Volvo 1997 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 1997 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

Significant differences between Swedish and U.S.

accounting principles

A. Foreign currency translation. When valuing outstanding forward

exchange contracts and currency options contracts, Volvo makes a

provision for unrealized losses to the extent that such losses exceed

unrealized gains. In calculating unrealized losses and gains, a portion of

the hedged amount is excluded for which there is great certainty that

the currency flow through commercial transactions will cover the con-

tracts. In accordance with U.S. GAAP, these forward exchange options

contracts are valued at market price through fictive closing. Gains and

losses arising therefrom are included in income. Unrealized losses net,

on forward and options contracts in 1997 were estimated at 1,163

(gain 3,660; gain 3,920).

B. Income taxes. Volvo applies the liability method of accounting for

income tax in accordance with U.S. GAAP, SFAS 109: Accounting for

income taxes. Under the liability method, deferred tax receivables and

liabilities are established for the temporary differences between the

financial reporting basis and the tax basis of Volvo’s assets and liabi-

lities at tax rates expected to be in effect when such amounts are

realized or settled.

The major difference between Swedish accounting principles and

U.S. GAAP is the principle for determining the valuation reserve. In

accordance with SFAS 109, deferred tax receivables are reported

when it is “more likely than not” that the receivable will be realized.

At December 31, 1997, the valuation reserve was 1,500 (1,400;

900) lower applying U.S. GAAP than in accordance with Swedish GAAP.

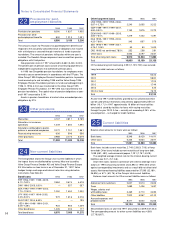

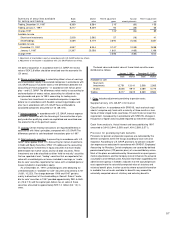

Specification of deferred tax

receivables and liabilities

(In accordance with Swedish GAAP) 1995 1996 1997

Deferred tax receivable:

Tax-loss carryforwards 1,290 1,640 1,582

Shares and participations 620 626 236

Investment deduction 26 106 103

Other (mainly temporary

differences) 2,136 2,905 3,838

4,072 5,277 5,759

Valuation reserve (1,757) (2,209) (2,578)

Deferred tax receivables after

deductions for valuation reserve 2,315 3,068 3,181

Deferred tax liabilities:

Temporary differences

(mainly untaxed reserves) 3,673 3,837 4,110

Other 1,232 1,098 1,214

4,905 4,935 5,324

Deferred tax liabilities, net 2,590 1,867 2,143

of which, long term 3,350 2,728 3,567

After taking into account offsetting possibilities the items above are

shown in Volvo’s balance sheet as follows:

1995 1996 1997

Other long-term receivables — 265 255

Other short-term receivables 760 923 1,514

Deferred taxes 3,350 3,055 3,912

Deferred tax liabilities, net 2,590 1,867 2,143

C. Tooling costs. Up to and including 1992 Volvo expensed all

tooling costs in the year incurred. In accordance with U.S. GAAP, all

significant tooling costs are capitalized and depreciated over a period

not exceeding five years, Effective in the 1993 accounts, Volvo has

applied this accounting method and is capitalizing type-specific

tools. Adjustments under this point pertain to depreciation of capitali-

zed tooling costs in accordance with U.S. GAAP prior to 1993.

D. Business combinations. There are differences between Swedish

reporting and U.S. GAAP in the method of accounting for certain

acquisitions, particularly in the recognition and amortization of excess

values and accounting for the tax benefits related to utilization of loss

carryforwards of acquired subsidiaries.

Volvo’s earnings in 1993 include a provision for an excess value

related to Volvo Trucks which resulted from the exchange of shares

with Renault. In accordance with U.S. GAAP, the corresponding

excess value should be reported as a fixed asset (goodwill) which is

being amortized over a period of five years.

In accordance with U.S. GAAP, the acquisition of BCP (Branded

Consumer Products AB (BCP) resulted in a gain, before taxes, of

1,320 in 1993. The gain was attributable to the exchange of

Pharmacia shares for BCP shares. The transaction is reported in

Volvo’s 1993 financial statements as an exchange of shares that did

not affect income.

In 1994 Volvo acquired the remaining outstanding BCP shares.

For U.S. GAAP purposes, an excess value (goodwill) of 5,280 was

recognized based on the fair value of Volvo shares exchanged for the

acquired BCP shares in June 1994. For Swedish GAAP purposes,

the acquisition resulted in a smaller excess value amounting to 2,500

based on the fair value of Volvo shares in October 1993. During

1995 Volvo sold some shares attributable to the BCP acquisition. Of

original goodwill of 5,280, approximately 20% was charged against

the capital gain.

All shareholdings attributable to the BCP acquisition were dives-

ted in 1996 through the distribution of Swedish Match.

In 1995 Volvo acquired the outstanding 50% of the shares of

Volvo Construction Equipment Corporation (formerly VME) from

Clark Equipment Company in the U.S. In connection with the acquisi-

tion, an excess value (goodwill) of SEK 2.8 billion was reported. The

shareholding was written down by SEK 1.8 billion, the portion of the

excess value estimated to be attributable to the Volvo brand name at

Notes to Consolidated Financial Statements

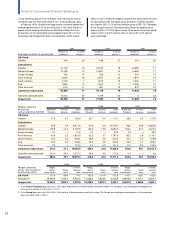

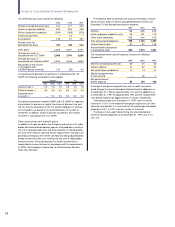

Net income Shareholders’ equity

Goodwill 1995 1996 1997 1995 1996 1997

Goodwill in accordance with

Swedish GAAP, December 31 (2,132) (195) (196) 5,431 2,163 3,075

Items affecting reporting of goodwill

Acquisition of shares in BCP (974) — — 2,988 — —

Volvo Truck with regard to exchange

of shares with Renault (438) (438) (438) 1,315 877 439

Acquisition of Volvo Construction

Equipment corporation 1,772 (91) (91) 1,772 1,681 1,590

Other (5) — — (5) — —

Net change in accordance with U.S. GAAP 355 (529) (529) 6,070 2,558 2,029

Approximate Goodwill in accordance

with U.S. GAAP, December 31 (1,777) (724) (725) 11,501 4,721 5,104