Volvo 1997 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 1997 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

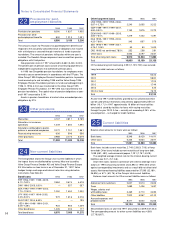

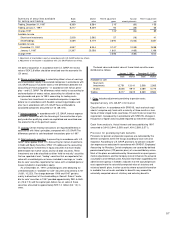

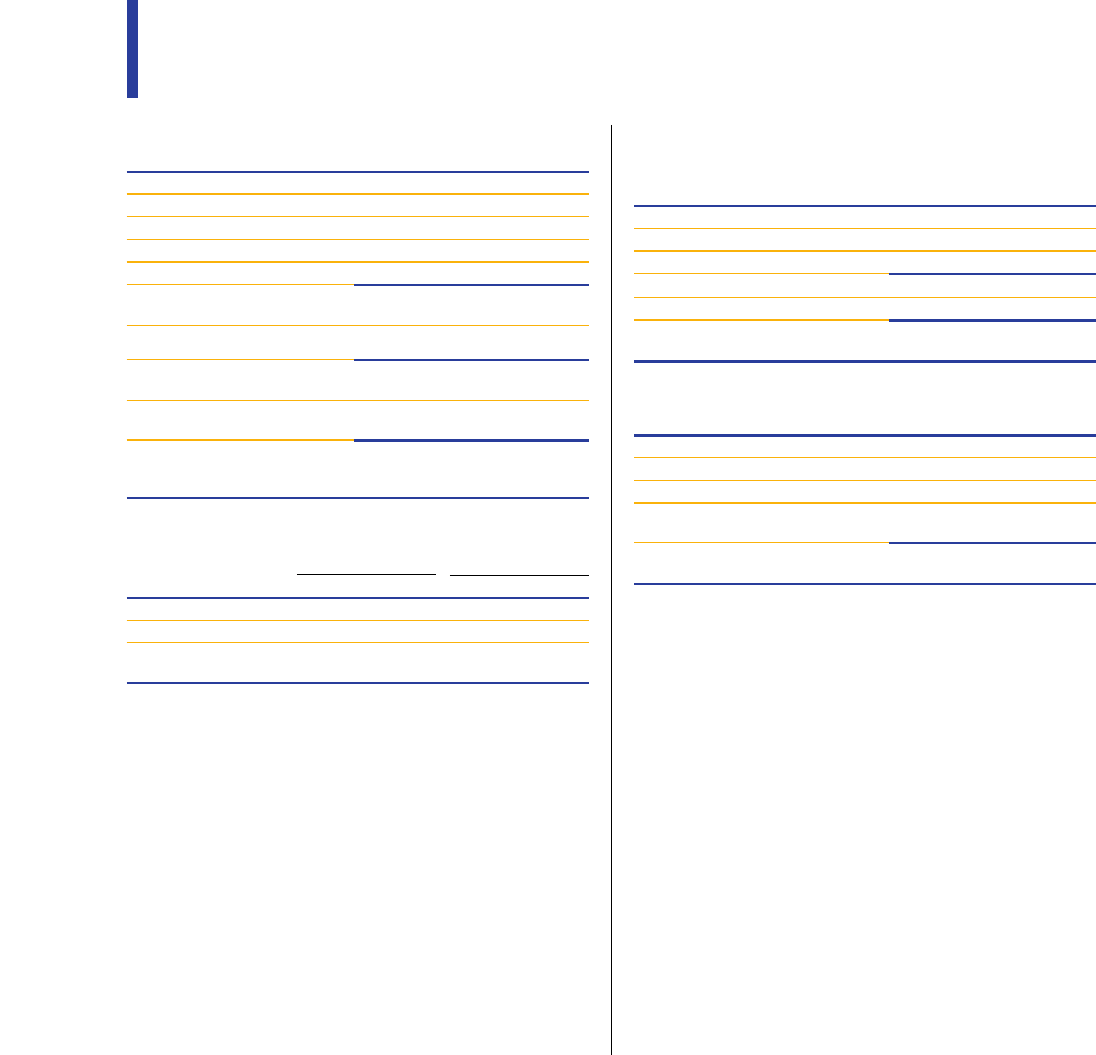

U.S. GAAP pension costs include the following:

