U-Haul 2006 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2006 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Oxford Life Insurance Company

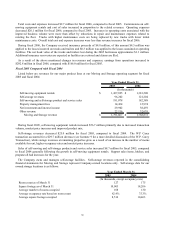

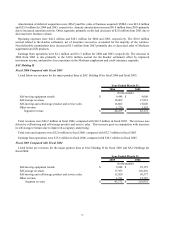

2005 Compared with 2004

Premium revenues were $120.4 million and $127.7 million for the years ended December 31, 2005 and 2004,

respectively. Medicare supplement premiums decreased by $5.7 million due to lapses on closed lines being greater

than new business written on active lines. Credit insurance premiums decreased $3.8 million. Oxford is no longer

writing credit insurance. Oxford expects the majority of the existing credit policies to earn out over the next three

years. Life premiums increased $1.6 million primarily due to increased sales from the final expense product.

Annuitizations increased $0.4 million, while other health premiums increased slightly. Other income decreased $2.5

million in the current year, compared to the prior year primarily due to decreased surrender charge income.

Net investment income was $22.0 million and $23.5 million for 2005 and 2004, respectively. The decrease was

primarily due to realized losses on the sale of investments in the current year. Investment yields were consistent

between the two years.

Benefits and losses incurred were $85.7 million and $91.5 million for 2005 and 2004, respectively. This decrease

was primarily a result of a $5.4 million decrease in Medicare supplement benefits due to reduced exposure and a

slightly improved loss ratio. All other lines combined for a $0.4 million decrease.

Amortization of deferred acquisition costs (DAC) and the value of business acquired (VOBA) was $21.4 million

and $23.8 million for 2005 and 2004, respectively. These costs are amortized for life and health policies as the

premium is earned over the term of the policy; and for deferred annuities in relation to interest spreads. Annuity

amortization decreased $1.9 million from 2004 primarily due to reduced surrender activity. Other segments

combined for a $0.5 million decrease primarily due to a decline in new business volume.

Operating expenses were $27.0 million and $42.2 million for 2005 and 2004, respectively. The decrease is

primarily due to a $10.6 million accrual in the prior year for the Kocher settlement as well as reduced legal and

overhead expenses in the current year. Included in operating expenses for the current year is $0.7 million of expense

related to the write-off of goodwill associated with a subsidiary engaged in selling credit insurance. Non-deferrable

commissions decreased $2.3 million due to decreased sales of Medicare supplement and credit products.

Earnings from operations were $13.9 million and $2.1 million for 2005 and 2004, respectively. The increase is

due primarily to the prior year accrual of $10.6 million related to the Kocher settlement as well as improved loss

ratios in the Medicare supplement and other health lines of business.

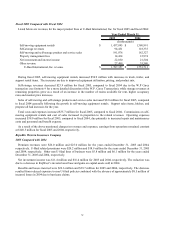

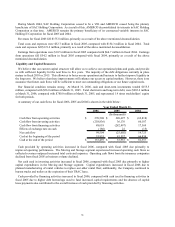

2004 Compared with 2003

Premiums revenues were $127.7 million, $147.8 million for the years ended December 31, 2004 and 2003,

respectively. Medicare supplement premiums decreased by $8.2 million from 2003 due to lapses on closed lines

being greater than new business written on active lines. Credit insurance premiums decreased $6.9 million from

2003 due to fewer accounts resulting from the rating downgrade by A.M. Best. Life, other health, and annuity

premiums decreased $5.0 million from 2003 primarily from reduced life insurance sales and fewer annuitizations.

Net investment income was $23.5 million and $19.0 million for 2004 and 2003, respectively.

Benefits and losses incurred were $91.5 million and $103.5 million for 2004 and 2003, respectively. Medicare

supplement benefits decreased $5.8 million from 2003 due primarily to reduced exposure. Credit insurance benefits

decreased $2.8 million from 2003 due to reduced exposure and improved disability experience. Life insurance

benefits decreased $3.6 million from 2003 as new business declined and existing exposure decreased. All other lines

had increases of $0.2 million from 2003.

36