U-Haul 2006 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2006 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

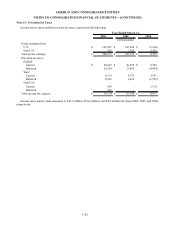

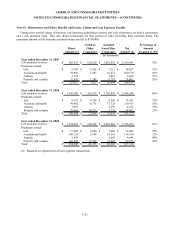

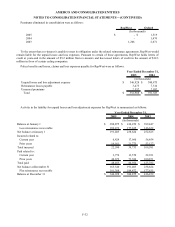

Note 15: Reinsurance and Policy Benefits and Losses, Claims and Loss Expenses Payable

During their normal course of business, our insurance subsidiaries assume and cede reinsurance on both a coinsurance

and a risk premium basis. They also obtain reinsurance for that portion of risks exceeding their retention limits. The

maximum amount of life insurance retained on any one life is $150,000.

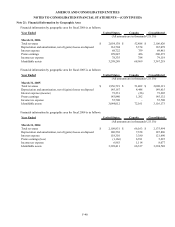

Direct

Amount (a)

Ceded to

Other

Companies

Assumed

from Other

Companies

Net

Amount (a)

Percentage of

Amount

Assumed to Net

Year ended December 31, 2005

Lif

e

i

nsurance

i

n

f

orce $ 586,835 $ 120,220 $ 1,642,876 $ 2,109,491 78%

Premiums earned:

Life $ 8,708 $ 1,862 $ 7,211 $ 14,057 51%

Accident and health 91,986 1,887 10,071 100,170 10%

Annuity 2,174 - 2,432 4,606 53%

Property and casualty 22,559 3,288 6,730 26,001 26%

Total $ 125,427 $ 7,037 $ 26,444 $ 144,834

Year ended December 31, 2004

Life insurance in force $ 1,147,380 $ 336,575 $ 1,785,441 $ 2,596,246 69%

Premiums earned:

Life $ 9,372 $ 6,106 $ 8,365 $ 11,631 72%

Accident and health 99,402 6,715 17,726 110,413 16%

Annuity 1,901 - 2,291 4,192 55%

Property and casualty 29,965 10,235 5,257 24,987 21%

Total $ 140,640 $ 23,056 $ 33,639 $ 151,223

Year ended December 31, 2003

Lif

e

i

nsurance

i

n

f

orce $ 1,134,051 $ 218,682 $ 1,842,666 $ 2,758,035 67%

Premiums earned:

Life $ 17,300 $ 2,840 $ 7,626 $ 22,086 35%

Accident and health 109,135 5,346 14,561 118,350 12%

Annuity 1,954 - 2,692 4,646 58%

Property and casualty 106,599 32,969 18,406 92,036 20%

Total $ 234,988 $ 41,155 $ 43,285 $ 237,118

(In thousands)

(a) Balances are reported net of inter-segment transactions.

F-31