Volvo 1997 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 1997 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16

Board of Directors’ report

Minority interests

Minority interests in the Volvo Group consist mainly of the Henly Group’s

49% interest in Prévost Car Inc, Hitachi Construction Machinery’s 40% interest

in Euclid-Hitachi Heavy Equipment Inc and GPA Group’s 40% interest in

The AGES Group ALP.

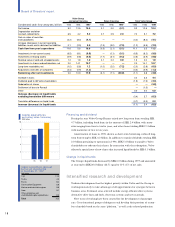

Financial position

The Group’s total assets increased by SEK 22.1 billion. Excluding foreign

exchange movements, acquisitions of companies and the expansion of sales-

financing operations, total assets decreased by SEK 8.5 billion. During the year

Volvo sold all of its shares in Renault, which together with the sale of the hold-

ing in Pripps Ringnes reduced the long-term financial assets by SEK 7.9 billion.

Excluding exchange rate movements and acquisitions of companies, inventories

rose SEK 2.6 billion.

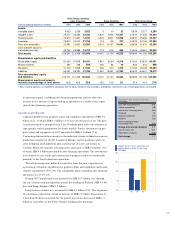

Sales Financing

Total assets in Volvo’s sales finance operations more than doubled during the

year, to SEK 46.9 billion (22.7). The increase was due largely to the fact that

sales-financing companies in North America and Great Britain, in which Volvo

had formerly been a joint owner, are now being operated by the Group as wholly

owned subsidiaries. Customer and leasing receivables amounted to SEK 32.1 bil-

lion (13.4). Assets in operational leasing increased from SEK 4.9 billion to

SEK 12.1 billion. The equity/assets ratio in sales-financing operations was 9.1%

in 1997, calculated as a percentage of equity and minority capital.

Net financial assets

The Group’s net financial assets, which are calculated exclusive of the sales-

financing operations and which amounted to SEK 12.0 billion at the end of

1996, increased by 7.1 billion to SEK 19.1 billion (Details of the change are

specified in the table on page 17).

Shareholders’ equity

Shareholders’ equity increased by SEK 2.6 billion in 1997. Net income for the

year increased shareholders’ equity by SEK 10.4 billion while the redemption of

shares, dividend to Volvo’s shareholders for the fiscal year 1996, and foreign

exchange differences, reduced shareholders’ equity by SEK 7.6 billion. Share-

holders’ equity and minority interests were equal to 37.6% (41.4) of total Group

assets and 50.8% (48.0) of assets excluding sales financing.

Cash flow analysis

Cash flow from the year’s operations amounted to SEK 11.5 billion (3.5), of

which SEK 16.6 billion was generated in the industrial operations while the cash

flow in sales finance operations was negative in the amount of SEK 5.1 billion.

Total operating capital increased by SEK 2.0 billion (increase: 5.9). The decrease

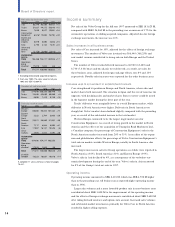

Impact of exchange rates

on Volvo’s operating incom e

Average spot rates in 1997 were signi-

ficantly more favorable for Volvo than in the

preceding year. As shown in the table

below, the net effect of changed spot rates

was positive in the amount of SEK 4,830 M.

The favorable effects of higher average

spot rates for “inflow” currencies, mainly

U.S. dollars and British pounds, and

Japanese yen, were reinforced by lower

average spot rates for “outflow” currencies:

mainly the Dutch guilder but also German

mark and Belgian franc.

However, since Volvo hedges large por-

tions of payment flows in foreign curren-

cies, the changes in spot rates do not have

an immediate impact on earnings. In 1997

the effect of forward contracts and option

contracts on earnings amounted to a loss

of 1,180 (1996:gain 1,100), resulting in a

negative impact of 2,280 on operating

earnings in 1997, compared with 1996.

Changes in spot exchange rates in con-

nection with the translation of foreign sub-

sidiaries’ earnings, as well as the revalua-

tion of balance sheet items in foreign cur-

rencies, also had an impact.

The total effect on Group operating in-

come of changes in foreign exchange rates

in 1997, compared with 1996, amounted to

2,600.

Total income effect due to changes in

foreign exchange rates

Net flow Income

1997 effect

Effect of changes

in spot rates in

each currency

USD 2,600 2,390

GBP 650 1,310

CAD 430 250

ITL 1,195,400 170

NLG (2,230) 140

AUD 240 100

Other 470

Effect of changed

spot rates, net 4,830

Effect of forward

contracts and

options contracts1(2,280)

Translation of foreign

subsidiaries’

operating income 80

Revaluation of

balance sheet

items in foreign

currency (30)

Total effect 2,600

1 Group sales are reported at average spot

rates and the effect of hedging is included

among other operating income/ expenses.