1995 1996 1997

Pensions earned during the year 134 177 260

Interest on pension liabilities 439 354 408

Return in pension foundations (264) (186) (376)

Severance payments — 32 —

Annualization 128 67 252

Pension costs for

defined benefit plans 437 444 544

Other plans 2,469 3,097 3,051

Total pension costs in

accordance with U.S. GAAP 2,906 3,541 3,595

Total pension costs in

accordance with Swedish GAAP 3,030 3,446 3,660

Adjustment of net income

in accordance with

USGAAP before tax effect 124 (95) 65

In calculating the provisions for pensions in accordance with U.S.

GAAP, the following assumptions were applied:

Sweden U.S.

1995 1996 1997 1995 1996 1997

Discount rate, % 7.5 7.5 7.0 7.5 7.5 7.0

Payroll increase, % 4.5 4.5 4.0 6.0 6.0 4.0

Expected return

on assets, % — 9.0 9.0 9.0 9.0 9.0

The difference between Swedish GAAP and U.S. GAAP for reporting

of provisions for pensions is mainly the choice of discount rate and

the fact that the calculation of the U.S. benefit obligation in contrast

to the Swedish, are based on the estimated salary at the date of

retirement. In addition, assets in pension foundations are marked

to market in accordance with U.S. GAAP.

Other postretirem ent benefit plans

In addition to its pension plans, the Company and certain of its subsi-

diaries and associated companies sponsor unfunded plans, mainly in

the U.S., to provide health care and other benefits for retired employ-

ees who meet minimum age and service requirements. The plans are

generally contributory, with retiree contributions being adjusted perio-

dically, and contain other cost-sharing features such as deductibles

and coinsurance. The estimated cost for health-care benefits is

recognized on an accrual basis in accordance with the requirements

of SFAS 106, Employers’ Accounting for Postretirement Benefits

Other than Pensions.

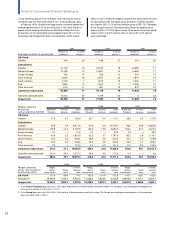

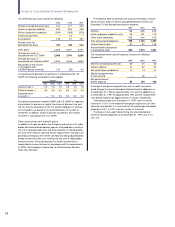

The following table summarizes the status of these plans, reconci-

led to amounts shown in Volvo’s consolidated balance sheet as of

December 31, distributed by personnel categories:

1995 1996 1997

Retirees 168 698 829

Active employees eligible to retire 96 131 115

Other active employees 475 304 313

Total accumulated obligations 739 1,133 1,257

Unamortized net gain 61 80 134

Accrued liability recognized

in the balance sheet 800 1,213 1,391

The net postretirement benefit expense includes the following

components:

1995 1996 1997

Benefits earned during the year 38 44 42

Interest expense 47 87 97

Net amortization and deferral (2) (2) (4)

Special recognition due

to restructuring — 25 1

Net postretirement

benefit expense 83 154 136

A change of one percentage point per year in health-care costs

would change the accumulated postretirement benefit obligation as

of December 31, 1996 by approximately 130, and the obligation as

of December 31, 1997 by approximately 189, and the net postretire-

ment benefit expense by approximately 27 and 20, respectively.

Calculations made as of December 31, 1997 show an annual

increase of 10.5% in the weighted average per capita costs of cove-

red healt-care benefits; it is assumed that the percentage will decline

gradually to 6.0% in 2007 and then remain at that level.

The discount rate used in determining the accumulated post-

retirement benefit obligation as of December 31, 1997 was 7.0%

(7.5; 7.5).

Notes to Consolidated Financial Statements