Volvo 1997 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 1997 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

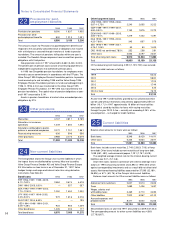

Fortos Fastigheter AB

In 1996, all of the shares of Fortos Fastigheter AB were sold to

Fabege AB. The sale resulted in a capital gain of SEK 39 M in

the Group. In addition, newly issued Fabege shares were received.

Swedish Match AB

As approved at Volvo’s Annual General Meeting on April 24, 1996, all

the shares of the wholly owned subsidiary Swedish Match AB were

distributed to Volvo’s shareholders in May 1996.

Volvo Construction Equipm ent Corporation

In April 1995, AB Volvo acquired the outstanding 50% of the shares

of Volvo Construction Equipment Corporation (formerly VME) from

Clark Equipment Company in the U.S. for 4,081. In connection with

the acquisition, the shareholding was written down by SEK 1.8 billion,

which is estimated to equal the excess value in Volvo Construction

Equipment that was attributable to the “Volvo” brand name at the

date of acquisition. The remaining excess value, SEK 0.9 billion, is

being amortized over 20 years. The company was consolidated as of

June 30, 1995. Volvo’s holding in the company in the first half of

1995 was reported in accordance with the equity method.

Groupe Pel-Job

Volvo Construction Equipment acquired all of the shares of Groupe

Pel-Job, a French company group, in December 1995. The group

manufactures mini-excavators (less than 6 tons total weight) and

other light construction equipment.

Prévost Car Inc.

Volvo Bus Corporation acquired Prévost Car Inc., a Canadian manu-

facturer of tourist buses, in June 1995. Thereafter, 49% of the sha-

res were sold to Henlys Group plc, Great Britain, which owns the

Plaxton company (bus bodies). Prévost Car Inc. was consolidated as

of June 30, 1995. Excess value amounting to SEK 0.4 billion, which

is being amortized over 20 years, arose in connection with the ac-

quisition.

Volvo Bus Poland Company Ltd.

Volvo Bus Poland Company Ltd. was formed in June 1995. The com-

pany, which is owned 55% by Volvo Bus Corporation and 45% by

Carrus Oy, a Finnish bus body manufacturer, produces buses used in

urban and intercity traffic. As of 1998 Carrus Oy is part of the Volvo

Group which results in Volvo Bus Poland being a wholly-owned

subsidiary.

Danabäck AB (form erly Pleiad Real Estate AB)

In 1995 Volvo concluded an agreement with the other shareholders

of Pleiad Real Estate AB covering acquisition of all of the company’s

shares for 1,675. Thereafter, properties unrelated to Volvo were

divested and the name of the company was changed to Danabäck AB.

Falcon Holding AB

In December 1995 Volvo sold Falcon Holding AB to a Nordic consor-

tium consisting of Spira Invest AB (Sweden), Carlsberg A/ S

(Denmark) and OY Sinebrychoff (Finland). The sale resulted in a

capital gain of SEK 217 M in the consolidated accounts.

Procordia Food and Abba Seafood

In September 1995 Volvo sold the Procordia Food and Abba

Seafood companies to Orkla ASA (Norway). The contract with Orkla

resulted in a capital gain of SEK 2.3 billion in the Volvo Group.

Alfred Berg Holding AB

In April 1995 all of the shares of Alfred Berg Holding AB were sold

to ABN AMRO Bank NV in Holland. The sale was effected at a price

of 300 after Volvo had received a dividend of 366 from Alfred Berg.

In addition, a supplemental purchase price of 614 was established.

Of this amount, 414 was received in 1995–1997. The remaining

portion will be paid in 1998. A capital gain of 515 was reported in

the 1995 accounts.

■

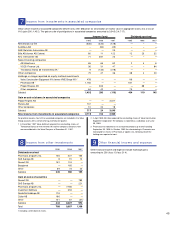

3Net sales

Net sales per business and market area are shown in tables on

page 14.

■

4Other operating income and expense

Other operating expense includes losses on forward and options

contracts of 1,180 (1996: gain of 1,100 which was reported under

Other operating income). Amortization of goodwill and provision for

bonuses to employees in Sweden amounting to 196 (195; 315) and

231 (300; 285), respectively, are included in Other operating expenses.

■

5Nonrecurring item s

Operating income in 1995 includes nonrecurring items amounting to

1,215 pertaining to gains on the sale of Procordia Food and Abba

Seafood, 2,300; Alfred Berg Holding, 515; and Falcon Holding, 217;

as well as a write-down of acquired shares in Volvo Construction

Equipment, 1,817.

■

6Operating income

Operating income before nonrecurring items by business area is

shown in a table on page 15. Depreciation is included in operating

income and is specified by type of asset as shown below:

1995 1996 1997

Intangible assets 387 266 253

Property, plant and equipment 4,485 4,247 4,731

Assets under operating leases 784 838 1,812

Total 5,656 5,351 6,796

Notes to Consolidated Financial Statements