U-Haul 2006 Annual Report Download - page 109

Download and view the complete annual report

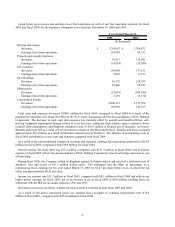

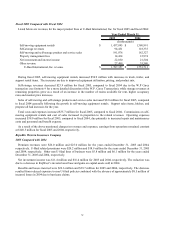

Please find page 109 of the 2006 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Interest expense for fiscal 2006 was $105.1 million, compared with $73.2 million in fiscal 2005. Fiscal 2006

results included a one-time, non-recurring charge of $35.6 million before taxes which includes fees for early

extinguishment of debt of $21.2 million and the write-off of $14.4 million of debt issuance costs. The expense

related to the increase in average borrowings was partially offset by a reduction in the average borrowing rate

resulting from the refinancing activities in fiscal 2006. The refinancing costs had the effect of decreasing, on a

nonrecurring basis, earnings for the year ended March 31, 2006 by $1.71 per share before taxes, in which the tax

effect was approximately $0.63 per share.

During the third quarter of fiscal 2005, the Company settled our litigation against our former auditor and received

a settlement (net of attorneys’ fees and costs) of $51.3 million before taxes. The settlement had the effect of

increasing, on a nonrecurring basis, earnings for the year ended March 31, 2005 by $2.47 per share before taxes, in

which the tax effect was approximately $0.91 per share.

Income tax expense was $79.1 million in fiscal 2006, compared with $55.7 million in fiscal 2005.

Dividends accrued on our Series A preferred stock were $13.0 million in both fiscal 2006 and 2005, respectively.

As a result of the above mentioned items, net earnings available to common shareholders were $108.2 million in

fiscal 2006, compared with $76.5 million in fiscal 2005.

The weighted average common shares outstanding: basic and diluted were 20,857,108 in fiscal 2006 and

20,804,773 in fiscal 2005.

Basic and diluted earnings per share in fiscal 2006 were $5.19, compared with $3.68 in fiscal 2005.

26