Volvo 1997 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 1997 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

■■

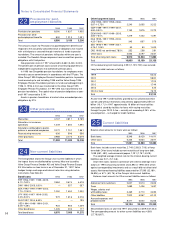

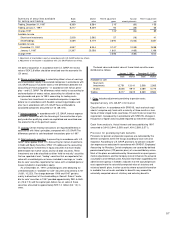

19 Marketable securities

Marketable securities consist mainly of holdings of interest-bearing

securities, distributed as shown below:

1995 1996 1997

Swedish Government 8,720 14,665 7,350

Swedish financial institutions 2,545 1,430 272

Commercial papers 316 165 —

Real estate financing institutions 1,382 1,526 1,051

Loans to associated companies 295 664 251

Shares 380 452 625

Other 2,179 2,675 1,413

Total 15,817 21,577 10,962

Marketable securities held in connection with interest arbitrage trans-

actions in 1995 amounting to 5,642 and 2,893 in 1996 were offset

against corresponding loans and as a result did not affect total assets.

■■

20 Cash and bank accounts

1995 1996 1997

Cash in banks 3,449 2,928 5,435

Time deposits in banks 4,040 2,156 4,206

Total 7,489 5,084 9,641

■■

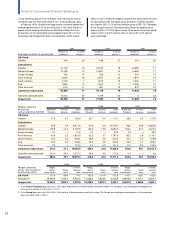

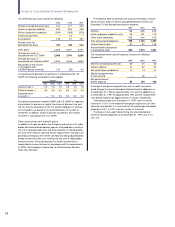

21 Shareholders’ equity

The share capital of the Parent Company is divided into two classes

of shares: A and B. Both classes carry the same rights, except that

each Series A share carries the right to one vote and each Series B

share carries the right to one tenth of a vote.

Number of shares and par value

A (no.) B (no.) Total (no.) Par

Dec. 31, 1996 142,151,130 321,407,122 463,558,252 2,318

Redemption (3,546,185) (19,050,682) (22,596,867) (113)

New issue — + 559,500 + 559,500 + 3

Bonus issue — — — + 4411

Dec. 31, 1997 138,604,945 302,915,940 441,520,885 2,649

1 Par value per share rose from SEK 5 to SEK 6.

In accordance with the Swedish Companies Act, distribution of divi-

dends is limited to the lesser of the unrestricted equity shown in the

consolidated or Parent Company balance sheets after proposed

appropriations to restricted equity. Unrestricted equity in the Parent

Company at December 31, 1997 amounted to 28,160.

As of December 31, 1997 foundations connected to Volvo and

the Volvo employee pension foundation’s holdings in Volvo were

0.66% and 0.05% of the share capital and 1.44% and 0.10% of the

voting rights, respectively.

As shown in the consolidated balance sheet as of December 31,

1997, unrestricted equity amounted to 41,309 (40,652; 34,618). It is

estimated that 44 of this amount will be allocated to restricted reserves.

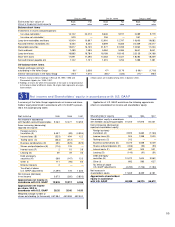

Share Restricted Unrestricted Total

Change in shareholders’ equity capital reserves equity equity

Balance, December 31 1994 2,220 14,545 26,567 43,332

Cash dividend — — (1,512) (1,512)

Net income — — 9,262 9,262

Conversion of debenture loans 98 1,510 — 1,608

Effect of equity method of accounting1— 818 (818) —

Transfer between unrestricted and restricted equity — (1,766) 1,766 —

Translation differences — (849) (995) (1,844)

Exchange differences on loans and futures contracts2— — 366 366

Other changes — 6 (18) (12)

Balance, December 31, 1995 2,318 14,264 34,618 51,200

Cash dividend — — (1,854) (1,854)

Distribution of shareholding in Swedish Match — — (4,117) (4,117)

Net income — — 12,477 12,477

Effect of equity method of accounting1— 373 (373) —

Transfer between unrestricted and restricted equity — 439 (439) —

Translation differences — (222) 87 (135)

Exchange differences on loans and futures contracts 2— — 40 40

Other changes — 52 213 265

Balance December 31, 1996 2,318 14,906 40,652 57,876

Cash dividend — — (1,993) (1,993)

Redemption of shares (113) — (5,694) (5,807)

Bonus issue of shares 441 (113) (328) —

Net income — — 10,359 10,359

New issue of shares 3 113 — 116

Effect of equity method of accounting 1— (34) 34 —

Transfer between unrestricted and restricted equity — 92 (92) —

Translation differences — 1,396 (528) 868

Exchange differences on loans and futures contracts2— — (665) (665)

Accumulated translation difference on the Renault holding 3— — (552) (552)

Other changes — 113 116 229

Balance, December 31, 1997 2,649 16,473 41,309 60,431

1 Mainly associated

companies’ contri-

butions to net

Group income,

reduced by divi-

dends received.

2 Hedge net assets

in foreign subsidi-

aries and associ-

ated companies.

3 Difference per-

tains to Renault

shares sold and, in

connection with

the sale, has

affected consoli-

dated capital

gains.