Volvo 1997 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 1997 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

Notes to Consolidated Financial Statements

Amounts in SEK M unless other specified. The amounts within

parentheses refer to the two preceding years; the first figure is for

1996 and the second for 1995.

■

1Accounting principles

Volvo’s operations

Volvo’s operations are concentrated in the automotive and transport

equipment industry. The focus is on further strengthening the Group’s

position in the passenger car field and developing its position as one

of the world’s leading manufacturers of trucks, buses, construction

equipment and drive systems for marine and industrial applications.

In the aircraft engine field Volvo has substantial resources for the

maintenance of engines and the development of engine components.

The consolidated accounts for AB Volvo and its subsidiaries are

prepared in accordance with Swedish accounting principles. These

principles differ in certain significant respects from American account-

ing principles. (See Note 31).

Change in accounting principles

New Annual Accounts Act

The new Annual Accounts Act, which primarily involves changes in

the forms of presentation of the income statement and balance

sheet, was applied effective in 1997. Income statements and balance

sheets for prior years have been adjusted to conform with the new

rules. The new Act has affected Volvo’s valuation principles only to an

insignificant degree.

Leasing contracts

Effective in 1997, Volvo is applying the Recommendation of the

Swedish Financial Accounting Standards Council pertaining to leasing

contracts, which came into force January 1, 1997. In accordance

with this Recommendation, leasing contracts are divided into opera-

tional and financial leasing contracts. The change represents an

adaptation to international standards. Volvo’s sales-financing opera-

tions have been reported earlier in accordance with international

standards. The Recommendation is otherwise being applied only to

transactions following the date when the Recommendation came into

force and has had only a limited effect on Volvo’s consolidated in-

come statement and balance sheet.

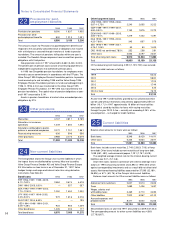

Principles of consolidation

The consolidated accounts comprise the Parent Company, all subsidiar-

ies and associated companies. Subsidiaries are defined as companies

in which Volvo holds more than 50% of the voting rights or in which

Volvo otherwise has a controlling influence. Subsidiaries in which

Volvo's holding is temporary are not consolidated, however. Associated

companies are companies in which Volvo has long-term holdings equal

to at least 20% but not more than 50% of the voting rights.

The consolidated accounts are prepared in accordance with the

principles set forth in the Recommendation of the Swedish Financial

Accounting Standards Council.

All acquisitions of companies are reported in accordance with the

purchase method.

Companies that have been divested are included in the consolidated

accounts up to and including the date of divestment. Companies acquir-

ed during the year are consolidated as of the date of acquisition.

Holdings in associated companies are reported in accordance with

the equity method. The Group's share of reported income before taxes

in such companies, adjusted for minority interests, is included in the

consolidated income statement, reduced in appropriate cases by amor-

tization of excess values. The Group's share of reported taxes in asso-

ciated companies, as well as estimated taxes in allocations, are includ-

ed in Group tax expense.

For practical reasons, most of the associated companies are includ-

ed in the consolidated accounts with a certain time lag, normally one

quarter. Dividends from associated companies are not included in con-

solidated income. In the consolidated balance sheet, the book value of

shareholdings in associated companies is affected by Volvo's share of

company's income after tax, reduced by amortization of excess values

and by the amount of dividends received.

Foreign currencies

In preparing the consolidated financial statements, all items in the

income statements of foreign subsidiaries (except subsidiaries in

highly inflationary economies) are translated to Swedish kronor at the

average exchange rates during the year (average rate). All balance

sheet items except net income are translated at exchange rates at

the respective year-ends (year-end rate). The differences in consoli-

dated shareholders’ equity arising as a result of variations between

year-end exchange rates are charged or credited directly to share-

holders’ equity and classified as restricted or unrestricted reserves.

The difference arising in the consolidated balance sheet as a result

of the translation of net income in foreign subsidiaries to Swedish

kronor at average rates is charged or credited to unrestricted re-

serves. Movements in exchange rates change the book value of

foreign associated companies. This difference affects restricted

reserves directly.

When foreign subsidiaries and associated companies are divested,

the accumulated translation difference is reported as a realized

gain/ loss and, accordingly, affects income.

Financial statements of subsidiaries operating in highly inflationary

economies are translated to Swedish kronor using the temporal

method. Monetary items in the balance sheet are translated at year-

end rates and nonmonetary balance sheet items and corresponding

income statement items are translated at rates in effect at the time

of acquisition (historical rates). Other income statement items are

translated at average rates. Translation differences are credited to, or

charged against, income in the year in which they arise.

In the individual Group companies as well as in the consolidated

accounts, receivables and liabilities in foreign currency are valued at

year-end exchange rates. In the individual Swedish Group companies,

unrealized exchange gains on long-term receivables and liabilities are

allocated to an exchange reserve. In the consolidated accounts, this

is divided into a Deferred tax liability and Equity in untaxed reserves.

Gains and losses pertaining to hedges are reported at the same time

as gains and losses of the items hedged. Premiums or payments for

currency options, which hedge currency flows in business transac-

tions are reported as income/ expense during the contract period.

When valuing outstanding forward exchange contracts, provision is

made for unrealized losses to the extent that the latter exceed un-

realized gains. In calculating the size of unrealized losses, a portion of

the amounts secured through forward contracts is excluded; this

consists of amounts for which there is substantial assurance that the

currency flow from commercial transactions will cover forward con-

tracts. Unrealized gains in excess of unrealized losses are not credited

to income.

In valuing loans whose original currency denomination has been

changed as a result of currency swap contracts, the amount of the

loans in Swedish kronor is calculated based on the currencies in

which the loans are to be repaid.

Exchange differences on loans and other financial instruments in

foreign currency, which are used to hedge net assets in foreign sub-

sidiaries and associated companies, are offset against translation dif-

ferences in the shareholders’ equity of the respective companies.

Exchange gains and losses on payments during the year and on