Volvo 1997 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 1997 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

63

■■

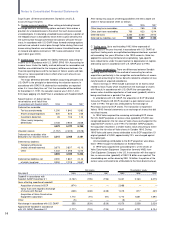

19 Other current liabilities

1995 1996 1997

Wages, salaries and

withholding taxes 38 46 34

Other liabilities 1,681 132 30

Accrued expenses

and prepaid income 141 122 58

Total 1,860 300 122

Other liabilities in 1995 included a debt of approximately FRF 1.1 bil-

lion to Renault pertaining to the balance of the purchase price for

Volvo Truck Corporation shares. This debt was paid in 1996. Current

liabilities amounting to 0 (1; 1,603) are secured.

■■

20 Assets pledged

1995 1996 1997

Mortgages on fixed assets — 1 —

Investments

in Volvo Truck Corporation 1,149 1,211 —

in companies outside

the Volvo Group 4 5 —

Total 1,153 1,217 —

Liabilities for which the above assets were pledged amounted to 0

(1; 1,603) at year-end.

■■

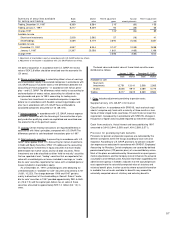

21 Contingent liabilities

Of the contingent liabilities amounting to 72,287 (64,650; 57,441)

71,930 (64,046; 56,795) pertained to subsidiaries.

Guarantees for various credit programs are included in amounts

corresponding to the credit limits. These guarantees amount to

67,493 (59,465; 42,754), of which guarantees on behalf of sub-

sidiaries total 67,488 (59,460; 42,749).

At December 31, 1997, the utilized portion amounted to 21,785

(19,918; 22,154), including 21,428 (19,313; 21,508) pertaining to

subsidiaries.

■■

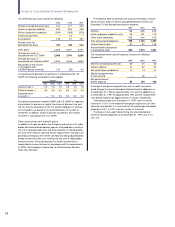

16 Provisions for pensions

Provisions for pensions and similar benefits correspond to the actuari-

ally calculated value of obligations not insured with third parties or

secured through transfers of funds to pension foundations. The

amount of pensions falling due within one year is included. AB Volvo

has insured the pension obligations with third parties. Of the amount

reported, 10 (12; 231) pertains to contractual obligations within the

framework of the PRI(Pension Registration Institute) system.

In 1996 two Groupwide pension foundations for employees were

formed to secure committments in accordance with the ITP plan. The

Volvo Group 1995 Employee Pension Foundation pertains to pension

funds earned through 1995 and the Volvo Group 1996 Employee

Pension Foundation pertains to funds earned beginning in 1996. In

1996, 12 was transferred and in 1996, 224 was transferred from

AB Volvo to the Volvo Group Employee Pension Foundation.

AB Volvo’s pension costs in 1997 amounted to 106 (102; 75).

The capital value of all AB Volvo’s pension obligations at year-end

1997 amounted to 588, which has been secured in part through

Provision for pensions and in part through funds in pension

Foundations. The Company’s share of reported capital in the pension

foundations amounted to 296. Assets in the pension foundations at

market value, exceeded pension obligations by 4.

■■

17 Other provisions

Other provisions comprise provisions for taxes in the amount of 63

(73: 77).

■■

18 Non-current liabilities

Long-term debt matures as follows:

1999 1,972

2000 —

2001 504

2002 1,030

2003 500

2004 or later 6,945

Total 10,951

Long-term liabilities to Group companies comprise loans of 10,951

(8,606: 10,958) from Volvo Group Finance.

■■■■

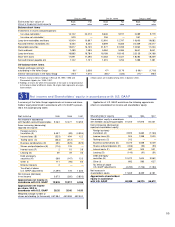

15 Untaxed reserves

The composition of, and changes in, Value in balance Allocations Value in balance Allocations Value in balance

untaxed reserves: sheet 1995 1996 sheet 1996 1997 sheet 1997

Tax equalization reserve 443 (89) 354 (89) 265

Exchange reserve 267 108 375 (172) 203

Accumulated extra depreciation

Machinery and equipment 29 0 29 (16) 13

Total 739 19 758 (277) 481