U-Haul 2006 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2006 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

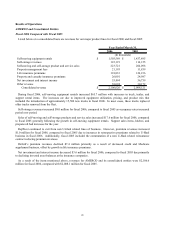

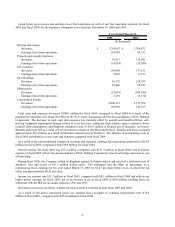

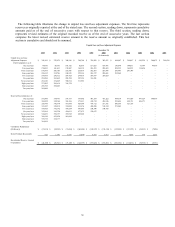

Listed below are revenues and earnings (loss) from operations at each of our four operating segments for fiscal

2005 and fiscal 2004; for the insurance companies years ended are December 31, 2004 and 2003:

2005 2004

Moving and storage

Revenues $ 1,791,667 $ 1,768,872

Earnings (loss) from operations 165,985 93,593

Property and casualty insurance

Revenues 41,417 114,941

Earnings (loss) from operations (14,814) (35,950)

Life insurance

Revenues 159,484 177,812

Earnings (loss) from operations 2,065 11,253

SAC Holdings

Revenues 43,172 218,955

Earnings (loss) from operations 10,466 64,693

Eliminations

Revenues (27,619) (104,586)

Earnings (loss) from operations 3,294 (6,674)

Consolidated Results

Revenues 2,008,121 2,175,994

Earnings (loss) from operations 166,996 126,915

Year Ended March 31,

(In thousands)

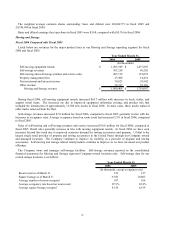

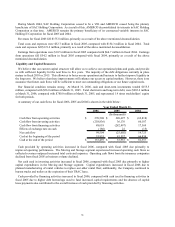

Total costs and expenses decreased $208.0 million for fiscal 2005, compared to fiscal 2004 as a result of the

productivity initiatives of U-Haul, the effect of the W.P. Carey Transaction and the deconsolidation of SAC Holding

Corporation. The decrease in total costs and expenses was partially offset by payroll and benefit inflation, self-

moving equipment impairment charges related to lease buy-outs, additional depreciation expense related to lower

residual value assumptions, and litigation settlement costs of $10.6 million at Oxford, net of insurance recoveries.

Benefits and losses fell as a result of lower premium revenues at RepWest and Oxford. Benefits and losses included

approximately $8.5 million as a result of hurricane related losses at RepWest. The absence of restructuring costs in

fiscal 2005 contributed to lower costs and expenses compared with fiscal 2004.

As a result of the aforementioned changes in revenues and expenses, earnings from operations improved to $167.0

million for fiscal 2005, compared with $126.9 million for fiscal 2004.

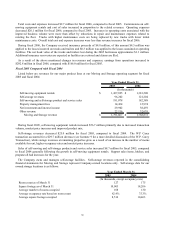

Interest expense for fiscal 2005 was $73.2 million, compared with $121.7 million in fiscal 2004. Lower interest

expense in fiscal 2005 reflects the deconsolidation of SAC Holding Corporation, lower borrowings and a lower cost

of borrowing.

During fiscal 2005, the Company settled its litigation against its former auditor and received a settlement (net of

attorneys’ fees and costs) of $51.3 million before taxes. The settlement had the effect of increasing, on a

nonrecurring basis, earnings for the year ended March 31, 2005 by $2.47 per share before taxes, in which the tax

effect was approximately $0.91 per share.

Income tax expense was $55.7 million in fiscal 2005, compared with $8.1 million in fiscal 2004 and reflects our

higher pretax earnings for fiscal 2005, net of an increase in tax in fiscal 2004 of $4.8 million resulting from our

settlement with the IRS for tax audits related to 1996 and 1997.

Dividends accrued on our Series A preferred stock were $13.0 million in both fiscal 2005 and 2004.

As a result of the above mentioned items, net earnings (loss) available to common shareholders were $76.5

million in fiscal 2005, compared with ($15.8) million in fiscal 2004.

28