Volvo 1997 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 1997 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

Board of Directors’ report

Different types

of finance contracts

Volvo customers are being offered

three types of finance contracts. These

contracts can be com bined with various

maintenance contracts and insurance

policies to create a “ package” that

meets a customer’s specific needs and

the conditions in a particular m arket.

Installm ent purchases are com m on

and constitute an important part of

Volvo’s total credit portfolio.

A distinguishing feature of financial

leasing is that paym ents for leasing,

except for interest costs, cover the

gradually declining m arket value of

the object being leased. The lessee

enjoys the financial benefits and risk s

attributable to the leased object but

does not acquire ownership rights to

it until the lease has expired.

In operational leasing, the leasing

period is shorter than the econom ic

life of the leased object. This means

that the leasing object has a residual

value when the leasing contract has

expired. This value is determ ined at

the tim e the leasing contract is sig-

ned. The lessor retains ownership of

the leasing object and also assum es

the residual-value risk.

Sales-financing companies also offer

inventory financing for Volvo’s dealers.

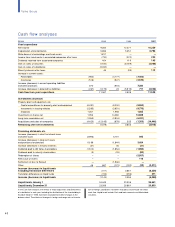

Income statements, Balance sheets and Cash flow analyses for Volvo’s sales financing are shown on pages 14-18.

Established sales-

financing companies

December 31, 1997

Other

North America

Australia

Brazil

Peru

Cars

Trucks

Sales financing

Volvo’s growing sales-financing operations include a broad range of services in

the form of installment and leasing plans as well as service and maintenance con-

tracts. The sales-financing operations are part of each business area. The level of

penetration, that is, the proportion of sales-financing contracts in relation to new

vehicle sales for cars and trucks varies by market and product but averaged

around 30% during 1997.

Operations expanded during 1997 as part of Volvo’s growth strategy and to

meet increased customer demands and strengthen competitiveness of the dea-

lers. The total assets of the sales-financing companies more than doubled during

the year. The credit portfolio amounted to SEK 44.2 billion and comprised

161,000 contracts. By value, dealer financing accounts for 20% and customer

funding for 80%. The customer financing portfolio comprised 34%

operational leasing, 27% financial leasing and 39% other customers

credits. See under headline “Different types of finance contracts.”

Funding of the sales-financing operations is coordinated by

Volvo’s internal bank, Volvo Group Finance.

Expanded sales financing in Europe and North America

Expansion in 1997 occurred mainly in Europe and North America. Car financing

in the U.S. and Great Britain, which was formerly carried out in joint ventures,

was managed during 1997 in wholly owned subsidiaries. New companies were

formed in France (cars) and in Sweden for markets in Eastern Europe (trucks).

In January 1998 Volvo Trucks’ acquisition of the truck-leasing business of the

British company, NFC Plc, was announced, which will strengthen Volvo Trucks’

position in the British market substantially.

Incom e

Operating income for Volvo’s sales financing amounted to SEK 202 M (146).

This includes establishment costs in a number of markets. In addition, operating

income was charged with the build-up of credit and residual value reserves. The

share of income in associated companies resulted in a loss of SEK 146 M, which

included the losses incurred in the Brazilian company Transbanco Banco de

Investimento.

Transbanco, which was 50% owned by Volvo during 1997, carries out sales

financing of Volvo trucks and buses in Brazil. The company has experienced sig-

nificant difficulties, necessitating comprehensive provisions for anticipated losses.

Volvo took over the remaining 50% of the shares and management responsibility

at the end of 1997 and Transbanco was consolidated as of December 31, 1997 in

the Volvo Group balance sheet. The loss related to Volvo’s holding in

Transbanco amounted to SEK 278 M.

Risk provisions

Excluding Transbanco, the credit portfolio amounted to SEK 43.3 billion at year-

end 1997. Specific provisions are made for those customers who cannot fulfill