U-Haul 2006 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2006 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

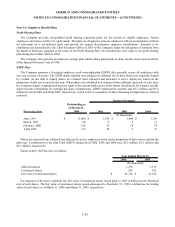

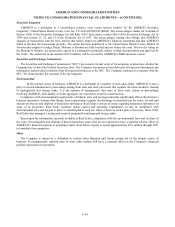

Note 16: Contingent Liabilities and Commitments

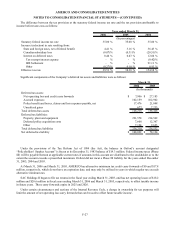

The Company leases a portion of its rental equipment and certain of its facilities under operating leases with terms that

expire at various dates substantially through 2034 with the exception of one land lease expiring in 2079. At March 31,

2006, AMERCO has guaranteed $193.1 million of residual values for these rental equipment assets at the end of the

respective lease terms. Certain leases contain renewal and fair market value purchase options as well as mileage and other

restrictions. At the expiration of the lease, the Company has options to renew the lease, purchase the asset for fair market

value, or sell the asset to a third party on behalf of the lessor. AMERCO has been leasing equipment since 1987 and has

experienced no material losses relating to these types of residual value guarantees.

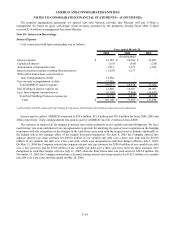

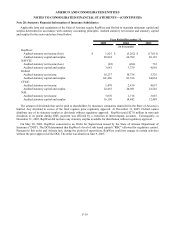

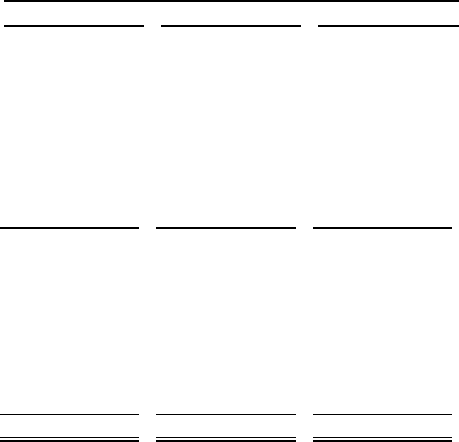

Lease expenses were as follows:

2006 2005 2004

Lease expense $ 142,781 $ 151,354 $ 160,727

Year Ended March 31,

(In thousands)

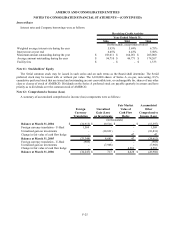

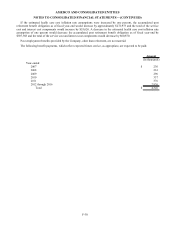

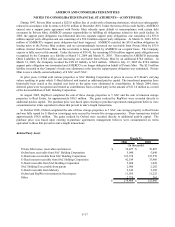

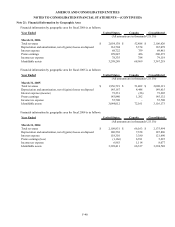

Lease commitments for leases having terms of more than one year were as follows:

Propert

y

,

Plant and

Equipment

Rental

Equipment Total

(In thousands)

Year-ended March 31:

2007 $ 11,726 $ 124,943 $ 136,669

2008 11,498 92,072 103,570

2009 11,260 75,081 86,341

2010 10,896 62,589 73,485

2011 10,679 39,986 50,665

Thereafter 36,618 34,493 71,111

Total $ 92,677 $ 429,164 $ 521,841

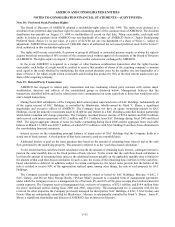

Note 17: Contingencies

Shoen

On September 24, 2002, Paul F. Shoen filed a derivative action in the Second Judicial District Court of the State of

Nevada, Washoe County, captioned Paul F. Shoen vs. SAC Holding Corporation et al., CV02-05602, seeking damages and

equitable relief on behalf of AMERCO from SAC Holdings and certain current and former members of the AMERCO

Board of Directors, including Edward J. Shoen, Mark V. Shoen and James P. Shoen as defendants. AMERCO is named a

nominal defendant for purposes of the derivative action. The complaint alleges breach of fiduciary duty, self-dealing,

usurpation of corporate opportunities, wrongful interference with prospective economic advantage and unjust enrichment

and seeks the unwinding of sales of self-storage properties by subsidiaries of AMERCO to SAC Holdings over the last

several years. The complaint seeks a declaration that such transfers are void as well as unspecified damages. On October

28, 2002, AMERCO, the Shoen directors, the non-Shoen directors and SAC Holdings filed Motions to Dismiss the

complaint. In addition, on October 28, 2002, Ron Belec filed a derivative action in the Second Judicial District Court of the

State of Nevada, Washoe County, captioned Ron Belec vs. William E. Carty, et al., CV 02-06331 and on January 16, 2003,

M.S. Management Company, Inc. filed a derivative action in the Second Judicial District Court of the State of Nevada,

Washoe County, captioned M.S. Management Company, Inc. vs. William E. Carty, et al., CV 03-00386. Two additional

derivative suits were also filed against these parties. These additional suits are substantially similar to the Paul F. Shoen

derivative action. The five suits assert virtually identical claims. In fact, three of the five plaintiffs are parties who are

working closely together and chose to file the same claims multiple times. These lawsuits alleged that the AMERCO Board

lacked independence. In reaching its decision to dismiss these claims, the court determined that the AMERCO Board of

Directors had the requisite level of independence required in order to have these claims resolved by the Board. The court

consolidated all five complaints before dismissing them on May 28, 2003. Plaintiffs appealed and, on September 12, 2005

the Nevada Supreme Court heard oral arguments. The parties are awaiting a ruling.

F-33