Volvo 1997 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 1997 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

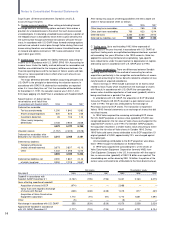

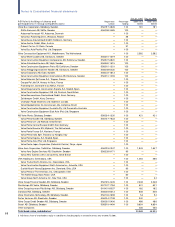

Shareholder contributions that increased book values were made

to Volvo Technology Transfer AB,74, Celero Support AB, 24, and

Volvo Aero Corporation, 196. The holding in Volvo Technology

Transfer AB was written down by 8 at year-end.

1996: All of the shares of Swedish Match AB were acquired from

AB Fortos for 8,000, following which the shares were distributed to

AB Volvo’s shareholders. Volvo Car Corporation was sold for 6,546 to

AB Fortos, whose name was then changed to Volvo Personvagnar

Holding AB. Sotrof AB, whose holdings include the remaining shares

of Pharmacia & Upjohn Inc., was acquired within the Group for 9,854.

AB Volvo purchased 80% of the shares of Volvo Construction

Equipment North America Inc. from Volvo Construction Equipment NV

for 1,054, following which the holding was conveyed to VNA Holding

Inc., a newly formed holding company for part of the operations in

North America, as a shareholder contribution. A share reserve of 500

was transferred from the holding in Volvo Truck Corporation to VNA

Holding Inc. The book value of VNA Holding amounted thereafter to

556.

The value of the holding of shares in Volvo Truck Corporation

acquired from Renault SA in 1994 declined by 67 in connection with

payment of the remaining portion of the purchase price. Volvo Bus

Corporation was purchased from Volvo Truck Corporation for 154.

The holding was written down by 35 at year-end.

Shareholder contributions that increased book values were made

to Volvo Aero Corporation, 295; Volvo Bus Corporation, 63; and

Rossareds Fastighets AB, 2.

1995: The outstanding 50% of the shares of Volvo Construction

Equipment Corporation were acquired for 4,081, following which the

holding was written down by 1,817. Volvo’s original holding, 318, was

transferred from shares in non-Group companies.

Shareholder contributions totaling 6,924 included contributions to

Volvo Car Corporation, 5,000 and AB Fortos (now Volvo Personvagnar

Holding AB), 1,720. Shares were acquired within the Group for 142.

Holdings in subsidiaries were written down in a total amount of 222.

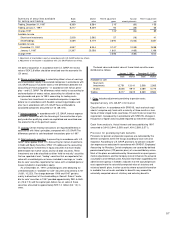

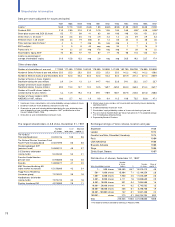

Shares in non-Group com panies

Call options had been written for shares of Bilia AB with book values of

– (3; 3) at a total exercise price of – (5; 5). Bilia AB shares with a book

value of 3 were sold in connection with exercise of call options. Shares

of Renault SA carried on the books at 6,080 were sold.Participations

in the newly formed partnership, Blue Chip Jet HB, were subscribed

for 138 (of which 58 by an aircraft) and written down by 7.

The holding in Euroventures BV was reduced by 4 in connection

with the reduction of the company’s share capital. The following hol-

dings (amounts in brackets) were sold to Volvo Technology Transfer

AB: Euroventures BV [13], Euroventures Nordica I BV [6],

Euroventures Nordica II BV [5], and Innovationskapital AB [8].

Shares of Ultralux AB were purchased for 2. Participations in two

tenant-owners associations were acquired for 12.

1996: The shares of Protorp Förvaltnings AB were written down

by 247 in connection with the repayment of share capital, and by 2 in

connection with the receipt of dividends. A shareholder contribution

of 1 was made to Dansk Mobiltelefon AB, following which all of the

company’s shares, with a book value of 42, were sold. AB Volvo sub-

scribed for shares issued by Euroventures Nordica II BV, 2, and the

holding in Euroventures BV was reduced by 4 in connection with the

reduction of the company’s share capital. A shareholder contribution

of 5 was made to Näringslivskredit NLK AB, following which the

holding was written down in the same amount.

1995: The shares of Danabäck AB with a book value of 618 were

sold to Danafjord AB in connection with Danafjord’s acquisition of

the remaining shares outstanding.

The holding in Volvo Construction Equipment Corporation was

transferred to “Shares and Participation in Group Companies.” Shares

of Innovationskapital were acquired for 8. Shareholder contributions

were made to Dansk Mobiltelefon, 16, and to Näringlivskredit NLK

AB, 5, following which the holding in NLK was written down by 5.

AB Volvo subscribed for new shares issued by Euroventures Nordica

II BV, 2, and the holding in Euroventures BV was reduced by 4 in

connection with the reduction in the company’s share capital.

■■

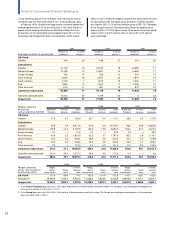

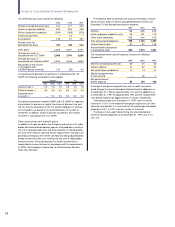

13 Other short-term receivables

1995 1996 1997

Tax receivables 9 8 13

Accounts receivable 9 15 14

Prepaid expenses

and accrued income 100 23 27

Other receivables 4 18 3

Total 122 64 57

The reserve for doubtful receivables amounted to – (—; 0) at the end of

the year.

■■■■■■

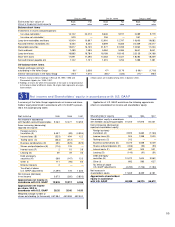

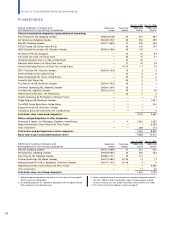

14 Shareholders’ equity

Restricted equity Unrestricted Total share-

Share capital Premium fund Legal reserve equity holders’ equity

December 31, 1994 2,220 — 5,731 25,418 33,369

Cash dividend — — — (1,512) (1,512)

Conversion of debenture loans 98 — 1,510 — 1,608

Net income 1995 3,176 3,176

December 31, 1995 2,318 — 7,241 27,082 36,641

Cash dividend — — — (1,854) (1,854)

Distribution of shareholding in Swedish Match — — — (8,000) (8,000)

Net income 1996 — — — 898 898

December 31, 1996 2,318 — 7,241 18,126 27,685

Cash dividend — — — (1,993) (1,993)

New issue of shares 3 113 — — 116

Redemption of AB Volvo shares (113) — — (5,694) (5,807)

Bonus issue of shares 441 (113) — (328) —

Net income 1997 — — — 18,049 18,049

December 31, 1997 2,649 — 7,241 28,160 38,050

The distribution of share capital by class of shares is shown in Note 21 to the consolidated financial statements, on page 49.

AB Volvo

62