Volvo 1997 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 1997 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

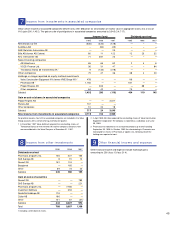

Definition of keys ratios

Operating margin

Operating income divided by net sales.

Return on operating capital

Operating income divided by average operating capital. Operating

capital consists of operating assets (tangible and intangible assets,

receivables and inventories) reduced by noninterest-bearing current

liabilities. This ratio is used only for Volvo’s business areas, not for the

Group as a whole.

Return on shareholders’ equity

Net income divided by average shareholders’ equity.

Interest coverage

Income divided by interest expense and similar charges. Income

includes operating income, income from investments in associated

companies, income from other investments and interest income and

similar credits.

Self-financing ratio

Cash flow from year’s operations (see Cash flow analyses) divided by

capital expenditures for property, plant and equipment and invest-

ments in assets under operating leases.

Net financial assets (net debt)

Cash and bank accounts, marketable securities and interest-bearing

long-term receivables reduced by short- and long-term interest-bea-

ring liabilities. Net debt in Volvo’s sales-financing companies is not in-

cluded since the interest expense on these liabilities is charged

against operating income and does not affect consolidated net inter-

est expense.

Income per share

Net income divided by the weighted average number of shares out-

standing during the period.

Average number of shares

The weighted average number of shares for a given year is calculat-

ed as follows: the eight opening and closing figures for the four

quarters of the year are totaled and then divided by eight.

■

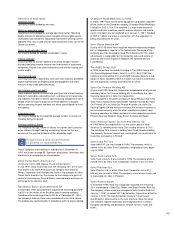

2Acquisitions and divestments

of shares in subsidiaries

Parent Company shareholdings in subsidiaries at December 31,

1997 are shown on page 65. Significant acquisitions, formations and

divestments of companies are shown below.

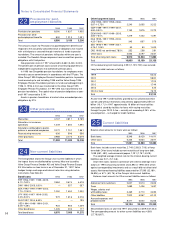

Volvo Trucks North Am erica, Inc

(formerly Volvo GM Heavy Truck Corporation)

In July 1997, Volvo Trucks took over the remaining 13% of the com-

mon shares in its North American truck company from General

Motors Corporation and changed the name of the company to Volvo

Trucks North America, Inc. The reason for the change is to gain full

control of the company. General Motors received preferred shares in

exchange for its common stock.

Transbanco Banco de Investim ento SA

In December 1997 Volvo do Brasil acquired the remaining outstand-

ing 50% of the shares of the Brazilian sales-financing company,

Transbanco Banco de Investimento SA. As of December 31, 1997,

the company’s balance sheet was consolidated in the Volvo Group.

The holding was reported earlier in accordance with the equity method.

Cham pion Road Machinery Limited

In March 1997 Volvo Construction Equipment Corporation acquired

all the shares of the Canadian company, Champion Road Machinery

Limited, for CAD 173 M. The company is a large manufacturer of

graders and other machines used in road construction and mainte-

nance. Champion was consolidated as of January 1, 1997. Goodwill

of SEK 0.7 billion that arose in connection with the acquisition is

being amortized over 20 years.

Volvo Penta Benelux BV

During 1997 AB Volvo Penta acquired Nebim Handelsmaatschappij

BV, an independent importer in the Netherlands. The name of the

company was then changed to Volvo Penta Benelux BV. The acquir-

ed company is responsible for the marketing, sales and service of

industrial and marine engines in Belgium, the Netherlands and

Luxembourg.

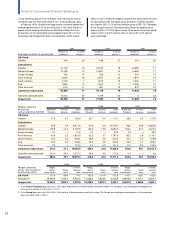

The AGES Group, ALP

In 1996 Volvo Aero increased its holding in The AGES Group, ALP

(Air Ground Equipment Sales) from 5% to 25%. Early 1997 the

holding was increased to 60% and AGES thereafter became a sub-

sidiary of Volvo. Goodwill of SEK 0.2 billion that arose in connection

with the acquisition is being amortized over 20 years.

Volvo Car Finance Holding AB

At year-end 1995 Volvo Car Corporation established a wholly owned

subsidiary, Volvo Car Finance Holding AB, to coordinate the sales-

financing operations in Volvo Car Corporation.

The company is the parent company of Volvo Rahoitus Suomi Oy,

Volvo Auto Leasing Deutschland GmbH, Modular Finance BV, Volvo

Car Finance UK Ltd., Volvo Car Finance Australia Ltd., Volvo Car

Renting España SA and Amazon Insurance NV. Amazon Insurance is

an insurance company, while the other subsidiaries conduct sales-

financing operations for Volvo's customers in their respective countries:

Finland, Germany, Belgium, Great Britain, Australia and Spain.

Volvo Rahoitus Suomi Oy (formerly Devoco Oy)

In 1996 Volvo Cars acquired 50% of the share capital in Volvo

Rahoitus Oy, following which Volvo Cars’ holding amounts to 75%.

The remaining 25% interest is held by Volvo Truck Finance Holding.

The company finances transactions involving both cars and trucks for

customers and dealers in Finland.

Volvo India PVT Ltd.

Volvo India PVT Ltd. was formed in 1996. The company, which is

owned 100% by Volvo Truck Corporation, will produce trucks begin-

ning in 1998.

Volvo Truck Latvia S/ A

Volvo Truck Latvia S/ A was formed in 1996. The company, which is

owned 100% by Volvo Truck Corporation, markets trucks in Latvia.

Volvo Pakistan Ltd.

Volvo Pakistan Ltd., in which Volvo Truck Corporation has a 51%

interest, was formed in 1996. The company manufactures trucks and

is responsible for sales in Pakistan.

Volvo Austria GmbH

In November 1996 Volvo Bus Corporation acquired the remaining

25% shareholding in Steyr Bus GmbH from Steyr-Daimler-Puch Ag.

The company, whose name was changed to Volvo Austria GmbH on

January 1, 1997, is owned 100% by Volvo Bus Corporation. Effective

January 1, 1997, the new distribution structure in Austria was

coordinated in Volvo Austria. In the new structure, Volvo has taken

over Denzel’s importer operations and integrated them in Volvo’s

European marketing and distribution network for cars, trucks and

buses.