U-Haul 2006 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2006 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

During 1997, Private Mini secured a $225.0 million line of credit with a financing institution, which was subsequently

reduced in accordance with its terms to $125.0 million in December 2001. Under the terms of this credit facility, AMERCO

entered into a support party agreement with Private Mini whereby upon default or noncompliance with certain debt

covenants by Private Mini, AMERCO assumes responsibility in fulfilling all obligations related to this credit facility. In

2003, the support party obligation was bifurcated into two separate support party obligations; one consisting of a $55.0

million support party obligation and one consisting of a $70.0 million support party obligation. At March 31, 2003, $55.0

million of AMERCO’ s support party obligation had been triggered. AMERCO satisfied the $55.0 million obligation by

issuing notes to the Private Mini creditor, and we correspondingly increased our receivable from Private Mini by $55.0

million. Interest from Private Mini on this receivable is being recorded by AMERCO on a regular basis. The Company

expects to fully recover this amount. Under the terms of FIN 45, the remaining $70.0 million support party obligation was

recognized by the Company as a liability at March 31, 2004 and March 31, 2003. This resulted in AMERCO increasing

Other Liabilities by $70.0 million and increasing our receivable from Private Mini by an additional $70.0 million. At

March 31, 2005, the Company revalued the FIN 45 liability to $2.9 million. Effective July 15, 2005 the $70.0 million

support party obligation was terminated and AMERCO is no longer obligated on behalf of Private Mini. The $2.9 million

liability recorded in the Company’ s books was eliminated at the time the support party obligation was terminated. Private

Mini is now a wholly-owned subsidiary of 4 SAC and 5 SAC.

In prior years, U-Haul sold various properties to SAC Holding Corporation at prices in excess of U-Haul’ s carrying

values resulting in gains which U-Haul deferred and treated as additional paid-in capital. The transferred properties have

historically been stated at the original cost basis as the gains were eliminated in consolidation. In March 2004, these

deferred gains were recognized and treated as contributions from a related party in the amount of $111.0 million as a result

of the deconsolidation of SAC Holding Corporation.

In August 2005, RepWest completed the sale of three storage properties to 5 SAC and the sale of nineteen storage

properties to Real Estate, for approximately $50.5 million. The gains realized by RepWest were recorded directly to

additional paid-in capital. The purchase price was based upon existing re-purchase agreements management believes were

consummated on terms equivalent to those that prevail in arm’ s-length transactions.

In October 2005, Oxford completed the sale of three storage properties to 5 SAC, one storage property to Real Estate

and was fully repaid by U-Haul on a mortgage note secured by twenty-five storage properties. These transactions totaled

approximately $38.0 million. The gains realized by Oxford were recorded directly to additional paid-in capital. The

purchase price was based upon existing re-purchase agreements management believes were consummated on terms

equivalent to those that prevail in arm’ s-length transactions.

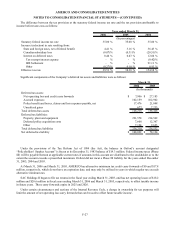

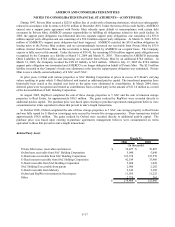

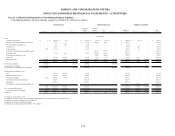

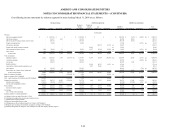

Related Party Assets

2006 2005

Private Mini notes, receivables and interest $ 74,427 $ 70,887

Oxford note receivable from SAC Holding Corporation 5,040 5,040

U-Haul notes receivable from SAC Holding Corporation 123,578 123,578

U-Haul interest receivable from SAC Holding Corporation 42,189 35,960

U-Haul receivable from SAC Holding Corporation 5,688 1,028

SAC Holding II receivable from parent 2,900 2,202

U-Haul receivable from Mercury 2,342 2,185

Oxford and RepWest investment in Securespace 11,585 11,225

Other 2,719 561

$ 270,468 $ 252,666

March 31,

(In thousands)

F-37