U-Haul 2006 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2006 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Environmental

In the normal course of business, AMERCO is a defendant in a number of suits and claims. AMERCO is

also a party to several administrative proceedings arising from state and local provisions that regulate the removal

and/or cleanup of underground fuel storage tanks. It is the opinion of management, that none of these suits, claims or

proceedings involving AMERCO, individually or in the aggregate, are expected to result in a material loss.

Compliance with environmental requirements of federal, state and local governments significantly affects Real

Estate’ s business operations. Among other things, these requirements regulate the discharge of materials into the

water, air and land and govern the use and disposal of hazardous substances. Real Estate is aware of issues regarding

hazardous substances on some of its properties. Real Estate regularly makes capital and operating expenditures to

stay in compliance with environmental laws and has put in place a remedial plan at each site where it believes such a

plan is necessary. Since 1988, Real Estate has managed a testing and removal program for underground storage

tanks.

Based upon the information currently available to Real Estate, compliance with the environmental laws and its

share of the costs of investigation and cleanup of known hazardous waste sites are not expected to have a material

adverse effect on AMERCO’ s financial position or operating results. Real Estate expects to spend approximately

$7.6 million through 2011 to remediate these properties.

Other

The Company is named as a defendant in various other litigation and claims arising out of the normal course of

business. In managements’ opinion none of these other matters will have a material effect on the Company’ s

financial position and results of operations.

Item 4.

Submission of Matters to a Vote of Security Holders

No matter was submitted to a vote of the security holders of AMERCO or U-Haul during the fourth quarter of the

fiscal year covered by this report, through the solicitation of proxies or otherwise.

PART II

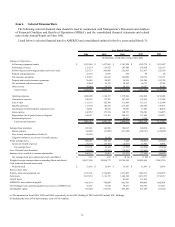

Item 5.

Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of

Equity Securities

As of April 30, 2006 there were approximately 3,200 holders of record of the common stock. AMERCO’ s

common stock is listed on NASDAQ (its principal market) under the trading symbol “UHAL”. The number of

shareholders’ is derived using internal stock ledgers and utilizing Mellon Investor Services Stockholder listings.

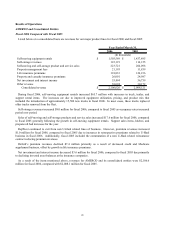

The following table sets forth the high and the low sales price of the common stock of AMERCO for the periods

indicated:

Year Ended March 31,

2006 2005

High Low High Low

First quarter $ 56.10 $ 42.75 $ 29.50 $ 19.76

Second quarter $63.61 $52.80 $38.03 $ 21.00

Third quarter $ 73.68 $ 54.60 $ 46.54 $ 36.89

Fourth quarter $101.24 $65.45 $48.23 $ 41.50

The common stock of U-Haul is wholly-owned by AMERCO. As a result, no active trading market exists for the

purchase and sale of such common stock.

14