Volvo 1997 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 1997 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

In the course of its operations the Volvo Group is exposed to various

types of financial risks. Group-wide policies form the basis for each

Group company’s action program. Monitoring and control is conduc-

ted continuously in each company as well as centrally. Most of the

Volvo Group’s financial transactions are carried out through Volvo’s

in-house bank, Volvo Group Finance, which conducts its operations

within established risk mandates and limits.

Foreign exchange risk

Volvo’s currency risk is related to changes in contracted and project-

ed flows of payments (commercial exposure), to payment flows relat-

ed to loans and investments (financial exposure), and to the revalua-

tion of assets and liabilities in foreign subsidiaries (equity exposure).

The objective of Volvo’s foreign exchange risk management is to

reduce the impact of foreign exchange movements on the Group’s

income and financial position.

Commercial exposure

Volvo uses forward exchange contracts and currency options to hedge

the value of future payment flows. Contracts related to hedging of

anticipated sales and purchases of foreign currency normally do not

exceed 36 months. In accordance with the Group’s currency policy,

between 40% and 80% of the net flow in each currency is hedged

for the coming 12 months, 20% to 60% for months 13 through 24

and 0% to 40% for months 25 through 36. The value of all forward

and options contracts as of December 31, 1997 was SEK 51.9 billi-

on (40.2; 41.0).

