U-Haul 2006 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2006 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

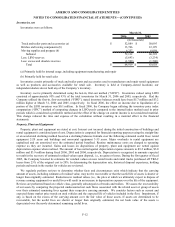

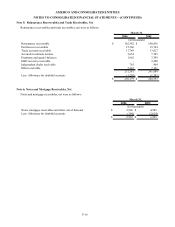

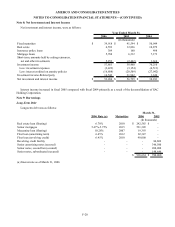

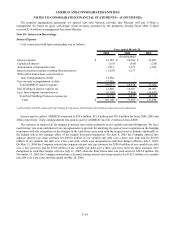

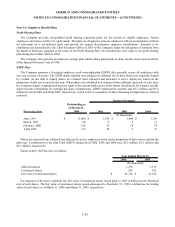

Note 8: Net Investment and Interest Income

Net investment and interest income, were as follows:

2006 2005 2004

Fixed maturities $ 39,918 $ 41,594 $ 50,044

Real estate 6,593 12,836 10,879

Insurance policy loans 309 160 498

Mortgage loans 5,788 6,312 7,173

Short-term, amounts held by ceding reinsurers,

net and other investments 5,253 (2,442) 1,616

Investment income 57,861 58,460 70,210

Less: investment expenses (2,422) (3,154) (6,511)

Less: interest credited on annuity policies (16,888) (20,509) (27,042)

Investment income-Related party 14,543 21,942 1,624

Net investment and interest income $ 53,094 $ 56,739 $ 38,281

Year Ended March 31,

(In thousands)

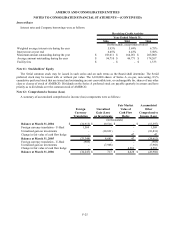

Interest income increased in fiscal 2005 compared with fiscal 2004 primarily as a result of the deconsolidation of SAC

Holding Corporation.

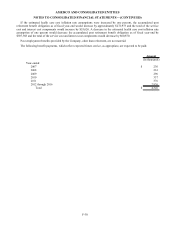

Note 9: Borrowings

Long-Term Debt

Long-term debt was as follows:

2006 Rate (a) Maturities 2006 2005

Real estate loan (floating) 6.70% 2010 $ 242,585 $-

Senior mortgages 5.47%-5.75% 2015 531,309 -

Mezzanine loan (floating) 10.28% 2007 19,393 -

Fleet loan (amortizing term) 6.45% 2012 82,347 -

Fleet loan (revolving credit) 6.45% 2010 90,000 -

Revolving credit facility - - - 84,862

Senior amortizing notes (secured) - - - 346,500

Senior notes, second lien (secured) - - - 200,000

Senior notes, subordinated (secured) - - - 148,646

$ 965,634 $ 780,008

(a) Interest rate as of March 31, 2006

March 31,

(In thousands)

F-20