Volvo 1997 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 1997 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

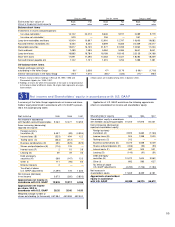

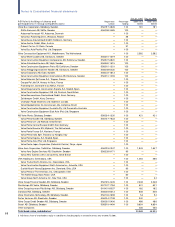

As of July 1, 1997 part of the Parent Company’s former operations

were transferred to the newly formed wholly owned subsidiary, Volvo

Teknisk Utveckling AB. Parent Company operations now comprise

only the Group’s head office.

Following the offer to the company’s shareholders to redeem Volvo

shares, a total of 22,596,867 shares were tendered for redemption

and the sum of 5,807 was paid out. New shares were then issued to

the Volvo Profit-Sharing Foundation and a bonus issue was effected

through a write-up of the par value of Volvo’s shares from SEK 5 each

to SEK 6 each. The share capital was thereby increased in a net

amount of 331. The redemption procedure is described on page 13.

A dividend of 22,000 was received from Volvo Personvagnar

Holding AB, following which the holding in the company was written

down by 8,026.

The remaining shareholdings in Renault SA, with a book value of

6,080, were sold, resulting in a capital loss of 146.

The book value of shares and participations in Group companies

amounted to 39,868 (46,893; 42,110), of which 39,866 (46,891;

42,108) pertained to shares in wholly owned subsidiaries. The cor-

responding shareholders’ equity in the subsidiaries (including equity

in untaxed reserves but excluding minority interests) amounted to

61,800 (75,380; 55,913). Shares and participations in non-Group

companies included 894 (897; 897) in associated companies that

are reported in accordance with the equity method in the consolida-

ted accounts. The portion of shareholders’ equity in associated com-

panies accruing to AB Volvo totaled 1,057 (834; 757). Shareholdings

and participations in non-Group companies included listed shares of

Bilia AB (formerly AB Catena) with a book value of 641. The market

value of the holding at year-end was 1,277.

Net debt amounted to 5,336 (15,838; 10,984).

AB Volvo’s risk capital (shareholders’ equity plus untaxed reserves)

amounted to 38,531, equal to 74% of total assets. The comparable

figure at year-end 1996 was 51%.

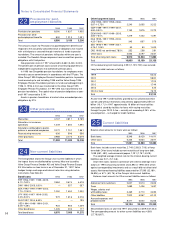

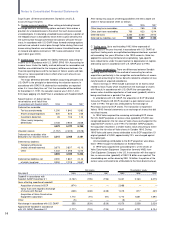

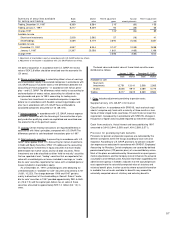

Incom e statements 1995 1996 1997

Net sales 488 559 520

Cost of sales (488) (559) (520)

Gross income ———

Administrative expenses Note 1 (356) (340) (426)

Other operating income 19 11 47

Other operating expenses Note 2 (52) (41) (24)

Operating income before

nonrecurring items (389) (370) (403)

Nonrecurring items Note 3 (1,817) — —

Operating income (2,206) (370) (403)

Income from investments

in Group companies Note 4 1,734 685 15,360

Income from investments

in associated companies Note 5 104 23 39

Income from other

shares and participations Note 6 218 156 (137)

Interest income and

similar credits Note 7 532 233 218

Interest expenses and

similar charges Note 7 (1,250) (1,048) (788)

Other financial income

and expenses Note 8 443 239 (594)

Income after

financial items (425) (82) 13,695

Allocations Note 9 3,601 978 4,354

Taxes Note 10 —2—

Net income 3,176 898 18,049

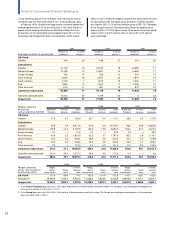

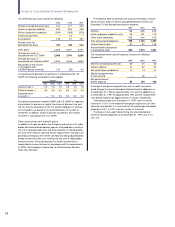

Board of Directors’ Report Dec 31, Dec 31, Dec 31,

Balance sheets 1995 1996 1997

Assets

Non-current assets

Property, plant

and equipment Note 11 82 97 30

Total tangible assets 82 97 30

Shares and participations

in Group companies Note 12 42,110 46,893 39,868

Long-term receivables

with Group companies 158 — 628

Other shares

and participations Note 12 7,317 7,025 1,051

Other long-term receivables 105 105 100

Total financial non-current assets 49,690 54,023 41,647

Total non-current assets 49,772 54,120 41,677

Current assets

Short-term receivables

from Group companies 3,484 1,971 5,309

Other short-term

receivables Note 13 122 64 57

Short term investments

in Group companies 1,584 — 5,178

Cash and bank accounts 6 6 5

Total current assets 5,196 2,041 10,549

Total assets 54,968 56,161 52,226

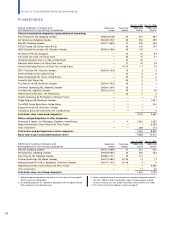

Shareholders’ equity and liabilities

Shareholders’ equity Note 14

Share capital (441,520,885

shares, par value SEK 6) 2,318 2,318 2,649

Legal reserve 7,241 7,241 7,241

Total restricted equity 9,559 9,559 9,890

Retained earnings 23,906 17,228 10,111

Net income 3,176 898 18,049

Total unrestricted equity 27,082 18,126 28,160

Total shareholders’ equity 36,641 27,685 38,050

Untaxed reserves Note 15 739 758 481

Provisions

Provisions for pensions Note 16 487 280 296

Other provisions Note 17 113 104 126

Total provisions 600 384 422

Non-current liabilities

Liabilities to Group

companies Note 18 10,958 8,606 10,951

Other loans 2 1 —

Total non-current liabilities 10,960 8,607 10,951

Current liabilities

Loans from Group companies 1,198 7,067 —

Other loans 34 2 1

Trade payables 52 36 37

Other liabilities to Group

companies 2,884 11,322 2,162

Other current liabilities Note 19 1,860 300 122

Total current liabilities 6,028 18,727 2,322

Total shareholders’ equity

and liabilities 54,968 56,161 52,226

Assets pledged Note 20 1,153 1,217 —

Contingent liabilities Note 21 57,441 64,650 72,287

AB Volvo