U-Haul 2006 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2006 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

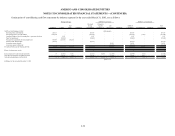

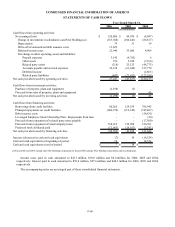

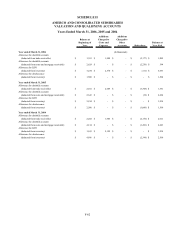

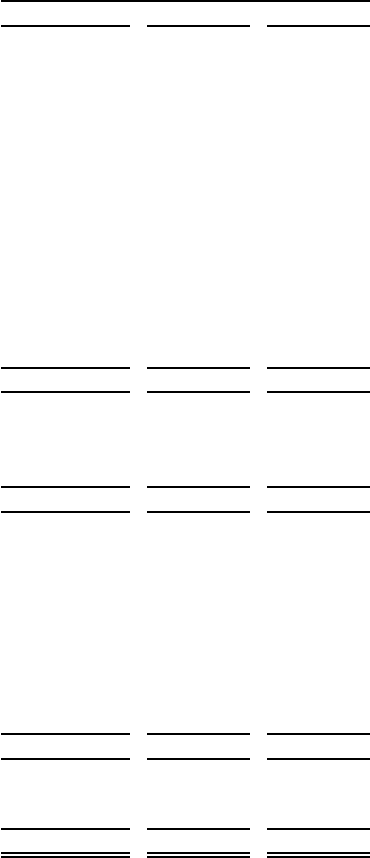

CONDENSED FINANCIAL INFORMATION OF AMERCO

STATEMENTS OF CASH FLOWS

2006 2005 2004

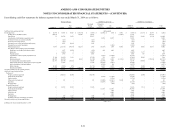

Cash flows from operating activities:

Net earnings (loss) $ 120,806 $ 89,076 $ (4,047)

Change in investments in subsidiaries and SAC Holdings (a) (163,388) (106,441) (86,817)

Depreciation 79 31 39

Write-off of unamortized debt issuance costs 13,629 - -

Deferred income taxes 22,940 33,060 4,909

Net change in other operating assets and liabilities:

Prepaid expenses 3,142 (4,782) 6

Other assets 576 5,388 (7,166)

Related party assets (218) 23,123 (48,775)

Accounts payable and accrued expenses 30,128 (61,640) 127,770

Deferred income - - (2,863)

Related party liabilities (447) (21,652) (123,269)

Net cash provided (used) by operating activities 27,247 (43,837) (140,213)

Cash flows from investment activities:

Purchase of property, plant and equipment (2,298) (3) -

Proceeds from sales of property, plant and equipment - - 45

Net cash provided (used) by investing activities (2,298) (3) 45

Cash flows from financing activities:

Borrowings from credit facilities 80,266 129,355 785,942

Principal repayments on credit facilities (860,274) (212,242) (745,407)

Debt issuance costs - - (24,831)

Leveraged Employee Stock Ownership Plan - Repayments from loan - - (20)

Proceeds from (repayment of) related party notes payable - - (17,500)

Proceeds from (repayment of) intercompany loans 768,015 155,908 126,701

Preferred stock dividends paid (12,963) (29,167) (3,241)

Net cash provided (used) by financing activities (24,956) 43,854 121,644

Increase (decrease) in cash and cash equivalents (7) 14 (18,524)

Cash and cash equivalents at beginning of period 14 - 18,524

Cash and cash equivalents at end of period

$

7 $ 14 $ -

(a) Fiscal 2006 and 2005 contain only SAC Holding Corporation II, fiscal 2004 includes SAC Holding Corporation and its subsidiaries

Year Ended March 31,

(In thousands)

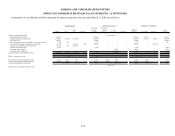

Income taxes paid in cash amounted to $43.3 million, $30.0 million and $4.0 million for 2006, 2005 and 2004,

respectively. Interest paid in cash amounted to $59.8 million, $57.6 million and $40.3 million for 2006, 2005 and 2004,

respectively.

The accompanying notes are an integral part of these consolidated financial statements.

F-60