Volvo 1997 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 1997 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

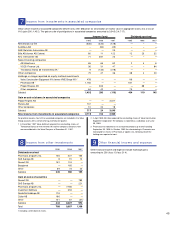

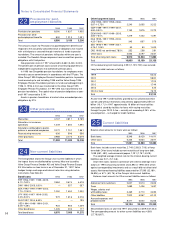

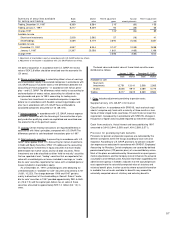

Value in Value in Subsidiaries Value in

balance balance acquired balance Book value

Accum ulated sheet sheet Depre- Sales/ and Translation Reclassi- sheet in balance

depreciation 1995 1996 ciation2scrapping divested differences fications 1997 sheet 19973

Goodwill 820 811 196 — — 11 — 1,018 3,075

Patents 84 50 14 (2) — 2 — 64 47

Aircraft engine costs 990 1,053 43 — — 3 — 1,099 162

Total intangible assets 1,894 1,914 253 (2) — 16 — 2,181 3,284

Buildings 5,776 5,728 506 (57) 31 67 203 6,478 8,497

Land and land improvements 535 516 39 (3) 1 9 (8) 554 1,745

Machinery and equipment125,604 26,222 4,186 (1,493) 142 160 (198) 29,019 17,478

Construction in progress,

including advance payments — — — — — — — — 3,073

Total property,

plant and equipment 31,915 32,466 4,731 (1,553) 174 236 (3) 36,051 30,793

Assets under

operating leases 1,070 1,730 1,812 (964) 284 143 (19) 2,986 13,501

Total tangible assets 32,985 34,196 6,543 (2,517) 458 379 (22) 39,037 44,294

1 Machinery and equipment pertains mainly to production equipment.

2 Includes accumulated write-downs. 3 Acquisition value less accumulated depreciation.

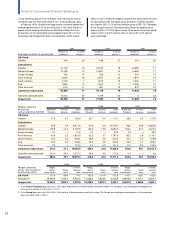

Investments in intangible and tangible assets amounted to 9,863

(8,200; 6,491). Investments in assets under operating leases

amounted to 9,773 (3,851; 2,585).

Investments approved but not yet implemented at the end of 1997

amounted to SEK 20.0 billion (16.8: 17.7).

Replacement cost (unaudited information)

At year-end 1997, the replacement cost of buildings, machinery and

equipment, based on methods of calculation applied by Volvo and

which in certain cases involves the use of indexes, was estimated at

SEK 47.3 billion after calculated depreciation. The corresponding

value shown in the Volvo Group balance sheet was SEK 30.8 billion.

Calculated depreciation based on the present replacement cost

amounted to SEK 7.4 billion in 1997. The corresponding depreciation

in the consolidated income statement, which is based on historical

cost, was SEK 4.7 billion.

■■

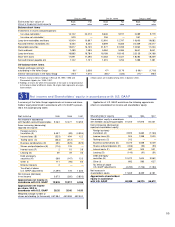

13 Shares and participations

A specification of Group holdings of shares and participations ap-

pears on page 64. Call options with a total exercise price of – (5; 5)

have been issued on shares with book values of – (2; 2).

The Volvo Group has transactions with some of its associated

companies. As of December 31, 1997, the Group’s net receivables to

associated companies amounted to 4,575 (6,909; 5,814).

The market value of Volvo’s holdings of securities in listed compa-

nies as of December 31, 1997 is shown below.

Book value Market value

Pharmacia & Upjohn, Inc. 2,082 5,770

Bilia AB (formerly AB Catena) 505 1,277

Verimation AB 7 9

Total 2,594 7,056

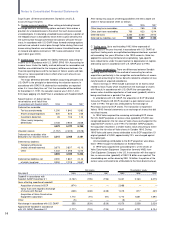

The AGES Group, ALP

During 1996 Volvo Aero increased its holding in The AGES Group,

ALP, Air Ground Equipment Sales, an American company, from 5% to

25%. In 1997 the holding was further increased to 60% and AGES

thereby became a subsidiary of Volvo.

OmniNova Technology AB

In March 1997 Volvo Bus Corporation and TWR, an English engineer-

ing company, formed a jointly owned company to develop manufac-

turing processes for buses and some production of bus components.

The company is owned 35% by Volvo Bus Corporation and 65% by

TWR. Its operations are located in facilities adjacent to AutoNova in

Uddevalla, Sweden.

Régie Nationale des Usines Renault SA (Renault SA)

In July 1997 Volvo divested its entire holding in Renault, equal to

11.4% of both the share capital and voting rights in the company.

The proceeds amounted to 5,934 and the Group gain was 783.

Pripps Ringnes AB

Pripps Ringnes AB was formed in September 1995 through an

agreement with Orkla ASA (Norway). At year-end 1996 Volvo owned

49% of the shares and held a convertible debenture loan which upon

conversion would increase the holding to 55%. In February 1997

Volvo sold its holding in Pripps Ringnes to Orkla. Volvo received

4,515 from the sale, plus 100 in dividends, and the transaction yield-

ed a capital gain of 3,027 in the Volvo Group.

SAS Sverige AB

In June 1997 Volvo sold its entire holding in SAS Sverige AB, equal

to 4.7% of the share capital and voting rights. The amount of the sale

was 319 and the capital gain was 221.

Fabege AB

In November 1996 Volvo concluded an agreement covering the sale

of buildings to Fabege AB. Fabege paid two thirds of the purchase

price in cash and the remaining third in the form of newly issued

Fabege shares. Volvo’s holding in the company thereafter amounted

to 8.3% of the share capital and 7.5% of the voting rights. In 1997

the entire holding was sold, yielding a profit of 19.

Merkavim Metal Work s Ltd.

In January 1996 Volvo Buses acquired 26.5% of the share capital

and voting rights in Merkavim Metal Works Ltd. (Israel). The company

produces tourist, intercity and city buses, as well as articulated buses

and minibuses.