Volvo 1997 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 1997 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

the valuation of assets and liabilities in foreign currencies at year-end

are credited to, or charged against, income before taxes and minority

interests in the year they arise. The more important exchange rates

employed are shown above.

Other financial instruments

Interest-rate and currency-rate swaps are reported as hedging of

assets and liabilities.

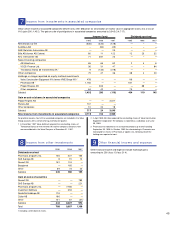

Capital expenditures for property, plant and equipm ent

Capital expenditures for property, plant and equipment include

investments in buildings, machinery and equipment, as well as in

long-term intangible assets. Investments pertaining to assets under

operating leases are not included.

Depreciation and amortization of tangible and intangible

non-current assets

Depreciation is based on the historical cost of the assets, reduced in

appropriate cases by write-downs, and estimated economic life.

Capitalized type-specific tools are generally depreciated over 2 to 5

years. The depreciation period for assets under operating leases is

normally 3 to 5 years. Machinery is generally depreciated over 5 to

10 years, and buildings over 25 to 50 years, while the greater part of

land improvements are depreciated over 20 years. In connection with

its participation in aircraft engine projects with other companies,

Volvo Aero in certain cases compensates these companies for part of

the development costs incurred before Volvo Aero entered the pro-

ject. These costs are capitalized and depreciated over 5 to 10 years.

The difference between depreciation noted above and depreci-

ation allowable for tax purposes is reported by the parent company

and in the individual Group companies as accumulated extra depreci-

ation, which is included in untaxed reserves. Consolidated reporting

of these items is described below under the heading Allocations,

deferred tax liability, untaxed reserves.

Goodwill is included in intangible assets and amortized on a

straight-line basis over 5 to 20 years. The goodwill items pertaining

to Volvo Construction Equipment, Champion Road Machinery, The

AGES Group and Prévost are being amortized over 20 years due to

the holdings’ long-term and strategic importance.

Inventories

Inventories are posted at the lower of cost, in accordance with the

first-in, first-out method (FIFO), or net realizable value. Adequate

provision has been made for obsolescence.

Marketable securities

Marketable securities are valued at the lower of cost or market value

in accordance with the portfolio method.

Research and developm ent expenses and warranty

expenses

Research and development expenses are charged to income as incurred.

Estimated costs for product warranties are charged to cost of sales

when the products are sold.

Nonrecurring item s

Nonrecurring items are reported separately in the income statement.

They pertain mainly to income and expenses attributable to major

changes in the composition of the Group. To show the results of the

Volvo Group’s continuing operations, “Operating income before non-

recurring items” is also reported. This deviates from Recommendation

RR4 of the Swedish Financial Accounting Standards Council, which

states that such an income/ loss term is not compatible with the pre-

mise upon which the Recommendation is based.

Application of estim ated values

In preparing the year-end financial statements in accordance with

generally accepted accounting principles, company management

makes certain estimates and assumptions which affect the value of

assets and liabilities as well as contingent liabilities at the closing

date. Reported amounts for income and expenses in the reporting

period are also affected. The actual result may differ from these

estimates.

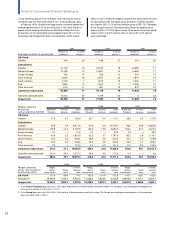

Allocations, deferred tax liability, untaxed reserves

Tax laws in Sweden and certain other countries allow companies to

defer payment of taxes through allocations to untaxed reserves.

The individual Group companies (including AB Volvo) report untax-

ed reserves as a separate balance sheet item. In the income state-

ments, allocations to and withdrawals from untaxed reserves are

reported under the heading Allocations. The reported tax expense is

based on income after allocations.

In the consolidated balance sheet, untaxed reserves are divided

into deferred tax liability in untaxed reserves, which is reported as

deferred taxes among Provisions, and Equity in untaxed reserves,

which is included in Restricted equity. The deferred tax liability in

untaxed reserves is calculated based on the anticipated tax rate for the

immediately following year in each country. Calculation of the amount

of tax liability takes into account that a portion of the untaxed reserves

may be withdrawn without tax consequences by utilizing tax-loss

carryforwards. Deferred tax receivables resulting from future tax-loss

carryforwards exceeding deferred tax liability are not reported.

No allocations to untaxed reserves are reported in the consolidated

statements of income. Group tax expense is calculated as the sum of

reported tax expense for each Group company, adjusted for the

effects of allocations to, and withdrawals from, untaxed reserves. This

adjustment corresponds to the annual change in the item deferred tax

liability in untaxed reserves included in Deferred taxes in the consoli-

dated balance sheet. Group tax expense is also affected by the

Group’s share of tax expenses in associated companies and by con-

solidated adjustments, primarily the elimination of internal profits. The

Group’s reported tax expense thereby becomes attributable mainly to

reported income after financial items.

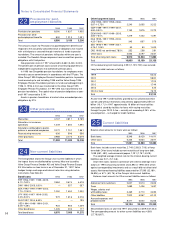

Exchange rates Average rate Year-end rate

Country Currency 1995 1996 1997 1995 1996 1997

Belgium BEF 0.242 0.217 0.214 0.226 0.215 0.213

Denmark DKK 1.274 1.158 1.158 1.200 1.156 1.155

Finland FIM 1.636 1.463 1.476 1.529 1.482 1.453

France FRF 1.430 1.312 1.310 1.360 1.312 1.314

Italy ITL 0.00439 0.00436 0.0045 0.00421 0.00451 0.0045

Japan JPY 0.0765 0.0618 0.0631 0.0648 0.0593 0.0606

Netherlands NLG 4.447 3.982 3.921 4.150 3.941 3.903

Norway NOK 1.126 1.040 1.082 1.052 1.066 1.072

Great Britain GBP 11.281 10.486 12.496 10.330 11.605 13.123

Germany DEM 4.981 4.462 4.412 4.644 4.423 4.398

United States USD 7.140 6.712 7.629 6.672 6.872 7.870

Notes to Consolidated Financial Statements