Volvo 1997 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 1997 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

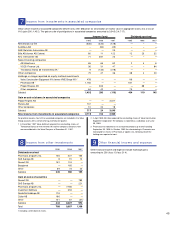

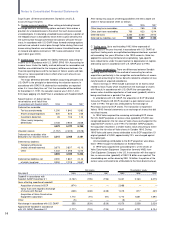

Dec 31, 1995 Dec 31, 1996 Dec 31, 1997

Estimated fair value of Book Fair Book Fair Book Fair

Volvo’s financial instruments value value value value value value

Balance sheet items

Investments in shares and participations:

fair value calculable 114,122 24,272 8,646 9,917 2,089 5,779

fair value not calculable 2529 — 206 — 361 —

Long-term receivables and loans 10,904 10,897 12,991 12,797 19,690 19,682

Accrued interest, receivables, etc 6,452 6,340 8,599 8,365 20,459 20,477

Marketable securities 15,817 16,139 21,577 22,059 10,962 11,203

Cash and bank 7,489 7,489 5,084 5,084 9,641 9,641

Long-term loans 16,885 16,784 18,189 18,145 23,135 24,168

Short-term loans 11,691 11,396 14,263 14,427 18,282 18,309

Accrued interest, payable, etc 1,102 1,101 1,315 1,294 1,288 1,281

Off-balance sheet items

Foreign exchange contracts

outstanding in the Volvo Group 96 32,608 47 33,179 (199)3(1,716)

Interest-rate contracts in the Volvo Group (157) 31,615 (85) 3(423) (77)3(957)

1 Pertains mainly to Volvo’s holdings in Renault SA 1995–1996 and

Pharmacia & Upjohn, Inc. 1995–1997.

2 Holdings of shares for which the calculation of fair value is not practical due

to the large number of different stocks. No single stock represents any signi-

ficant amount.

3 Book values are included among items in balance sheet.

■■

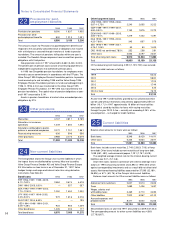

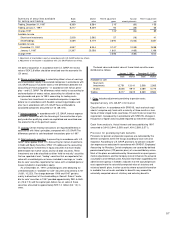

31 Net income and Shareholders’ equity in accordance with U.S. GAAP

Net incom e 1995 1996 1997

Net income in accordance

with Swedish accounting principles 9,262 12,477 10,359

Items increasing (decreasing)

reported net income:

Foreign currency

translation (A) 5,457 (89) (4,994)

Income taxes (B) (523) 494 122

Tooling costs (C) (633) (312) —

Business combinations (D) 355 (529) (529)

Shares and participations (E) (116) 176 —

Interest costs (F) 2 15 28

Leasing (G) 49 49 46

Debt and equity

securities (H) 368 (147) 123

Other (I) 111 (95) 65

Minority interests 2 — —

Tax effect of above

U.S. GAAP adjustments (1,399) 178 1,336

Net increase (decrease)

in net income 3,673 (260) (3,803)

Approximate net income in

accordance with U.S. GAAP 12,935 12,217 6,556

Approximate net income

per share, SEK in

accordance with U.S. GAAP 28.20 26.40 14.50

Weighted average number of

shares outstanding (in thousands) 457,984 463,558 452,540

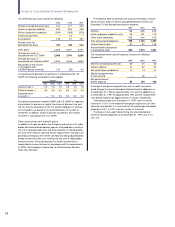

Shareholders’ equity 1995 1996 1997

Shareholders’ equity in accordance

with Swedish accounting principles 51,200 57,876 60,431

Items increasing (decreasing)

reported shareholders’ equity:

Foreign currency

translation (A) 3,920 3,660 (1,163)

Income taxes (B) 904 1,398 1,520

Tooling costs (C) 312 — —

Business combinations (D) 6,070 2,558 2,029

Shares and participations (E) (266) (90) (90)

Interest costs (F) 487 503 531

Leasing (G) (140) (91) (51)

Debt and equity

securities (H) 10,472 1,604 3.962

Other (I) 682 583 627

Tax effect of above

U.S. GAAP adjustments (4,782) (1,726) (1,184)

Net increase in

shareholders’ equity 17,659 8,399 6,181

Approximate shareholders’

equity in accordance

with U.S. GAAP 68,859 66,275 66,612

A summary of the Volvo Group’s approximate net income and share-

holders' equity determined in accordance with U.S. GAAP, is presen-

ted in the accompanying tables

Application of U.S. GAAP would have the following approximate

effect on consolidated net income and shareholders’ equity: