U-Haul 2006 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2006 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

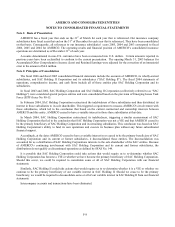

Derivative Financial Instruments

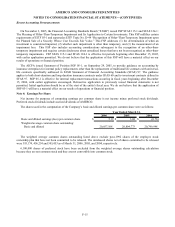

The Company’ s primary objective for holding derivative financial instruments is to manage interest rate risk. The

Company’ s derivative instruments are recorded at fair value under SFAS No. 133 and are included in prepaid expenses.

The Company uses derivative financial instruments to reduce its exposure to interest rate volatility. The exposure to

market risk for changes in interest rates relates primarily to our variable rate debt obligations. We have used interest rate

swap and interest rate cap agreements to provide for matching the gain or loss recognition on the hedging instrument with

the recognition of the changes in the cash flows associated with the hedged asset or liability attributable to the hedge risk or

the earnings effect of the hedged forecasted transaction. On June 8, 2005 the Company entered into separate interest rate

swap contracts for $100.0 million of our variable rate debt over a three year term and for $100.0 million of our variable rate

debt over a five year term, which were designated as cash flow hedges effective July 1, 2005. On May 13, 2004 the

Company entered into separate interest rate cap contracts for $200.0 million of our variable rate debt over a two year term

and for $50.0 million of our variable rate debt over a three year term, however these contracts were designated as cash flow

hedges effective July 11, 2005 when the debt was paid down by $222.4 million. On November 15, 2005 the Company

entered into a forward starting interest rate swap contract for $142.3 million of a variable rate debt over a six year term, that

started on May 10, 2006, in conjunction with the expiration of the $200.0 million interest rate cap.

The hedging relationship of the cap agreements is considered to be perfectly effective for the portion of the instrument

hedging debt. Therefore all changes in the interest rate caps fair value (including changes in the option’ s time value),

except for changes in the interest rate caps fair value associated with un-hedged amounts, are charged to accumulated other

comprehensive income. The change in each caplets’ respective allocated fair value amount is reclassified out of

accumulated other comprehensive income into earnings when each of the hedged forecasted transactions (the quarterly

interest payments) impact earnings and when interest payments are either made or received. For the year ended March 31,

2006 the Company recorded $0.6 million to interest expense related to these cap agreements which is offset by $1.5 million

of interest income representing the portion of the caps in excess of the balance of related debt that impacted earnings during

the period.

The hedging relationship of the interest rate swap agreements is not considered to be perfectly effective. Therefore, for

each reporting period an effectiveness test is performed. For the portion of the change in the interest rate swaps fair value

deemed effective, this is charged to accumulated other comprehensive income. The remaining ineffective portion is

charged to interest expense for the period. The change in each of the swaps fair value amounts are reclassified out of

accumulated other comprehensive income into earnings each quarter when interest payments are made or received. For the

year ended March 31, 2006 the Company recorded $1.0 million to interest income related to these swap agreements of

which $1.1 million of interest income represented the ineffective component of the swap that impacted earnings during the

period.

F-11