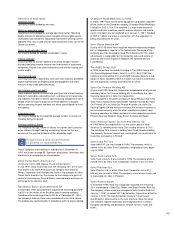

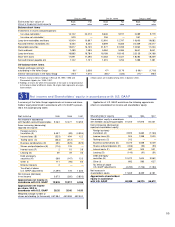

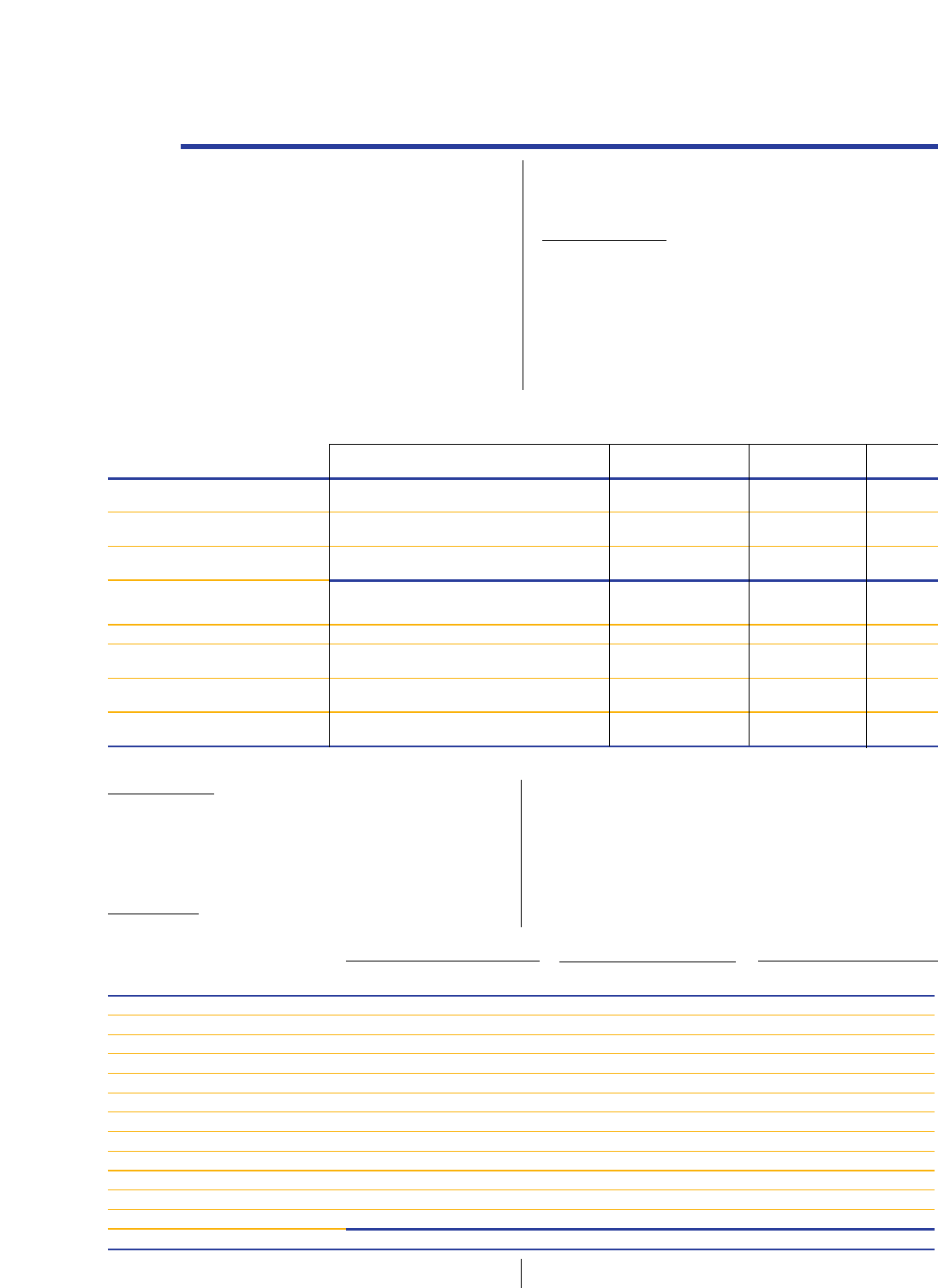

Inflow currencies Outflow currencies Other currencies Total

Net expressed in

SEK M USD GBP ITL JPY DEM BEF SEK

Due date 1998 amount 2,281 487 933,459 41,741 (1,212) (19,011) 4,654

rate17.38 11.64 0.0043 0.0838 4.64 0.2186

Due date 1999 amount 1,526 351 368,888 34,489 (768) (7,823) 3,036

rate17.53 12.20 0.0044 0.0697 4.53 0.2167

Due date 2000 amount 625 215 24,500 17,230 (147) (1,705) 952

rate17.68 12.43 0.0045 0.0694 4.40 0.2155

Total 4,432 1,053 1,326,847 93,460 (2,127) (28,539) 8,642

of which options contracts 355 72 4,341 15,974 (273) 0 260

Translated to actual value, SEK233,128 12,647 5,792 7,253 (9,884) (6,222) 9,234 51,948

Translated to SEK a year-end

1997 rates 34,887 13,814 5,904 5,664 (9,351) (6,082) 8,642 53,478

Difference between actual value

and year-end exchange rates (1,759) (1,167) (112) 1,589 (533) (140) 592 (1,530)

Year-end exchange rates,

December 31, 1997 7.87 13.12 0.0045 0.0606 4.40 0.2131

■■

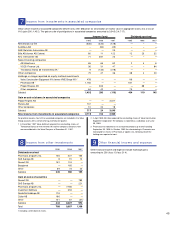

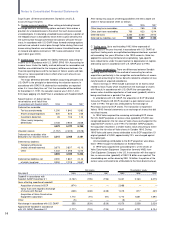

30 Financial risks

1995 1996 1997

Total outstanding currency Notional Carrying Estimated Notional Carrying Estimated Notional Carrying Estimated

contracts, December 31 amount amount fair value amount amount fair value amount amount fair value

Foreign exchange contracts

– receivable position 127,290 5,771 8,320 56,238 3,388 3,492 40,349 1,951 2,006

– payable position 261,736 (5,669) (6,956) 50,303 (3,377) (1,477) 84,591 (2,150) (3,762)

Foreign exchange swaps

– receivable position 4,652 — 49 83,301 4 2,623 27,268 — 1,416

– payable position 123 — (1) 81,565 (1) (2,517) 26,045 — (1,604)

Options – purchased

– receivable position 13,558 21 1,255 11,163 33 1,075 5,135 — 379

– payable position 802 (23) (23) 34 — — 4,156 — (147)

Options – written

– receivable position 27 — — — — — 2,080 — 57

– payable position 7,235 (4) (36) 5,806 — (17) 4,274 — (61)

Total 96 2,608 47 3,179 (199) (1,716)

1 Average contract rate. 2 Average forward contract rate and, for options, the most favorable of the year-end rate and contract rate.

Volvo Group outstanding currency contracts pertaining to com m ercial exposure, Decem ber 31, 1997

The table shows contracts hedging

future flows of commercial payments.

Financial exposure

Group companies operate in local currencies. Through loans and

investments being mainly in the local currency, financial exposure is

avoided. In companies which have loans and investments in foreign

currencies, hedging is carried out in accordance with Volvo’s financial

policy, which means a limited risk-taking.

Equity exposure

In conjunction with translation of the Group’s assets and liabilities in

foreign subsidiaries to Swedish kronor, a risk arises that the currency

rate will have an effect on the consolidated balance sheet. In accord-

ance with the Group’s currency policy, net assets (shareholders’

equity) in foreign subsidiaries and associated companies are hedged

up to 50%. Hedging is mainly done through borrowing in the same

currency as the net assets. At year-end 1997, net assets in subsidia-

ries and associated companies outside Sweden amounted SEK 25

billion, of which 17% was hedged.

The notional amount of the derivative contracts represents the gross contract

amount outstanding. To determine the estimated fair value, the major part of

the outstanding contracts have been marked-to-market. Discounted cash flows

has been used in some cases.