U-Haul 2006 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2006 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

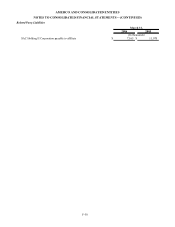

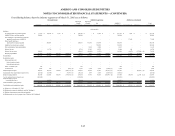

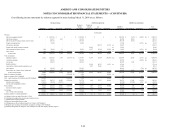

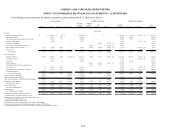

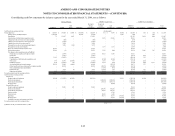

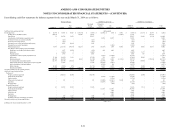

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

F-43

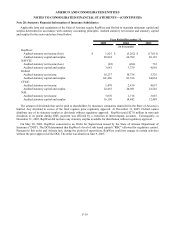

Consolidating balance sheets by industry segment as of March 31, 2006 are as follows:

AMERCO U-Haul Real Estate Eliminations

Moving &

Storage

Consolidated

Property &

Casualty

Insurance (a)

Life

Insurance (a) Eliminations

AMERCO

Consolidated SAC Holding II Eliminations

Total

Consolidated

Liabilities:

Accounts payable and accrued expenses 23,405$ 203,243$ 4,988$ -$ 231,636$ -$ 3,188$ -$ 234,824$ 1,054$ -$ 235,878$

AMERCO's notes and loans payable - 212,133 753,501 - 965,634 - - - 965,634 - - 965,634

SAC Holding II Corporation notes and loans

payable, non-recourse to AMERCO - - - - - - - - - 76,232 - 76,232

Policy benefits and losses,

claims and loss expenses payable - 295,567 - - 295,567 352,960 151,886 - 800,413 - - 800,413

Liabilities from investment contracts - - - - - - 449,149 - 449,149 - - 449,149

Other policyholders' funds and liabilities - - - - - 5,222 2,483 - 7,705 - - 7,705

Deferred income - 14,412 - - 14,412 6,136 - - 20,548 798 - 21,346

Deferred income taxes 181,355 - - - 181,355 (46,219) 2,907 - 138,043 (2,967) (26,984) (d) 108,092

Related party liabilities 201 1,134,939 26,994 (1,147,881) (c) 14,253 3,728 12,175 (30,156) (c) - 91,472 (84,307) (c) 7,165

Total liabilities 204,961 1,860,294 785,483 (1,147,881) 1,702,857 321,827 621,788 (30,156) 2,616,316 166,589 (111,291) 2,671,614

Stockholders' equity:

Series preferred stock:

Series A preferred stock - - - - - - - - - - - -

Series B preferred stock - - - - - - - - - - - -

Series A common stock 929 - - - 929 - - - 929 - - 929

Common stock 9,568 540 1 (541) (b) 9,568 3,300 2,500 (5,800) (b) 9,568 - - 9,568

Additional paid-in capital 413,726 121,230 147,481 (268,711) (b) 413,726 80,369 26,271 (106,640) (b) 413,726 - (46,071) (b) 367,655

Accumulated other comprehensive income (loss) (28,902) (29,996) - 29,996 (b) (28,902) 386 331 (717) (b) (28,902) - - (28,902)

Retained earnings (deficit) 765,277 (436,917) (329,318) 766,235 (b) 765,277 53,340 98,205 (151,545) (b) 765,277 (14,275) 22,782 (b,d) 773,784

Cost of common shares in treasury, net (418,092) - - - (418,092) - - - (418,092) - - (418,092)

Unearned employee stock

ownership plan shares - (9,338) - - (9,338) - - - (9,338) - - - (9,338)

Total stockholders' equity (deficit) 742,506 (354,481) (181,836) 526,979 733,168 137,395 127,307 (264,702) 733,168 (14,275) (23,289) 695,604

Total liabilities and stockholders' equity 947,467$ 1,505,813$ 603,647$ (620,902)$ 2,436,025$ 459,222$ 749,095$ (294,858)$ 3,349,484$ 152,314$ (134,580)$ 3,367,218$

(a) Balances as of December 31, 2005

(b) Eliminate investment in subsidiaries and SAC Holding II

(c) Eliminate intercompany receivables and payables

(d) Eliminate gain on sale of property from U-Haul to SAC Holding II

Moving & Storage AMERCO Legal Group AMERCO as Consolidated

(In thousands)