350) 178 330 3,104 46,497

Construction in progress

including advance payments 2,840 4,860 2,019 (2) — 43 (3,847) 3,073

Total property, plant and equipment 57,009 58,924 9,762 (2,476) 210 602 (178) 66,844

Assets under operating leases 3,917 6,698 9,773 (1,896) 1,303 665 (56) 16,487

Total tangible assets 60,926 65,622 19,535 (4,372) 1,513 1,267 (234) 83,331