Volvo 1997 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 1997 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

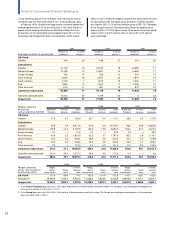

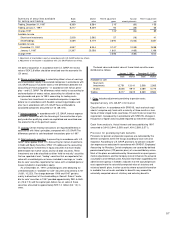

The accounting principles applied by Volvo are described on page 41.

Intra-Group transactions

Of the Parent Company’s sales, 505 (545: 474) were to Group com-

panies, and purchases from Group companies amounted to 183

(136; 74).

Employees

The number of employees at year-end was 181 (468; 452). Wages,

salaries and social costs amounted to 284 (324; 272). Information

on the average number of employees as well as wages, salaries and

other renumerations is shown on page 52.

■

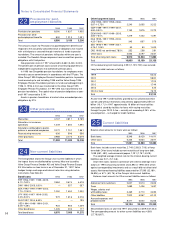

1Adm inistrative expenses

Administrative expenses include depreciation of 11 (17; 14), of

which 11 (16; 14) pertained to machinery and equipment, and 0 (1;

0) to buildings.

■

2Other operating expenses

Other operating costs include provision for bonus to employees in

the amount of 1 (1; 4).

■

3Nonrecurring item s

Income in 1995 was charged with 1,817 pertaining to a write-down

of acquired shares in Volvo Construction Equipment Corporation.

■

4Income from investm ents

in Group companies

Of the income reported, 23,563 (738; 1,951) pertained to dividends

from Group companies. Write-downs of shareholdings amounted to

8,244 (53; 217).

Income in 1997 included a supplementary payment of 41 for

shares of Örekron International AB, which was sold in 1988 due to

Örekron having won a tax case pertaining to 1987 taxes.

■

5Income from investm ents

in associated com panies

Dividends from associated companies that are reported in the Group

accounts in accordance with the equity method amounted to 37

(28; 109). Shareholdings were written down by 7 (5; 5), and were

divested with a capital gain of 2 (–; –).

■

6Income from other shares

and participations

Of the income reported, 16 (158; 218) pertained to dividends from

other companies. Dividends were reduced through write-downs of

shareholdings amounting to 0 (2; 0). Income in 1997 included a loss

of 146 on the sale of Renault SA shares, and a loss of 7 on the parti-

cipation in Blue Chip Jet HB.

