U-Haul 2006 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2006 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

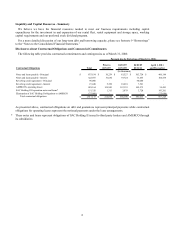

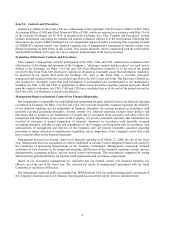

Liquidity and Capital Resources - Summary

We believe we have the financial resources needed to meet our business requirements including capital

expenditures for the investment in and expansion of our rental fleet, rental equipment and storage space, working

capital requirements and our preferred stock dividend program.

For a more detailed discussion of our long-term debt and borrowing capacity, please see footnote 9 “Borrowings”

to the “Notes to the Consolidated Financial Statements.”

Disclosures about Contractual Obligations and Commercial Commitments

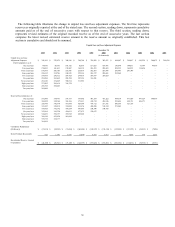

The following table provides contractual commitments and contingencies as of March 31, 2006:

Contractual Obligations Total

Prior to

03/31/07

04/01/07

03/31/09

04/01/09

03/31/11

April 1, 2011

and Thereafter

Notes and loans payable - Principal $ 875,634 $ 30,239 $ 81,527 $ 303,724 $ 460,144

Notes and loans payable - Interest 322,697 51,030 93,724 73,465 104,478

Revolving credit agreement - Principal 90,000 - - 90,000 -

Revolving credit agreement - Interest 23,448 5,309 10,618 7,521 -

AMERCO's operating leases 429,164 124,943 167,153 102,575 34,493

SAC Holding II Corporation notes and loans* 151,320 1,313 3,078 3,728 143,201

Elimination of SAC Holding II obligations to AMERCO (75,088) - - - (75,088)

Total contractual obligations $ 1,817,175 $ 212,834 $ 356,100 $ 581,013 $ 667,228

Payment due by Period (as of March 31, 2006)

(In thousands)

As presented above, contractual obligations on debt and guarantees represent principal payments while contractual

obligations for operating leases represent the notional payments under the lease arrangements.

* These notes and loans represent obligations of SAC Holding II issued to third party lenders and AMERCO through

its subsidiaries.

41