U-Haul 2006 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2006 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

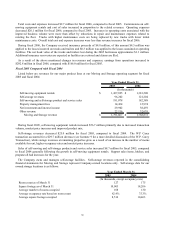

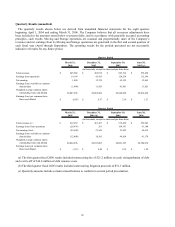

Amortization of deferred acquisition costs (DAC) and the value of business acquired (VOBA) was $23.8 million

and $25.0 million for 2004 and 2003, respectively. Annuity amortization increased $0.8 million from 2003 primarily

due to increased surrender activity. Other segments, primarily credit, had decreases of $2.0 million from 2003 due to

decreased new business volume.

Operating expenses were $42.2 million and $38.1 million for 2004 and 2003, respectively. The $10.6 million

accrual related to the Kocher settlement, net of insurance recoveries, accounted for the majority of the variance.

Non-deferrable commissions have decreased $5.5 million from 2003 primarily due to decreased sales of Medicare

supplement and life products.

Earnings from operations were $2.1 million and $11.3 million for 2004 and 2003, respectively. The decrease in

2004 from 2003 is due primarily to the $10.6 million accrual for the Kocher settlement offset by improved

investment income, and positive loss experience in the Medicare supplement and credit insurance segments.

SAC Holding II

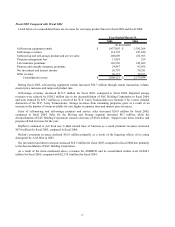

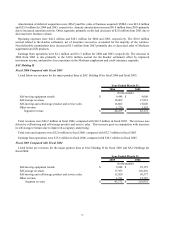

Fiscal 2006 Compared with Fiscal 2005

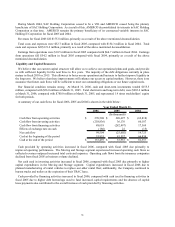

Listed below are revenues for the major product lines at SAC Holding II for fiscal 2006 and fiscal 2005:

2006 2005

Self-moving equipment rentals $ 9,498 $ 9,008

Self-storage revenues 18,869 17,953

Self-moving and self-storage product and service sales 16,602 15,020

Other revenue 1,270 1,191

Segment revenue $ 46,239 $ 43,172

(In thousands)

Year Ended March 31,

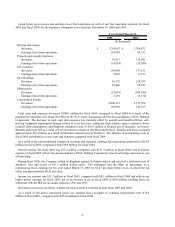

Total revenues were $46.2 million in fiscal 2006, compared with $43.2 million in fiscal 2005. The increase was

driven by self-moving and self-storage product and service sales. This increase grew in conjunction with increases

in self-storage revenues due to improved occupancy and pricing.

Total costs and expenses were $32.6 million in fiscal 2006, compared with $32.7 million in fiscal 2005.

Earnings from operations were $13.6 million in fiscal 2006, compared with $10.5 million in fiscal 2005.

Fiscal 2005 Compared with Fiscal 2004

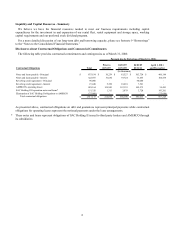

Listed below are revenues for the major product lines at SAC Holding II for fiscal 2005 and SAC Holdings for

fiscal 2004:

2005 2004

Self-moving equipment rentals $ 9,008 $ 29,155

Self-storage revenues 17,953 126,436

Self-moving and self-storage product and service sales 15,020 50,577

Other revenue 1,191 12,787

Segment revenue $ 43,172 $ 218,955

Year Ended March 31,

(In thousands)

37