U-Haul 2006 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2006 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

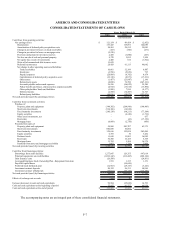

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

Note 7: Investments

Held-to Maturity Investments

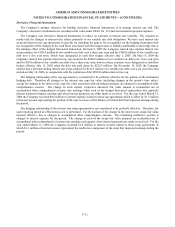

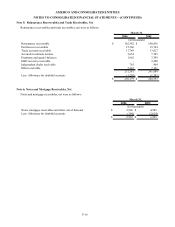

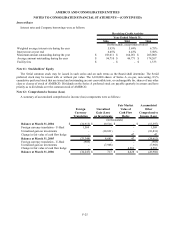

Held-to maturity investments at December 31, 2005 were as follows:

Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Estimated

Market

Value

U.S. treasury securities and government obligations $ 613 $ 107 $ - $ 720

Mortgage-backed securities 409 6 - 415

$1,022 $ 113 $ - $ 1,135

(In thousands)

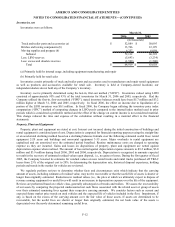

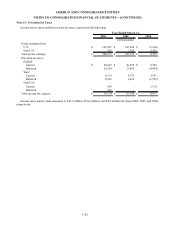

Held-to maturity investments at December 31, 2004 were as follows:

Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Estimated

Market

Value

U.S. treasury securities and government obligations $ 566 $ 133 $ - $ 699

Mortgage-backed securities 864 23 (2) 885

$1,430 $ 156 $ (2) $ 1,584

(In thousands)

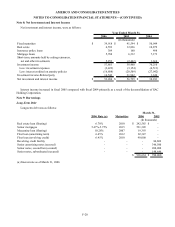

The adjusted cost and estimated market value of held-to maturity investments in debt securities at December 31, 2005

and December 31, 2004, by contractual maturity, were as follows:

Amortized

Cost

Estimated

Market

Value

Amortized

Cost

Estimated

Market

Value

Due in one year or less $ 169 $ 172 $ - $ -

Due after one year through five years 203 228 260 287

Due after five years through ten years 167 210 220 285

After ten years 74 110 86 127

613 720 566 699

Mortgage backed securities 409 415 864 885

$1,022 $ 1,135 $ 1,430 $ 1,584

December 31, 2005 December 31, 2004

(In thousands)

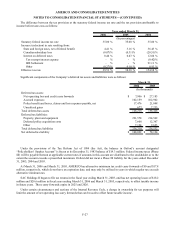

Expected maturities may differ from contractual maturities as borrowers may have the right to call or prepay obligations

with or without call or prepayment penalties.

The Company deposits bonds with insurance regulatory authorities to meet statutory requirements. The adjusted cost of

bonds on deposit with insurance regulatory authorities was $13.0 million at December 31, 2005 and $12.9 million at

December 31, 2004.

F-17