Volvo 1997 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 1997 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22

Financial review by business area

Cars

The passenger car industry is one of the world’s most competitive businesses.

Increased efficiency and the establishment of new factories increased the total

capacity of manufacturers in 1997. The excess capacity varies greatly from one

segment and price class to another. A strong brand name and a well-conceived

product mix will therefore become increasingly important.

Volvo consolidated its m arket positions with a broader

product program

With a broadened and market-focused product program, Cars was able to conso-

lidate and strengthen its positions during 1997, notably in Europe and North

America. In the large-car segment – which includes the Volvo S70, V70, C70,

940, S90 and V90 – Volvo’s share of the market in Europe was 8.2% (7.8); in

North America, 10.9% (9.5); and in Japan, 2.1% (2.5). The Volvo S40 and V40,

which are in the medium-size class, had 3.6% (3.1) of the market in Europe. The

most important competitors in the world market are Audi, BMW and Mercedes.

Two platforms will constitute the base for future product programs

New products and a better product mix in 1997 gave an indication of how Cars

will be able to reach new categories of customers. In the future two platforms will

constitute the base for Volvo’s product program offering more model versions,

differentiated products and shorter product life cycles. The first car based on the

new, large platform is being introduced in 1998 and will be the first concrete

expression of the new platform concept.

Increased sales in Europe and North Am erica

A total of 386,440 (368,250) Volvo passenger cars, nearly 5% more than in

1996, were invoiced in 1997. The medium-size cars Volvo S40 and V40 were

well received in Europe and were also introduced in Japan, South Africa and a

number of markets in Southeast Asia. The new turbo version of the Volvo S40

and V40 had a major impact on the market during the second half of the year.

The Volvo S70 and V70, which replace the Volvo 850, helped to strengthen

Cars´ sales in the North American market.

Volvo’s sales and market shares both increased in many countries in Europe.

Sales of new cars in Sweden rose following the end of the uncertainty about the

taxation of company cars. The number of Volvo passenger cars registered in-

creased 18%, to 51,400 (43,700), while the Group’s share of the market de-

clined slightly. Volvo models captured the three top spots in the ranking of car

sales in Sweden. The Volvo S70 and V70 ranked first, ahead of the Volvo 940,

S90 and V90 in second place. Following a rise in the last quarter of the year, the

Volvo S40 and V40 ended up in third place. The number of registrations in

Great Britain increased by 21%, to 40,700 (33,700) and Volvo’s share of a growing

market was higher. The Volvo S40 and V40 accounted for half of the registrations.

The rise in Italy was also fully attributable to the Volvo S40 and V40.

For the first time since the end of the 1980s Volvo sold more than 100,000

cars in North America. The Group’s market shares rose in both the U.S. and

Canada. The four-wheel-drive Volvo V70 AWD and V70 XC estate wagons that

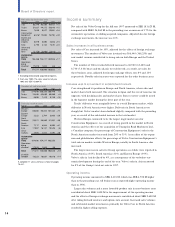

SEK million 1995 1996 1997

Net sales 83,340 83,589 96,453

Operating income 1,089 1,498 4,510

Operating margin, % 1.3 1.8 4.7

Num ber of cars invoiced

Number 1995 1996 1997

Western Europe 219,340 219,980 234,050

Eastern Europe 5,820 4,910 5,910

North America 99,230 95,660 101,980

South America 2,840 950 2,280

Asia 42,130 40,280 36,170

Other 5,280 6,470 6,050

Total 374,640 368,250 386,440

Cars’ largest m arkets

Volvo car Market share,

registrations %

1996 1997 1996 1997

USA187,600 90,000 1.0 1.1

Sweden 43,700 51,400 23.8 22.8

Great Britain 33,700 40,700 1.7 1.9

Germany 31,700 36,900 0.9 1.0

Italy 21,900 25,300 1.2 1.0

Japan 24,000 19,900 0.7 0.6

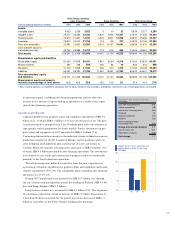

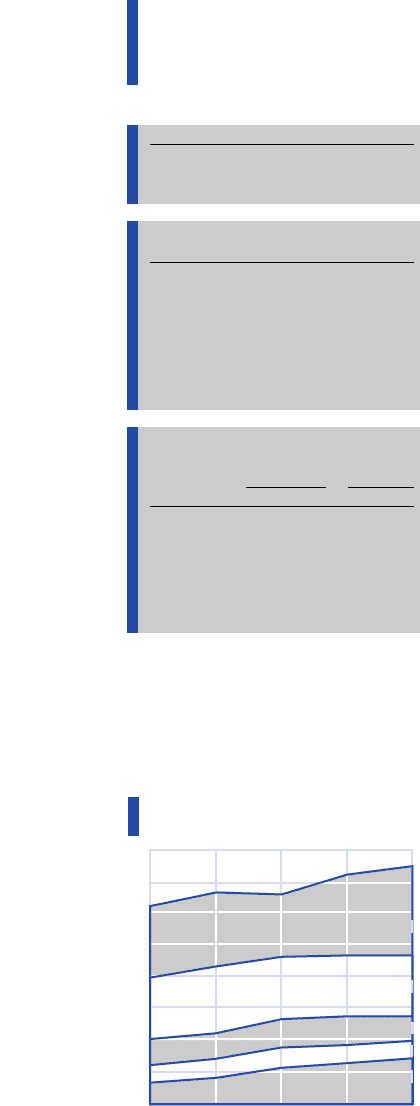

Market trend cars

Registrations of new passenger cars,

millions of units

97

96959493

5

10

15

20

25

40

35

30

Western Europe

Nafta

Japan

Other Countries

36.4 37.5

12.8

9.4

9.4

4.5

4.7

7.2

6.5

3.1

3.0

Asia

13.3

Total

The total market for cars

rose in 1997 to 37.5 m illi-

on cars (36.4). The m ar-

kets in USA and Canada

decreased 2%, while the

European m arket rose 5%.

The predicted growth m ar-

kets in Southeast Asia

were hit by a financial

recession and car sales

declined in the latter part

of the year, notably in

Thailand, Taiwan and

Malaysia.

1 Signed orders.

A complete 11-year summary is shown on pages

76–87.