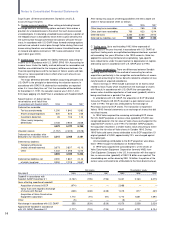

Notes to financial statements

AB Volvo

60

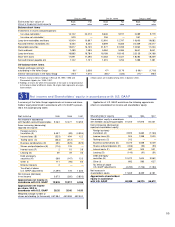

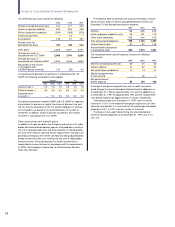

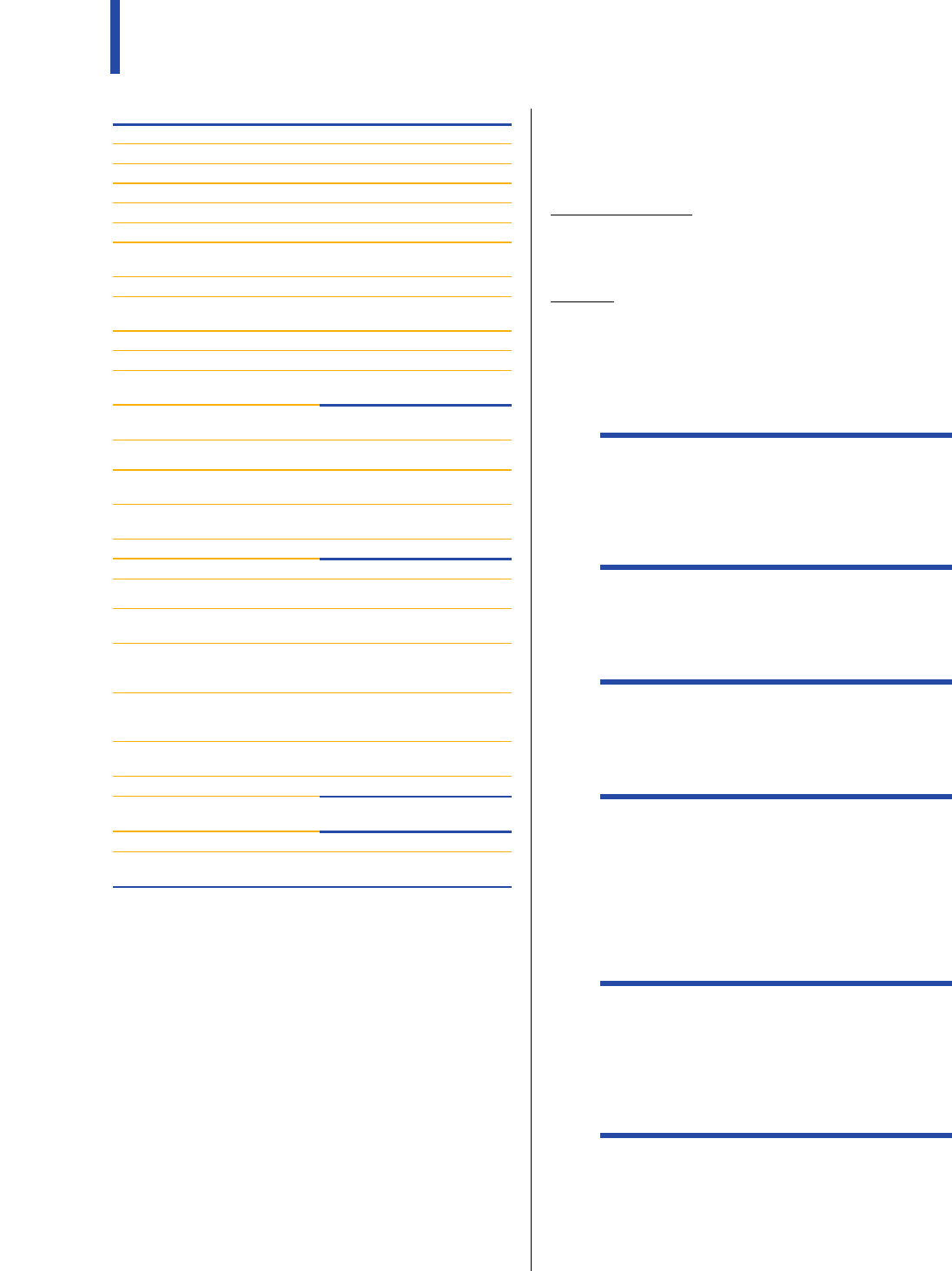

Cash flow analyses 1995 1996 1997

Year’s operations

Net income 3,176 898 18,049

Depreciation 14 17 11

Write-down of shareholdings 2,044 60 8,252

Gain on sales of securities — — 102

Changes in untaxed reserves (285) 19 (277)

Decrease (increase) in current

operating assets:

Receivables (2,577) 1,573 (3,332)

Increase (decrease) in current

operating liabilities:

Accounts payable 21 (16) 1

Amounts due to subsidiaries 1,491 8,438 (9,160)

Other current liabilities

and other provisions (133) (1,569) (156)

Net financing from

year’s operations 3,751 9,420 13,490

Investments (increase)

Property, plant and

equipment, net (17) (32) 56

Investments in shares and

participations, net (10,558) (12,551) 4,645

Long-term receivables, net 2,674 158 (623)

Net after investments (4,150) (3,005) 17,568

Financing, dividends, etc

Increase (decrease)in

short-term loans (942) 5,836 (7,067)

Increase (decrease) in

long-term loans and

provisions for pensions 1,324 (2,561) 2,360

Increase in shareholders’ equity

as a result of conversions and

new issue of shares 1,608 — 116

Redemption of shares

in AB Volvo — — (5,807)

Dividend paid to shareholders (1,512) (1,854) (1,993)

Increase (decrease)

in liquid funds (3,672) (1,584) 5,177

Liquid funds, January 1 5,262 1,590 6

Liquid funds, December 31 1,590 6 5,183

Liquid funds include Cash and bank accounts and Short-term investments in

Group companies.